Cristiano Ronaldo Faces Class-Action Lawsuit for Allegedly Promoting Unregistered Securities with Binance-Linked NFTs

Crypto News – Cristiano Ronaldo, the world-renowned soccer superstar, has recently found himself at the center of a legal storm. A group of plaintiffs has initiated a class-action lawsuit against him, alleging that his promotional activities for the cryptocurrency exchange Binance led to their financial losses. This lawsuit, filed on November 27th in a district court in Florida, USA, accuses Ronaldo of being actively involved in the promotion and sale of what they claim are unregistered securities, in collaboration with Binance.

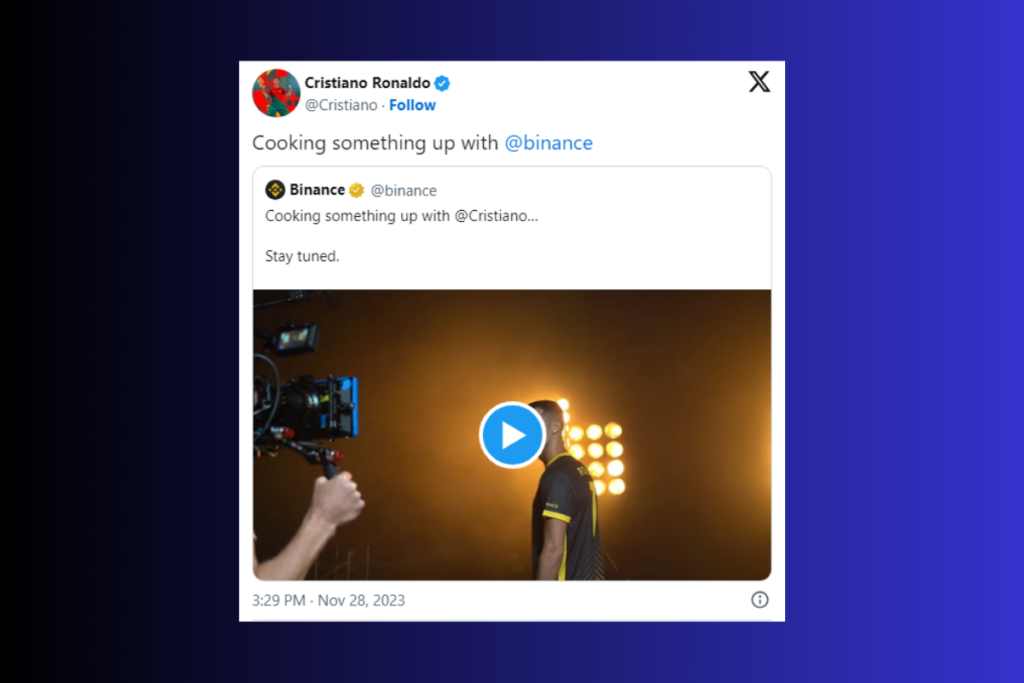

In mid-2022, Binance and Ronaldo embarked on a significant partnership, marked by the launch of several nonfungible token (NFT) collections bearing the soccer icon’s name. At least three of these collections were directly associated with Binance. The lawsuit contends that Ronaldo’s involvement not only boosted the popularity of these NFTs but also indirectly encouraged his massive social media following, estimated at around 850 million, to engage more deeply with Binance’s platform. This includes investments in products that the plaintiffs describe as unregistered securities, such as Binance’s BNB token and various crypto yield programs.

The plaintiffs argue that Ronaldo’s marketing campaigns significantly elevated Binance’s profile. They point to a staggering 500% surge in online searches for Binance following the initial release of his NFTs as evidence of his considerable influence. Furthermore, the lawsuit suggests that Ronaldo, with his extensive investment experience and access to expert advisors, should have been aware of the potential regulatory implications of promoting Binance’s products.

The legal filing also highlights the U.S. Securities and Exchange Commission’s (SEC) guidelines, which mandate celebrities to disclose any compensation received for endorsing cryptocurrency-related products. The complaint alleges that Ronaldo failed to adhere to these guidelines.

Leading the lawsuit are Michael Sizemore, Mikey Vongdara, and Gordon Lewis, who are seeking compensatory damages and the reimbursement of legal fees.

Meanwhile, Binance and its founder, Changpeng “CZ” Zhao, are grappling with their own set of legal challenges. The company recently admitted guilt and agreed to a substantial $4.3 billion settlement with the U.S. government over accusations of anti-money laundering law violations and operating an unlicensed money-transmitting business. Zhao has resigned as CEO and could face up to 18 months in prison. In addition, Binance has consented to up to five years of oversight by the U.S. Department of Justice and the Department of the Treasury.

The SEC has also taken legal action against Binance, levying various charges including the sale of unregistered securities. There are ongoing investigations to determine if the company misused customer funds.

1 Comment