Market Reacts to False Bitcoin ETF Approval News with Sell-Off, Revealing Vulnerability to Rumors

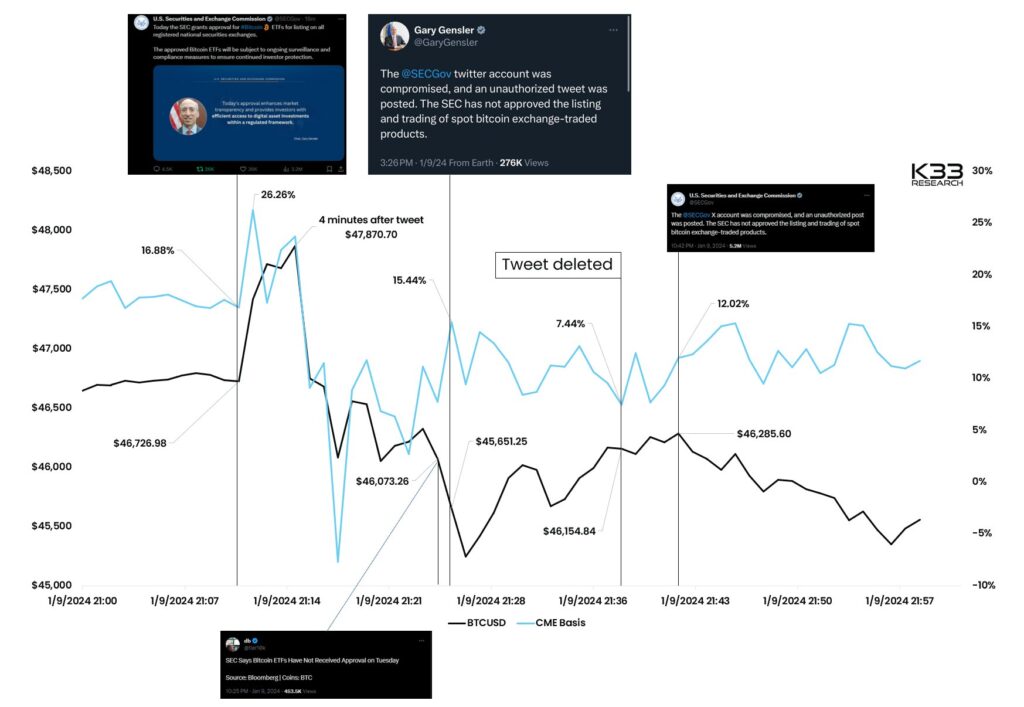

Crypto News – The cryptocurrency market recently experienced a tumultuous response to erroneous news regarding the approval of a Bitcoin spot exchange-traded fund (ETF). On January 9th, a falsified announcement from the official account of the U.S. Securities and Exchange Commission (SEC), previously known as Twitter, claimed the sanctioning of multiple Bitcoin ETFs for listing. This misinformation, later clarified by SEC Chair Gary Gensler who revealed the SEC account had been compromised, sparked a swift sell-off in the market.

Vetle Lunde, an analyst from K33 Research, observed that this incident inadvertently offered a preview of the market’s potential reaction to genuine ETF approval news. Lunde noted, “The market revealed its strategy; the simulated approval of the ETF leans toward a sell-the-news reaction.” He pointed out that the market’s skepticism was notably absent in the first quarter-hour following the announcement.

Post-announcement, a surge in buying activity created a volatile environment. Bitcoin’s value briefly skyrocketed to $47,870, only to plummet to $46,000 within minutes. This fluctuation occurred immediately before the SEC’s intervention and confirmation of the account hack.

This scenario aligns with the predictions of leading industry executives like Cathie Wood, the CEO of ARK Invest, a potential issuer of a Bitcoin ETF. Wood anticipates a short-lived sell-off following the news of ETF approval, attributing it to a significant build-up of market anticipation. However, she underscores the long-term potential, “This will likely be a fleeting response, as we anticipate the SEC’s green light for a spot Bitcoin ETF will open doors for institutional investors, which is a more significant and promising development.”

Analysts, including those from QCP Capital, echo the sentiment that an approved Bitcoin ETF might not catalyze immediate positive market trends. They suggest the market has already factored in the potential approval, implying a limited rally post-approval. QCP Capital’s recent market update from January 10th highlighted the subdued initial reaction to the false approval news, with Bitcoin failing to break through key resistance levels.

A trader, reflecting on the event on the social media platform X, concurred, expecting similar market dynamics in anticipation of the SEC’s decision on multiple Bitcoin ETFs. This incident underscores the crypto market’s sensitivity to regulatory news and the potential for rapid, significant reactions to such developments.

Leave a comment