Bitcoin’s Record Highs Spark Continued 2024 Crypto Inflows

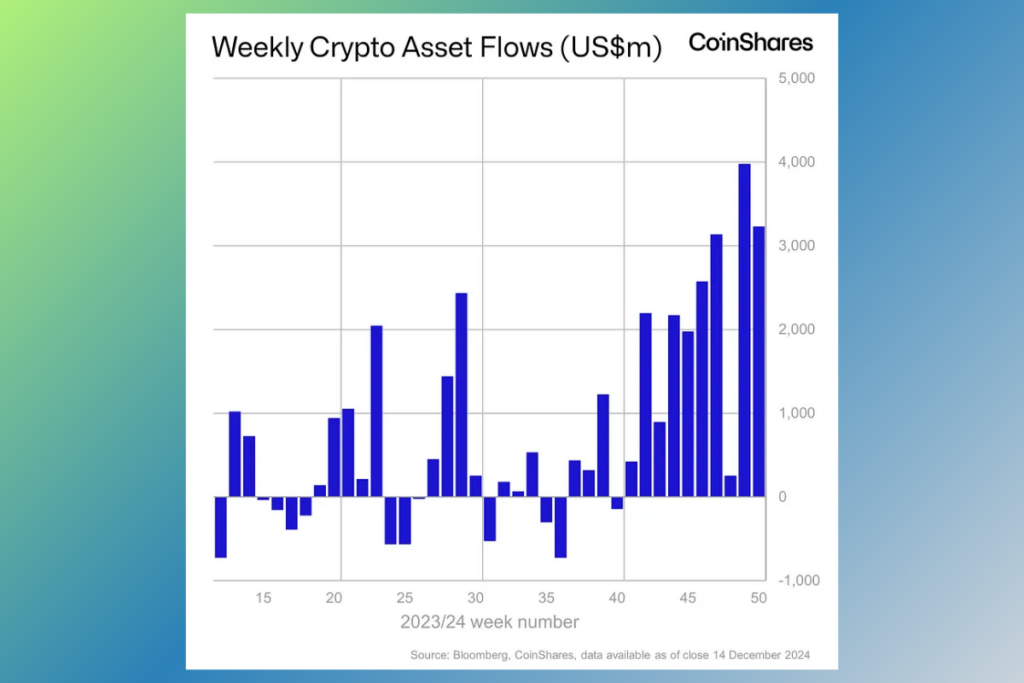

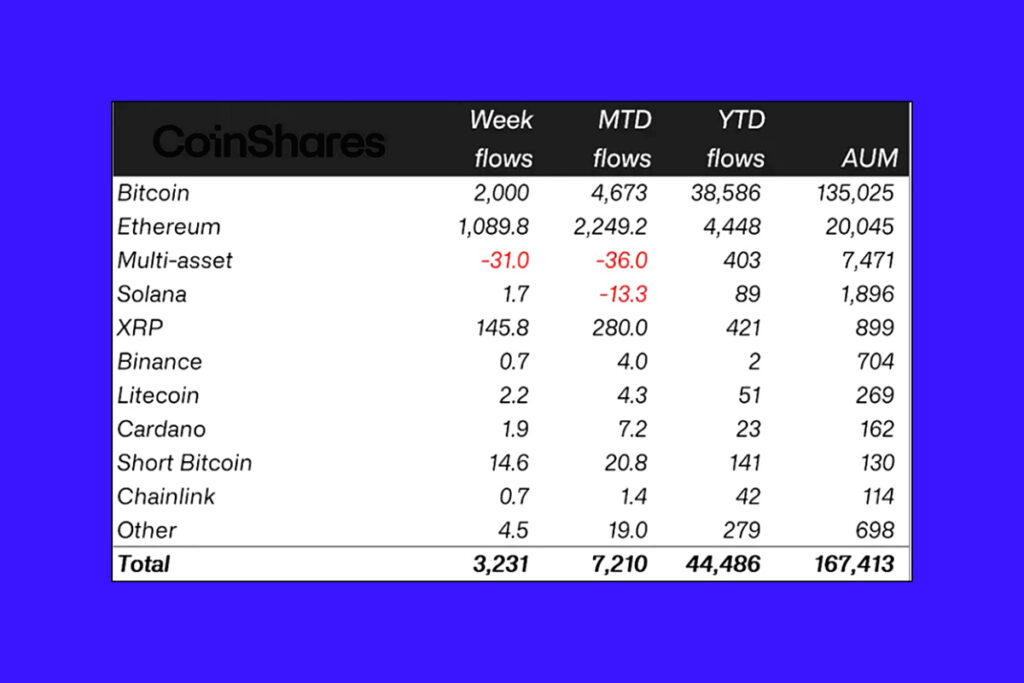

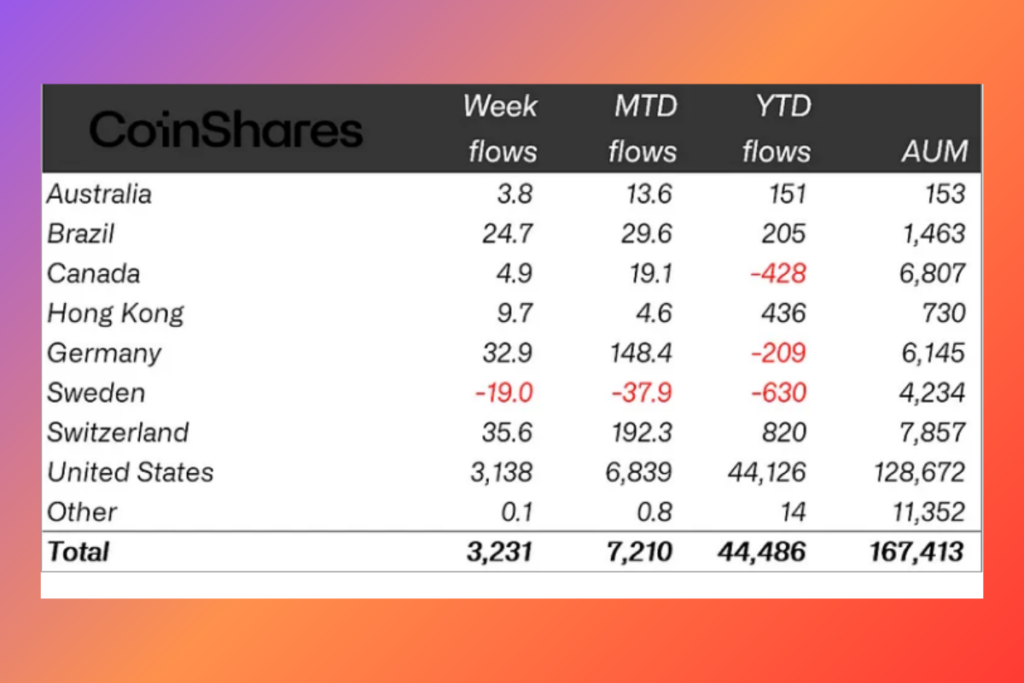

As Bitcoin hits new highs and cryptocurrency investment products see their tenth consecutive week of inflows, cryptocurrency investors have not stopped their buying binge. Crypto investment company CoinShares said in its most recent weekly flows report on Monday, December 16, that digital asset investment products received an additional $3.2 billion in inflows over the trading week of December 9–13. Inflows for 2024 now reach $44.5 billion, after a record $3.85 billion in weekly inflows during the prior period. The milestone comes after a string of weekly inflows that have been occurring since early October. Two-thirds of 2024’s inflows, or $20.3 billion, have come in the last ten weeks alone.

CoinShares Research Highlights $2 Billion in Bitcoin ETP Inflows, $1 Billion for Ethereum

James Butterfill, head of research at CoinShares, noted in the update that $2 billion had been invested in Bitcoin investment products in the last week, increasing the total amount since the US presidential election to $11.5 billion. With inflows of $14.6 million over the previous week, short Bitcoin instruments also saw a surge in activity. According to Butterfill, the total assets under management for short BTC ETPs stayed modest at $130 million. Grayscale’s Bitcoin Trust experienced withdrawals of $145 million, while BlackRock’s iShares Bitcoin Trust ETF saw the most inflows of $2 billion.

With $1 billion in inflows into Ethereum ETPs last week, Ether—the second-largest cryptocurrency in terms of market capitalization behind Bitcoin—reported another great week for ETP investments. The fresh inflows reflect seven weeks in a row of inflows totaling $3.7 billion in various Ether-based ETPs, demonstrating the sustained strength of Ethereum ETPs.

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a comment