Morgan Stanley Foresees Digital Assets Shifting Global Currency Dynamics

Crypto News – Andrew Peel, the Head of Digital Assets at Morgan Stanley, has raised an alert about a significant change in the landscape of digital currencies, which may pose a threat to the dominance of the U.S. dollar in global finance. He refers to this change as a “paradigm shift” in how digital assets like Bitcoin and central bank digital currencies (CBDCs) are perceived and utilized.

Despite the U.S. dollar currently accounting for about 60% of the world’s foreign exchange reserves, Peel, in a January 12th investment note, suggests that this shift in digital asset dynamics could challenge its preeminence. He attributes this acceleration partly to the U.S. Securities and Exchange Commission‘s approval of multiple Bitcoin exchange-traded funds in the U.S., which have seen a surge in investment, with inflows exceeding $1.18 billion weekly.

Peel highlights Bitcoin’s impressive adoption worldwide over the last decade and a half, with approximately 106 million global users and the presence of Bitcoin ATMs in over 80 countries, as indicators of its sustained growth.

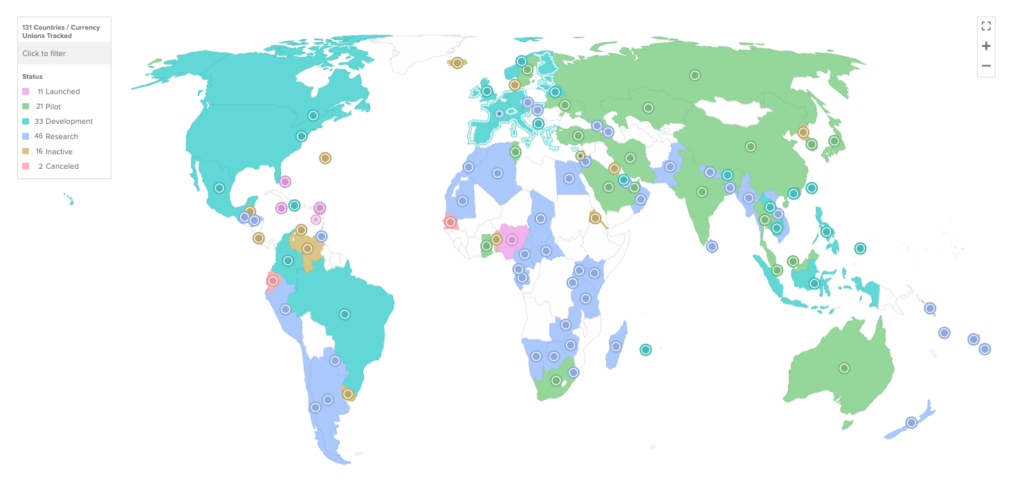

He also points out the potential of CBDCs from various countries to disrupt the U.S. dollar’s dominance by facilitating faster cross-border payments without relying on a common currency. He emphasizes the potential of CBDCs to set a new standard for international transactions, potentially reducing dependence on traditional systems like SWIFT and dominant currencies, including the dollar. Data from the Atlantic Council CBDC Tracker shows a significant uptick in interest, with 130 countries (accounting for over 98% of the global GDP) exploring or developing CBDCs.

Peel also notes that CBDCs could foster notable innovations in financial services, such as the implementation of smart contracts for automated payments, making the concept of programmable money more tangible.

While highlighting the potential challenges Bitcoin and CBDCs pose to the U.S. dollar’s supremacy, Peel believes that stablecoins, particularly those pegged to fiat currencies, could be a more constructive addition to the global financial system. He describes these stablecoins as the “killer app” of the crypto world, foreseeing their growing significance and the transformative impact they might have on international financial transactions and the movement of money across borders.

Leave a comment