XRP Technical Analysis: Signs of Recovery After October Dip

XRP is trading at $2.42, up 0.62% in the last 24 hours but down 0.83% over the week, according to crypto.news data. After the market crash on October 10, XRP lost a strong support level it had held since July, which has now become resistance.

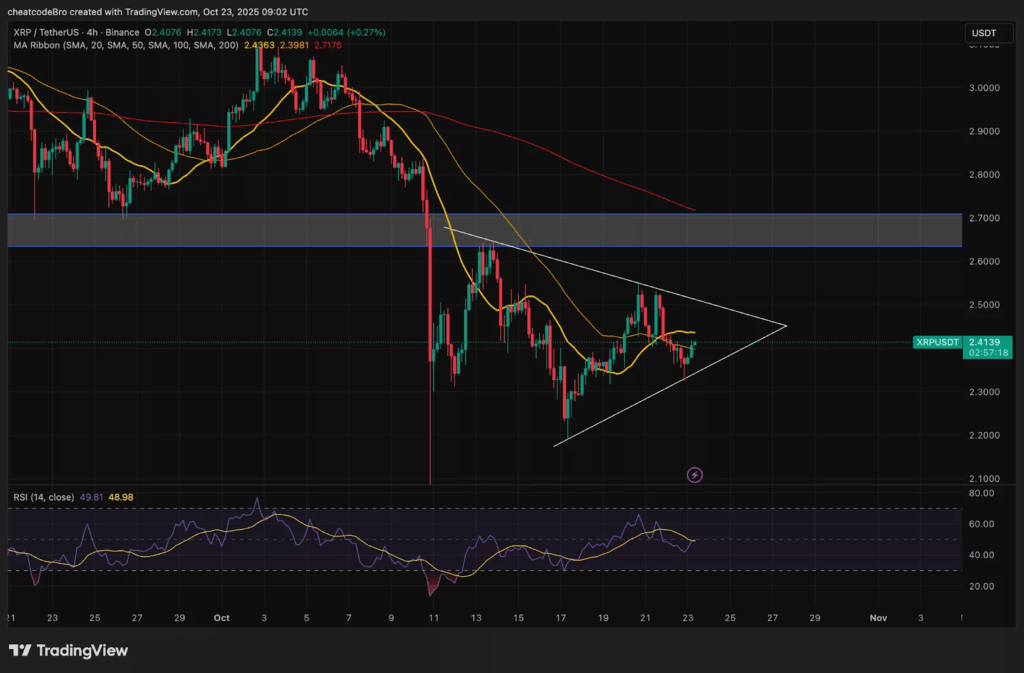

Following the crash, XRP entered a consolidation phase, forming a symmetrical triangle pattern on the charts. This indicates market uncertainty but also suggests a potential breakout that could shape the next major trend.

Growing Institutional Interest and DeFi Expansion

Market confidence in XRP is increasing thanks to positive developments. T. Rowe Price, a major asset manager, recently filed with the SEC to launch a crypto ETF including XRP, Bitcoin, and Ethereum. This move highlights rising institutional acceptance and greater visibility among retail investors.

XRP’s role in decentralized finance (DeFi) is also expanding. The launch of FXRP on the Flare Network has made Flare the top DeFi platform for XRP, with over $86 million in wrapped XRP circulating in the system, boosting its utility.

Technical Analysis and Outlook

XRP’s short-term momentum shows signs of recovery after a period of weakness. The price stabilizing near $2.40 suggests buyers are regaining control. The 20-day simple moving average (SMA) recently crossed above the 50-day SMA, often a signal of trend recovery.

If XRP rises above the $2.45–$2.50 range, it may confirm a breakout towards the next resistance near $2.70. However, failure to hold above these levels or a drop below $2.30 could lead to a decline toward $2.10, continuing the downtrend.

Momentum indicators like the Relative Strength Index (RSI) hover near 49, showing market balance. The direction of XRP will likely depend on which side gains volume momentum next.

Comments are closed.