Featured News Headlines

Can XRP Reach $6.75 First Time? 2025 Technical & On-Chain Setup

A technical analysis based on Elliott Wave theory suggests XRP might be positioned for a significant price surge, with targets ranging from $6.75 to $18.25. This bullish outlook coincides with unprecedented token outflows from cryptocurrency exchanges, signaling strong accumulation behavior among investors.

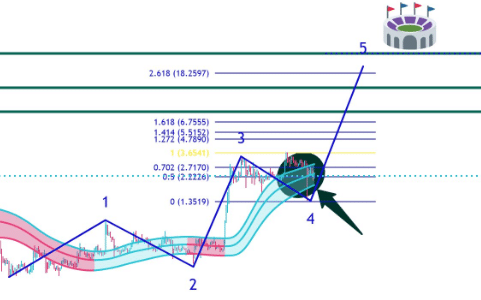

Elliott Wave Pattern Points to Major Rally

The Elliott Wave Principle, developed by accountant R.N. Elliott in 1938, identifies repeating patterns in market movements driven by investor psychology. Trader EGRAG recently applied this framework to XRP, highlighting what he calls the “power of 5” wave structure.

This pattern incorporates Fibonacci ratios to identify potential market turning points. The analysis suggests current price levels may represent a market bottom similar to the one observed in April. If this technical setup plays out as anticipated, the token could experience substantial upward momentum in the coming months.

The eight-wave pattern has historically provided reliable signals for traders tracking long-term trends. However, technical analysis remains one of many tools investors use to evaluate market conditions.

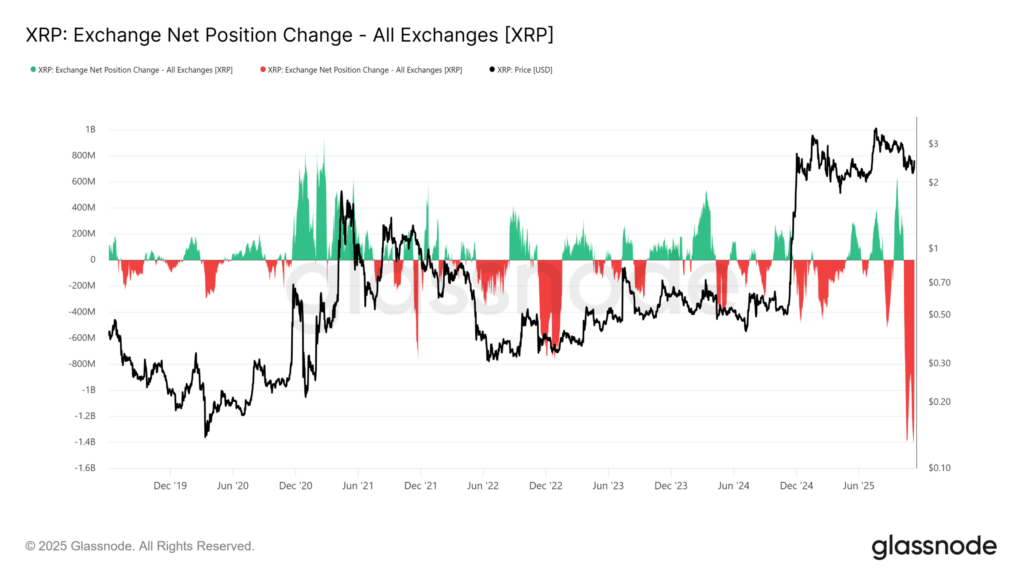

Historic Exchange Outflows Signal Strong Accumulation

Exchange netflow data reveals extraordinary XRP withdrawals throughout the second half of October. The exchange net position change metric, which tracks the difference between inflows and outflows across all platforms, shows the highest negative values ever recorded on Glassnode.

These massive outflows typically indicate investors are moving tokens to private wallets for long-term holding rather than active trading. When combined with the Elliott Wave projections, this on-chain behavior strengthens the case for potential price appreciation.

Large-scale exchange withdrawals often precede major rallies, as reduced selling pressure on exchanges can amplify upward price movements when demand increases.

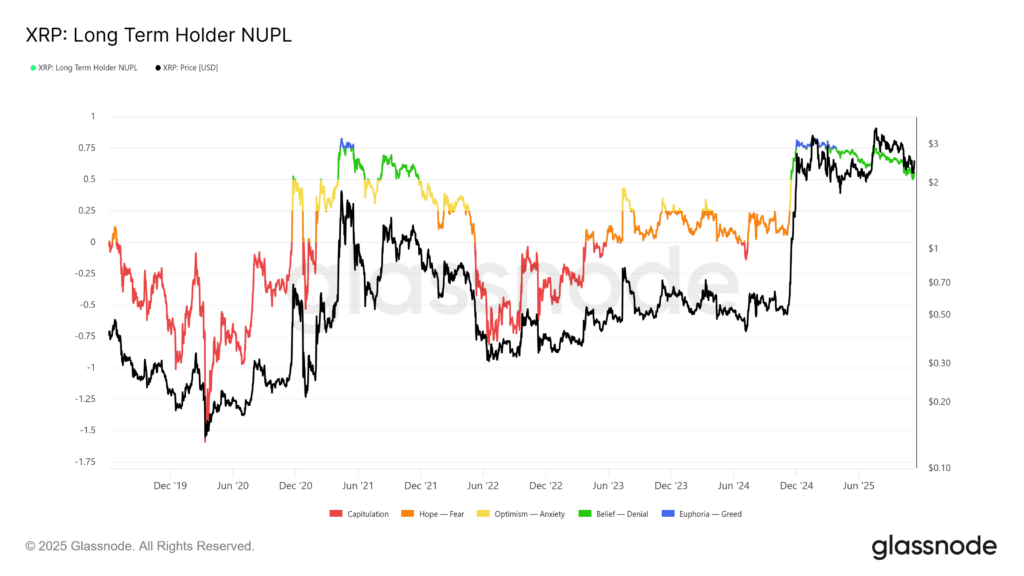

Long-Term Holder Sentiment Shows Mixed Signals

The Net Unrealized Profit/Loss (NUPL) metric for long-term holders presents a more nuanced picture. This indicator recently corrected from euphoric levels reached in late 2024, when XRP surged to $3.66 in July.

At that peak, the NUPL touched 0.748, approaching but not quite reaching the euphoria zone. Historically, when this metric hits extreme profit levels, prices tend to correct rather than continue climbing within the same cycle.

The question facing analysts is whether the current pullback represents a healthy consolidation or the beginning of an extended downtrend. Previous market cycles suggest that reaching euphoric profit levels twice within one cycle is uncommon.

Market Context Requires Balanced Perspective

While on-chain metrics and technical patterns paint a bullish picture, market conditions can shift rapidly. The combination of record exchange outflows and Elliott Wave projections creates an intriguing setup, but no analysis guarantees future performance.

Investors monitoring XRP should establish clear risk parameters and identify price levels that would invalidate their bullish thesis. Understanding both the supporting evidence and potential contrary indicators helps market participants make informed decisions based on their individual strategies and risk tolerance.

Comments are closed.