Crypto News – FTX debtors have filed new claims with the US bankruptcy judge. Accordingly, creditors reject the shuttered exchange’s valuation of cryptocurrency deposits based on 2022 prices.

FTX Creditors Demand In-Kind Crypto Repayments

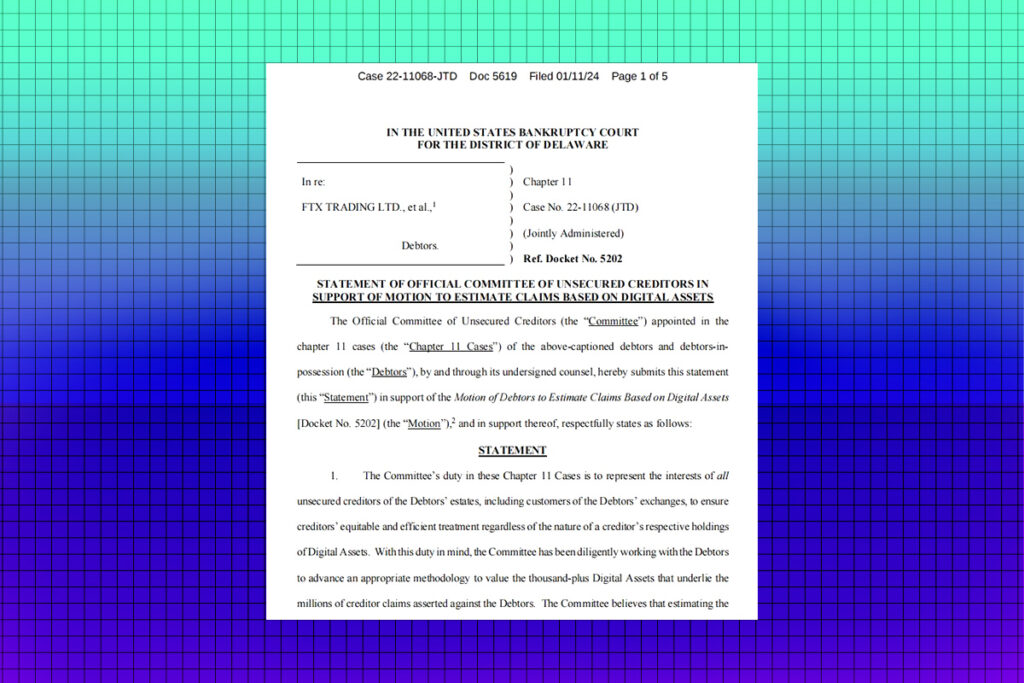

According to the Official Committee of Unsecured Creditors, aggregated estimates of claim values, as proposed in the motion, are the most effective way to streamline the claims settlement process as well as expedite Chapter 11 approval.

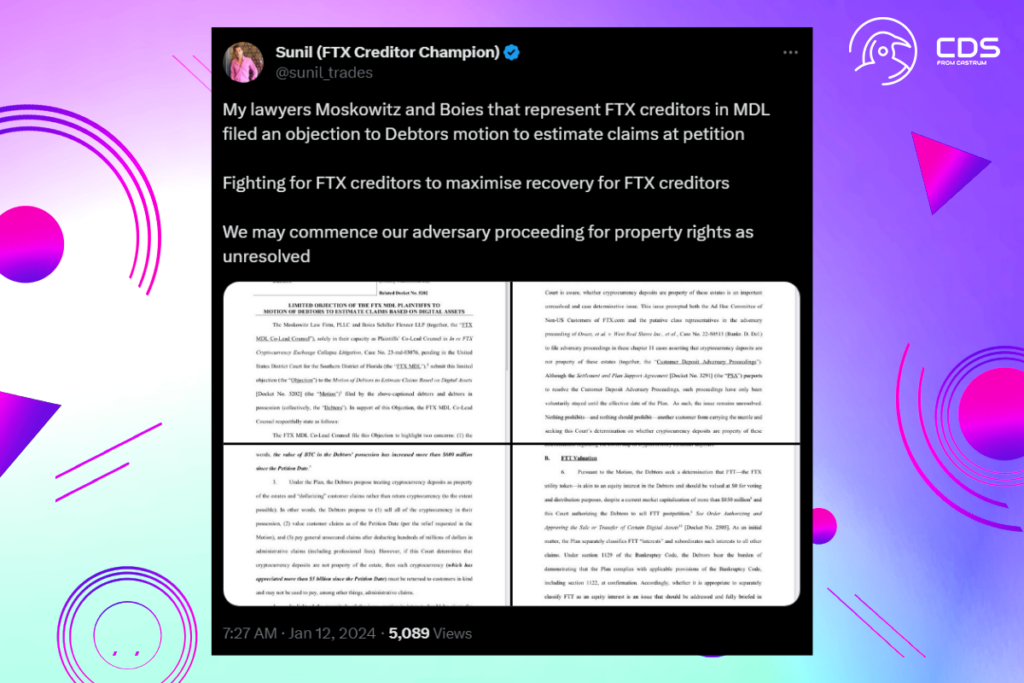

If the court determines that cryptocurrency deposits are not property of the estate then such cryptocurrency (which has appreciated more than $5 billion since the petition date) must be returned to customers in kind and may not be used to pay, among other things, administrative claims.

The motion by the Debtors

Consumers Refuse to Receive Payments Under Insolvency Plan and Seek Their Rights

In line with the terms of the bankruptcy plan, FTX intends to pay back consumers in US dollars, which will be decided by the value of cryptocurrencies on November 20, 2022, when FTX files for bankruptcy. Although FTX argues that this date must be used to assess claims under U.S. bankruptcy law, consumers counter that this approach undervalues cryptocurrencies, which have increased dramatically since the 2022 market trough.

An activist for FTX creditors, Sunil Kavuri, made a post on X regarding his attorneys, Moskowitz and Boies, opposing the debtor’s move to estimate claims. According to Kavuri, since property rights are still up for debate, the attorneys contend that clients ought to get at least the value of their cryptocurrency back.

Leave a comment