50x Hyperliquid Whale Returns: The Long Bet Nets $1.87M in Profit Amid Market Chaos

With a daring long position of 47,253 ETH utilizing 20x leverage, the notorious Hyperliquid 50x whale has made a strong comeback. The whale took advantage of Ethereum’s steep decline after a month of inactivity, entering the market at $1,459 with a liquidation threshold set at $1,391, increasing the total value of the position to over $70.86 million.

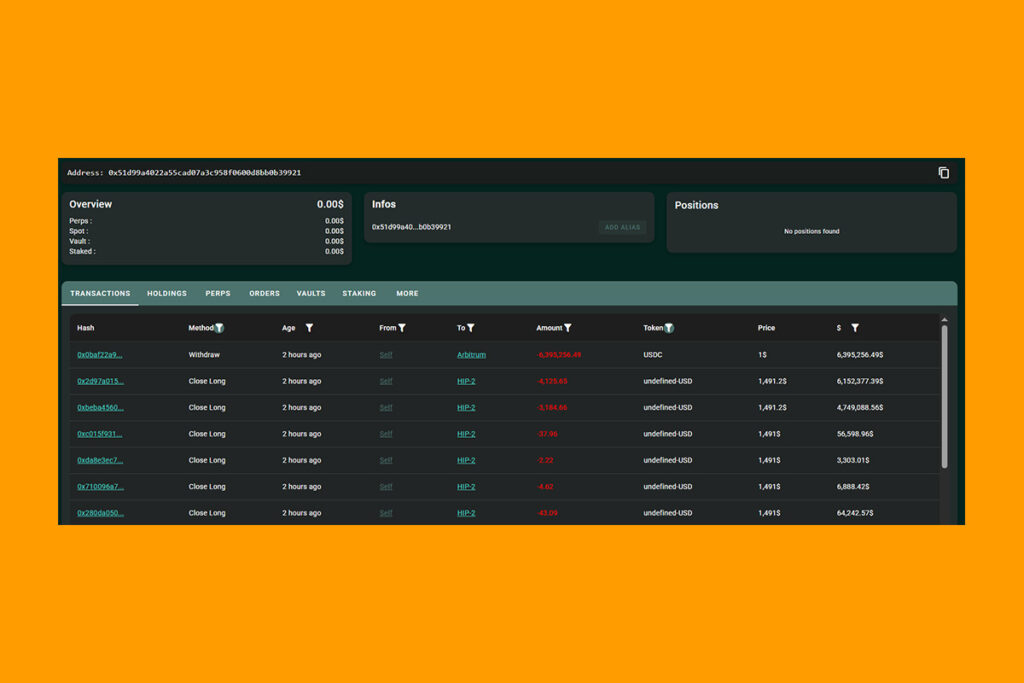

On-chain data indicates that the strategic trade produced significant returns, with peak unrealized profits of $4.52 million. The whale concluded the trade at around 11:00 AM UTC on April 7, locking in a $1.87 million realized profit and returning $6.3 million to Arbitrum (ARB). The trader’s reputation for making high-stakes bets during times of intense market volatility is strengthened by this move, which emphasizes the whale’s continued impact and astute timing.

Massive ETH Liquidation Forces Hyperliquid to Cut Leverage Limits

On March 12, the anonymous trader initiated a long position of 175,000 ETH with 50x leverage, earning the moniker “Hyperliquid 50x ETH whale.” The position nearly caused a market crash on the liquidity platform and was worth about $340 million. The whale moved almost 17.09 million USDC in margin back to their address after closing at 15,000 ETH. The platform instantly liquidated the remaining 160,000 ETH after the margin was withdrawn.

At $1,915, Hyperliquid Vault took over the position and attempted to unravel it due to the size of the liquidation. Consequently, Hyperliquid was forced to bear the brunt of the liquidation and lost over $4 million. In spite of the enormous liquidation, the whale was still able to make almost $1.8 million in net profit. Hyperliquid declared it would reduce its maximum leverage for ETH and BTC to 25x and 40x, respectively, in order to avoid a recurrence of the situation.

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a comment