Crypto Market Rally: BTC and TOTALCAP Bounce Back, BONK Hits Record High

Crypto News – The cryptocurrency market witnessed a significant rebound yesterday, averting potential declines from key support levels. Notably, Bitcoin (BTC) and the overall Crypto Market Capitalization (TOTALCAP) demonstrated a robust recovery, while the cryptocurrency BONK achieved a new all-time high.

TOTALCAP’s Resilience Above Ascending Support

Since late October, TOTALCAP has been on an upward trajectory, closely adhering to an ascending support trend line. This bullish momentum peaked with a new yearly high of $1.63 trillion on December 9. Despite a subsequent pullback, the market cap’s resilience was evident as it bounced back from the ascending support trend line yesterday.

Traders often turn to the Relative Strength Index (RSI) as a key momentum indicator to gauge overbought or oversold conditions and to inform their buying or selling decisions. Generally, an RSI reading above 50, coupled with an upward trend, suggests a bullish market control. Conversely, readings below 50 indicate bearish dominance.

Currently, the daily RSI stands above 50 and is on the rise, despite being in the overbought zone. A notable observation is the emergence of a bearish divergence (indicated by a green line), which preluded the market’s dip on December 11.

Looking ahead, whether TOTALCAP sustains its support trend line or breaches it to reach new highs will be pivotal in determining the market’s direction. A breakdown could see a 13% drop to the 0.382 Fibonacci retracement level, marking a 12.5% decline from its current position. Conversely, surpassing the yearly high might trigger a surge up to $1.90 trillion, a 20% increase.

Bitcoin’s Quest to Reclaim Resistance

Mirroring TOTALCAP‘s pattern, Bitcoin has also been following an ascending support trend line since October. This bullish phase led BTC to a new yearly peak of $44,730 on December 8. However, a sharp decline on December 11 interrupted this ascent, only for Bitcoin to bounce back at the trend line yesterday.

This decline was preceded by a bearish divergence in the daily RSI and a fall below the crucial $42,450 resistance level. If Bitcoin manages to reclaim and surpass this level, it could aim for the next resistance at $49,000, marking a 14% increase from the current price. Alternatively, a downward break from the support trend line might result in a 14% dip to the 0.382 Fibonacci retracement support level at $37,200.

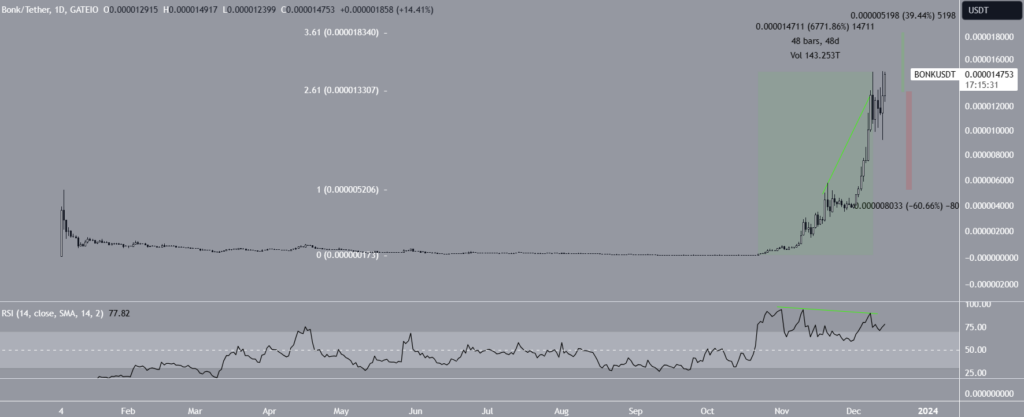

BONK’s Meteoric Rise

BONK‘s price trajectory has been particularly impressive. Since December 1, BONK has seen a swift and significant increase, culminating in a new all-time high of $0.000015 on December 9. Despite experiencing a drop due to a bearish divergence in the RSI, BONK quickly regained momentum, achieving another record high, slightly above the previous one. Both peaks occurred at the 2.61 external Fibonacci retracement of the earlier decline.

Should BONK maintain its upward trend, it could potentially surge by an additional 40%, reaching the 3.61 external Fibonacci retracement level at $0.000018. However, it’s crucial to note that a close below $0.000013 might precipitate a significant 60% plunge to the nearest support level at $0.000005.

This dynamic landscape in the crypto market underscores the importance of vigilance and strategic decision-making for traders and investors alike.

Leave a comment