XLM Price – Bitcoin’s Drop Pressures XLM; Technicals Highlight Pullback

XLM Price – Stellar (XLM) experienced a sharp rally of 110% in just one week, signaling a strong bullish momentum. However, recent price action suggests the possibility of a minor pullback. As reported by AMBCrypto, “bulls may be exhausted after driving a 110% rally in just one week,” indicating a temporary pause in upward movement.

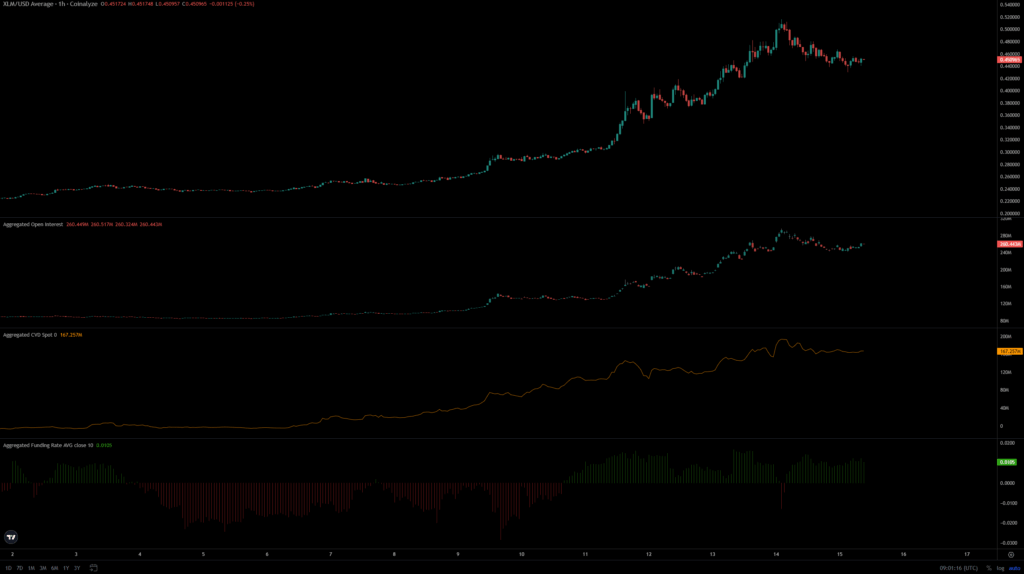

XLM’s recent price dip coincided with a 4.95% pullback in Bitcoin (BTC), which dropped from $123.2k to $117.1k. According to Coinalyze data, despite the pullback, bullish enthusiasm remains intact in the short term, supported by positive funding rates. The 10.6% drop in XLM’s price was accompanied by a $20 million decline in open interest, suggesting profit-taking and long liquidations near the $0.51 resistance zone.

On-Chain Indicators Signal Shallow Correction

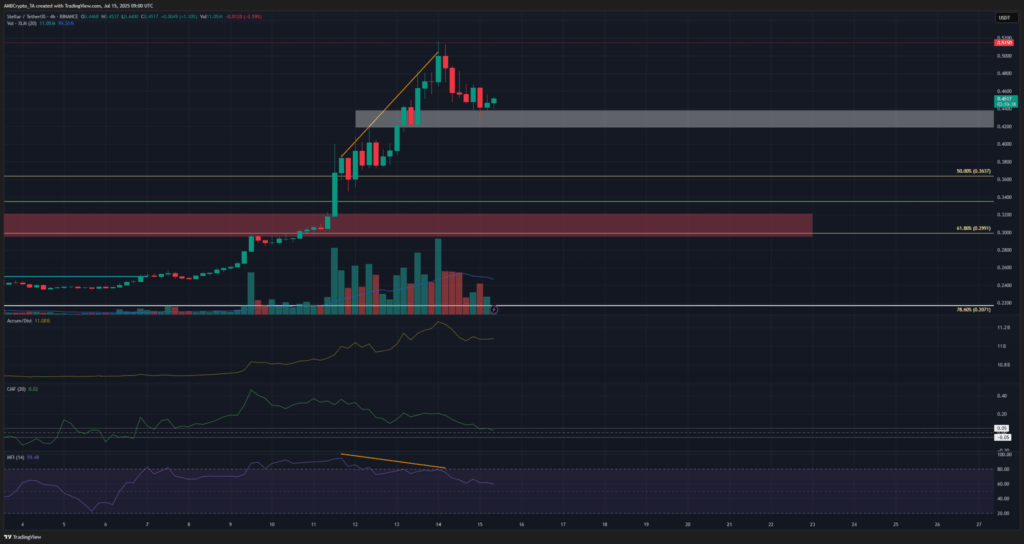

Spot cumulative volume delta (CVD) maintained an uptrend, indicating that sellers have not yet gained dominance. This points to a shallow price correction rather than a significant downtrend. The rally starting June 22 saw Stellar’s price climb to $0.516 by July 6, supported by high trading volumes. During the upward move, a price gap between $0.42 and $0.44 emerged and was being retested recently.

The Accumulation/Distribution (A/D) line trended upward, reflecting strong buying pressure, while the Chaikin Money Flow (CMF) reading of +0.23 indicated healthy capital inflows. The Money Flow Index (MFI), however, showed a bearish divergence on the 4-hour chart despite strength on the daily chart. This divergence forecasted the recent pullback to $0.43, with CMF falling to neutral levels.

Outlook Amid Market Dynamics

The bearish divergence led XLM prices back to the fair value gap acting as a demand zone. Should Bitcoin’s price correct further below $116k, XLM might face additional pressure. Until then, on-chain data and technical signals suggest cautious optimism for Stellar’s near-term price action.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Cryptocurrencies and stocks, particularly in micro-cap companies, are subject to significant volatility and risk. Please conduct thorough research before making any investment decisions.

Comments are closed.