Ethereum Price Outlook: Analysts Optimistic on ETH’s Future, Predicting a Surge to $3,500 Amidst Growing Interest and ETF Discussions

Crypto News – The second-largest cryptocurrency in the world, Ethereum (ETH), has exhibited significant strength recently, reclaiming the $2,100 price level. This bullish trend coincides with the United States Securities and Exchange Commission (SEC) initiating discussions regarding the approval of a spot Ethereum ETF.

As of the latest update, the price of ETH is trading at $2,099, marking a 2.9% increase, with a market capitalization of $252 billion.

Ethereum Price Projections Reach $3,500

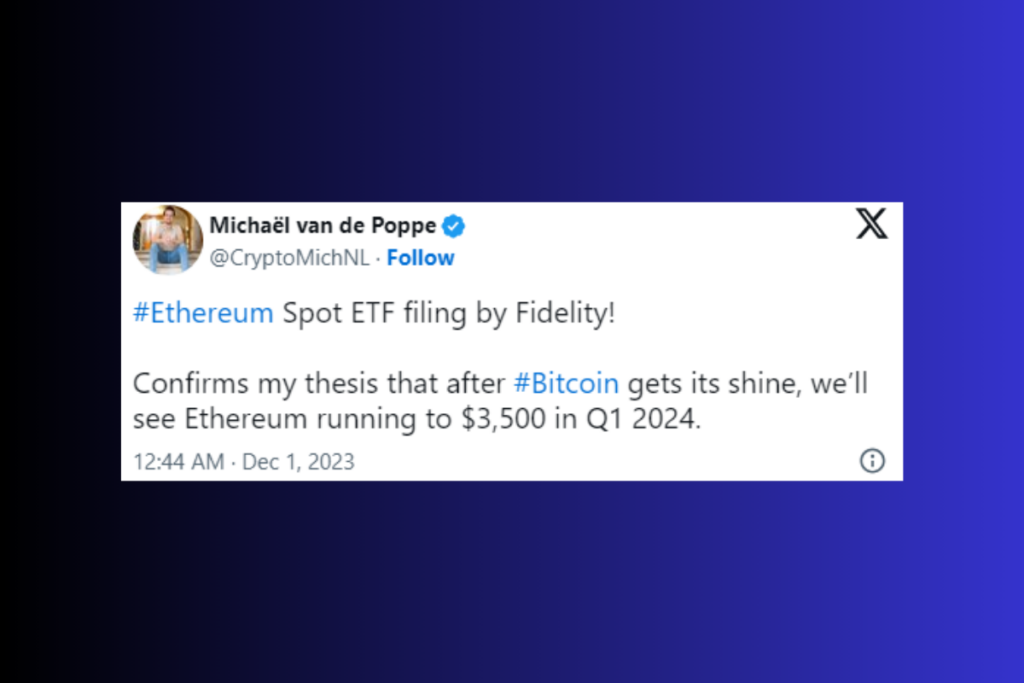

Renowned crypto analyst Michael van de Poppe has expressed optimism about Ethereum, particularly in response to the recent Fidelity filing. He firmly believes that Ethereum, following Bitcoin’s impressive rally, has the potential to reach $3,500 during the first quarter of 2024. Reports from CoinGape also suggest that Ethereum might achieve a new all-time high in 2024.

Recent reports indicate substantial accumulation of Ethereum by prominent holders, often referred to as “whales.” Furthermore, on-chain data highlights a notable shift in wallet holdings. According to Santiment, the largest Ethereum wallets are displaying a positive trend, signifying a significant change in the market.

Exchange wallets have dwindled to their lowest levels in the past six months, totaling 8.03 million ETH, while non-exchange wallets have surged to an all-time high of 41.03 million ETH. This shift reflects an increasing preference for self-custody solutions, as more investors are moving their assets away from exchanges.

Ethereum’s Price Volatility and Future Prospects

In the month of November, Ethereum exhibited a remarkable price surge of 13%, outpacing Bitcoin’s 8% growth. A key catalyst for Ethereum’s ascent was the official filing by BlackRock for a spot Ethereum ETF, an Ethereum-based Exchange Traded Fund.

Despite the waning media frenzy surrounding ETFs, on-chain data reveals that Ethereum’s price volatility has now surpassed that of Bitcoin. This development could potentially attract swing traders and short-term investors to allocate more of their funds into ETH, especially during the month of December.

According to IntoTheBlock, Ethereum’s 30-day Average Intra-Day Volatility currently stands at 0.45%, outstripping Bitcoin’s score of 0.32%.

Throughout a significant portion of November, Ethereum’s price exhibited sideways movement, fluctuating between the $2,133 and $1,917 price levels. Multiple tests of these horizontal support and resistance levels suggest a prevailing sense of uncertainty among market participants.

Over the past two weeks of consolidation, Ethereum faced two notable setbacks when approaching the $2,133 resistance level, indicating a significant supply overhead. These reversals have highlighted the emergence of a bullish reversal pattern, identified as a “Double Bottom” on the daily timeframe chart. The question that remains is whether Ethereum can attain the $3,000 price milestone by the conclusion of 2023.

Leave a comment