Featured News Headlines

Why XRP Price Remains Range-Bound as Ripple Expands Payments and ETF Access

XRP Price – Ripple’s native token XRP remains under noticeable price pressure, even as capital inflows, adoption, and infrastructure development continue to expand in tandem. This growing disconnect has placed XRP at the center of market attention, with traders closely monitoring why strengthening fundamentals have yet to translate into upward price movement.

Price Compression Persists Despite Growing Interest

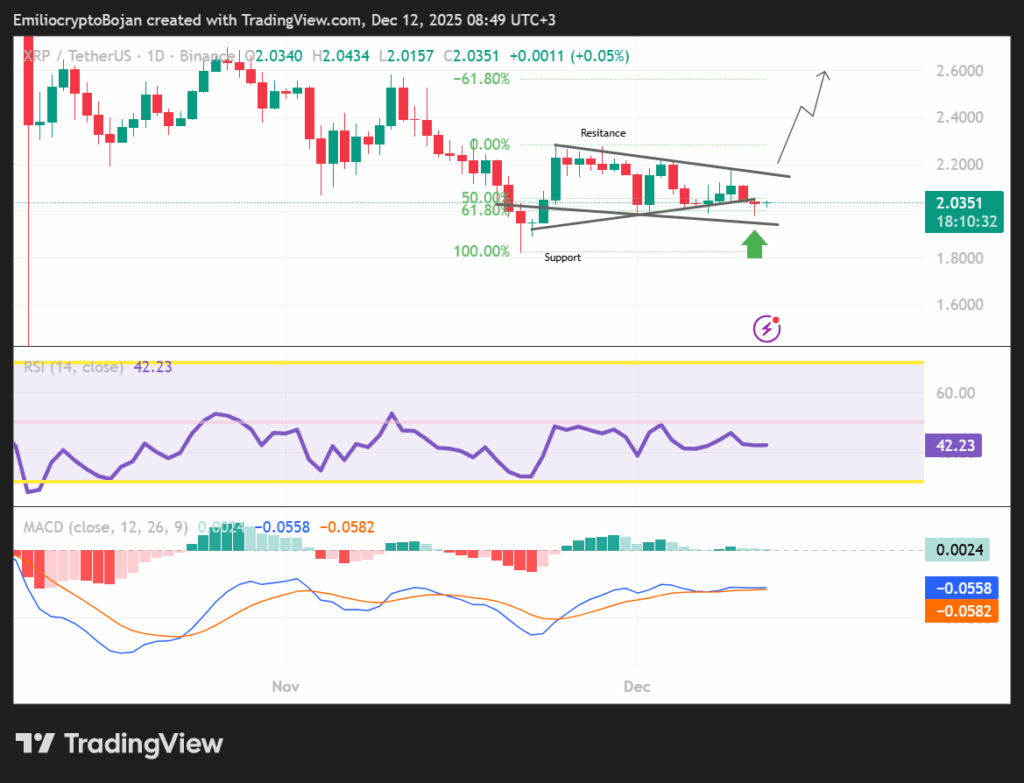

At press time, XRP was trading near the 50% Fibonacci retracement level around $2.02, with volatility tightening into an ascending triangle formation. Momentum indicators reflected hesitation rather than weakness. The Relative Strength Index (RSI) hovered near 42, while the MACD compressed and edged closer to a potential bullish crossover.

Despite consistent inflows, price action remained muted, suggesting absorption instead of distribution. Liquidity continued to cluster within the current range, indicating that the market may be testing trader patience rather than confidence. Analysts have openly discussed long-term projections as high as $27, but near-term price reaction has yet to materialize.

Net Inflows Continue Without Immediate Price Response

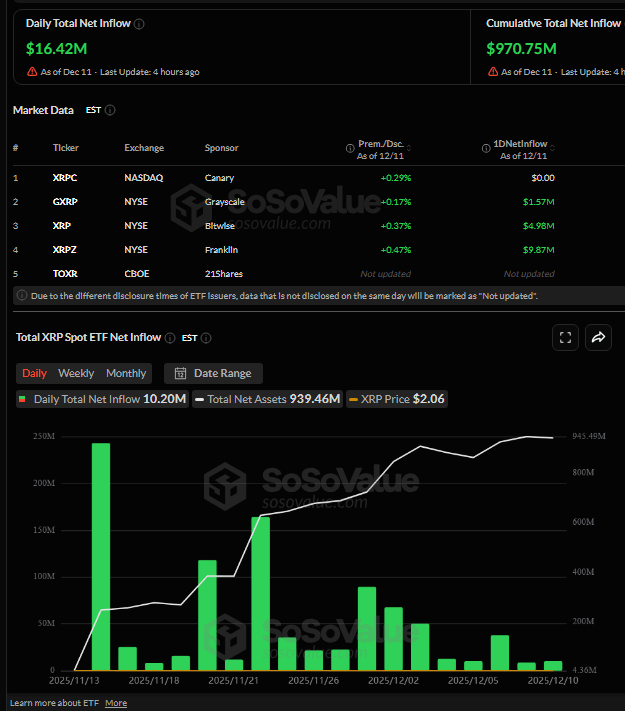

XRP recorded $16.42 million in Net Inflows, extending a 19-day streak of capital entering the asset. Still, these inflows failed to trigger an immediate repricing. Adding to the flow narrative, 21Shares launched its spot XRP ETF under the ticker $TOXR, expanding regulated market access without causing instant price acceleration.

Historically, XRP has shown phases where capital access and positioning build first, followed by delayed price movement once accumulation completes.

Ripple’s Infrastructure Expansion Gains Momentum

On the fundamental side, Ripple confirmed the completion of its Rail acquisition, strengthening its end-to-end stablecoin and payments infrastructure. Previous expansions across custody, treasury intelligence, and prime brokerage continue to position Ripple as a unified digital asset infrastructure provider.

Additionally, Ripple announced the first European bank adoption of Ripple Payments via AMINA Bank, enabling real-time cross-border settlement in regulated markets.

Market Watches for the Timing Shift

As of writing, XRP’s structure reflects a familiar pattern where capital flows and utility grow ahead of price action. With adoption advancing and compression persisting, market focus has shifted from growth to timing, as participants wait for the price to respond to the expanding foundation beneath it.

Comments are closed.