Ark Invest Continues Massive Sell-Off: Coinbase, Robinhood, and Bitcoin Trust Shares on the Move

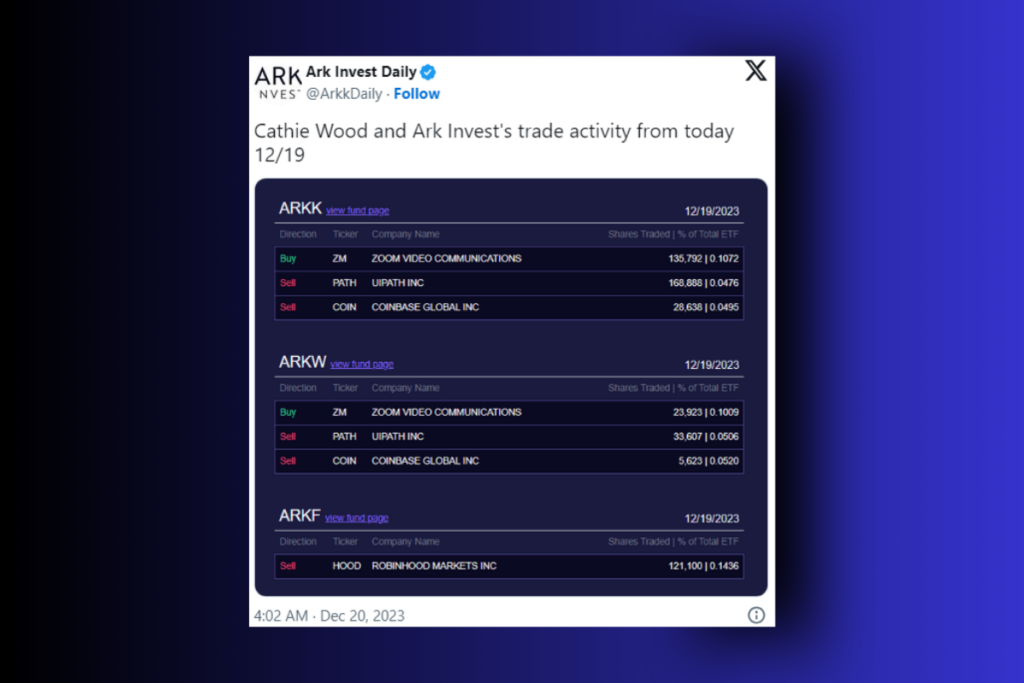

Crypto News – Ark Invest, led by renowned investor Cathie Wood, has made headlines again by offloading a significant number of Coinbase shares. On Tuesday, the investment firm sold 34,261 shares of the largest US-based cryptocurrency exchange, valued at approximately $5.5 million. This move comes as Coinbase’s stock price has soared, experiencing an impressive 107% increase since early November.

In today’s pre-market trading, Coinbase (COIN) saw its stock rise by an additional 5%. This latest sale is part of a broader divestment strategy by Ark Invest in Coinbase. Earlier in the month, the firm had disposed of Coinbase shares worth $100 million, followed by another substantial sale totaling $59 million last week.

These shares were sold through the ARK Next Generation Internet ETF (ARKW), a fund managed by Ark Invest. The firm’s recent investment activities also extended to Robinhood, the popular trading platform that focuses on retail investors. Ark Invest parted with 121,100 shares of Robinhood through its Ark Fintech Innovation ETF (ARKF), a transaction valued at $1.6 million.

The sale occurred as Robinhood’s stock experienced a notable uptick, closing 10.4% higher at $13.17. This surge in Robinhood’s stock price is thought to be linked to the broader positive momentum in the market, particularly as Bitcoin continues to maintain its value above $42,500.

In a separate but equally significant transaction, Ark Invest sold a massive 809,441 shares of the Grayscale Bitcoin Trust (GBTC) on Monday. This sale, worth $27.6 million, was executed through the same ARKW ETF and marked the biggest sale of its kind by Ark Invest in more than a year. This flurry of activity from Ark Invest underscores the dynamic nature of the cryptocurrency and fintech investment landscape.

Leave a comment