ETF Inflows Signal Steady Institutional Interest

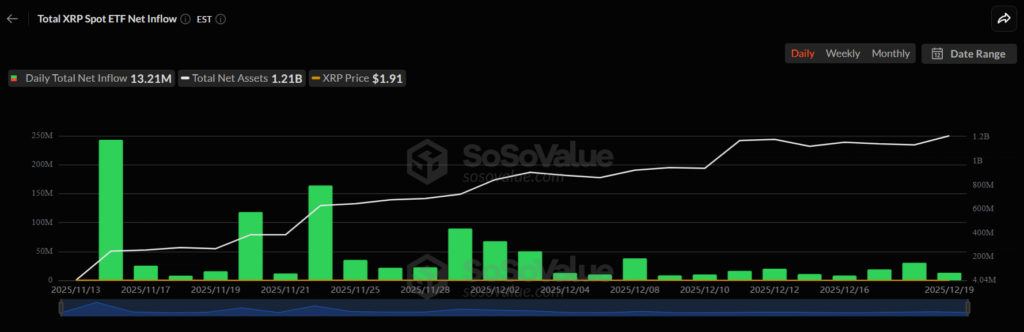

Spot XRP exchange-traded funds have played a key role in setting the current market tone. Recent inflows have lifted total net assets above $1.2 billion, with capital continuing to enter even on low-volatility trading days. Rather than a sharp spike, the pattern points to consistent and sustained interest.

Notably, XRP’s price has remained near the $1.90–$1.95 range despite these inflows. This muted reaction stands out. Instead of chasing momentum, institutional participants appear to be accumulating gradually, potentially laying groundwork rather than driving short-term price moves. As one market observation notes, “This kind of price stability during steady inflows often reflects base-building behavior rather than speculative excess.”

Whale Activity Picks Up Again

On-chain data reinforces this narrative. According to Santiment metrics, wallets holding between 100 million and 1 billion XRP have begun increasing their share of the total supply once more. Whale ownership has rebounded toward the 12.8% level after a brief pullback earlier in the month.

This shift has been decisive rather than slow. Following a mid-December dip, large-holder balances rose sharply, suggesting active positioning rather than passive holding. When whale accumulation aligns with institutional inflows, it often indicates a change in who exerts influence over short-term market dynamics.

XRP Price Tries to Stabilize

At the time of writing, XRP traded around $1.94, still below its key exponential moving averages. The 20-, 50-, 100-, and 200-day EMAs remained overhead, indicating that the broader trend has yet to turn bullish.

Momentum indicators reflect this hesitation. The Relative Strength Index (RSI) hovered near 43, showing mild recovery without strong buying pressure. On-Balance Volume (OBV) has flattened after earlier declines, while the MACD remained below zero, though downside momentum appears to be slowing.

Comments are closed.