Global Stablecoin Regulations and Market Growth: PwC Report Insights 2023

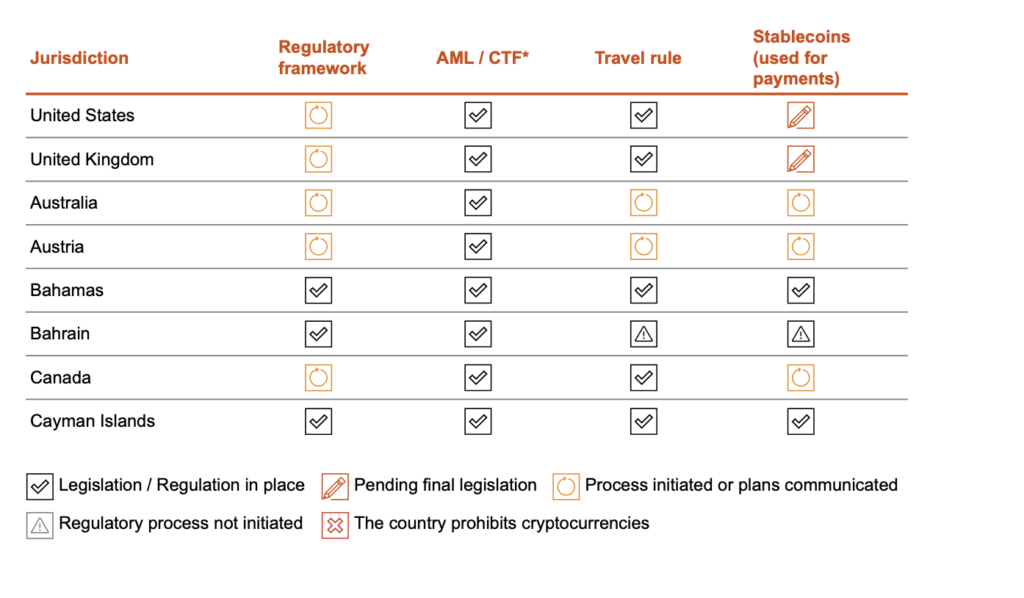

Crypto News – In 2023, amidst a landscape of 35 countries analyzed, only a sextet of jurisdictions, including Switzerland and Japan, had established regulations for stablecoins, a burgeoning sector of cryptocurrencies like Tether and USDC. This finding comes from the PwC Global Crypto Regulation Report 2023, released on December 19th.

The report reveals that the stablecoin industry has experienced a remarkable surge, setting new records in market value during 2023. Yet, this rapid growth contrasts sharply with the regulatory response: only a handful of countries have begun legislating this market.

The six nations with established stablecoin regulations are The Bahamas, The Cayman Islands, Gibraltar, Japan, Mauritius, and Switzerland. These countries have not only implemented stablecoin laws but also adhered to a comprehensive set of regulations, including a cryptocurrency regulatory framework, Anti-Money Laundering (AML) standards, and the Financial Action Task Force’s Travel Rule.

Stablecoin Regulations and Market Trends: A Global Overview in 2023

PwC’s comprehensive analysis covered the regulatory landscape in 35 countries, including major players like the United States and the United Kingdom. Notably, these two countries are still in the process of finalizing their stablecoin legislation and broader cryptocurrency regulatory frameworks.

The report further highlights that 40% of the countries reviewed, equating to 14 jurisdictions, have not yet begun formulating stablecoin regulations. This list includes nations like Denmark, Estonia, France, Germany, Taiwan, and Turkey. Meanwhile, 25% of the jurisdictions, including Hong Kong and Italy, are in the initial stages or have plans underway for stablecoin regulation. Only about 9% of countries, such as the United Arab Emirates, are in the final stages of enacting stablecoin laws.

Additionally, PwC’s report identifies three countries – mainland China, Qatar, and Saudi Arabia – that have outright banned the use of cryptocurrencies.

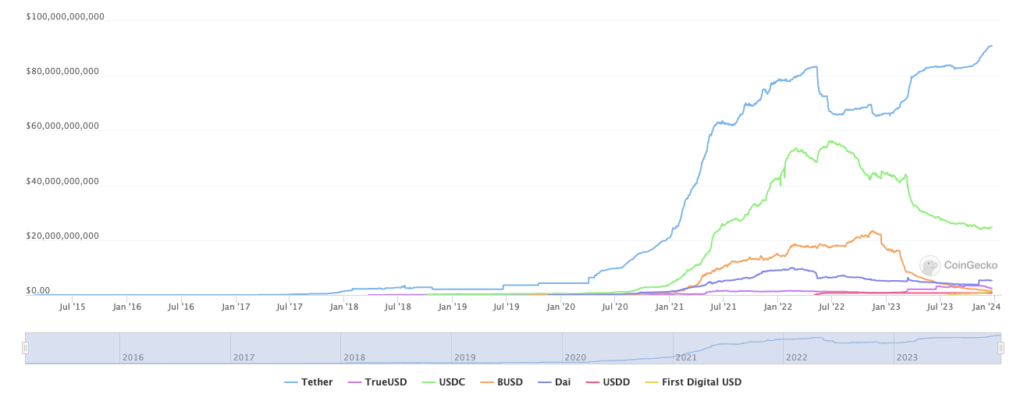

In the realm of cryptocurrency, stablecoins, especially Tether, play a pivotal role. Tether notably surpasses Bitcoin in daily trading volumes, with figures from CoinGecko indicating that Tether’s volumes are 23% higher, amounting to $34 billion.

2023 marked a significant milestone for the stablecoin market, which saw immense growth led by Tether and similar currencies. Tether‘s market capitalization exceeded $90 billion for the first time in mid-December 2023, registering a 36% increase since January. The total market capitalization for stablecoins reached a historic peak, hitting $131 billion.

Looking ahead, analysts like Bitwise’s Ryan Rasmussen project that stablecoins will continue their ascendant trajectory. Rasmussen predicts that in 2024, stablecoins could surpass global payment giant Visa in terms of the amount of money settled.

Leave a comment