Featured News Headlines

Stablecoins Surge, Crypto Stalls: What’s Driving the Split?

The market capitalizations of major stablecoins continue to climb, yet their growth no longer moves in tandem with the broader crypto market. According to CoinGecko, USDT reached $185 billion and USDC hit $78 billion in December—both all-time highs. Despite this expansion, the fresh supply has not translated into stronger Bitcoin or altcoin performance. Three structural shifts explain why.

More Stablecoins Are Flowing Into Derivatives Markets

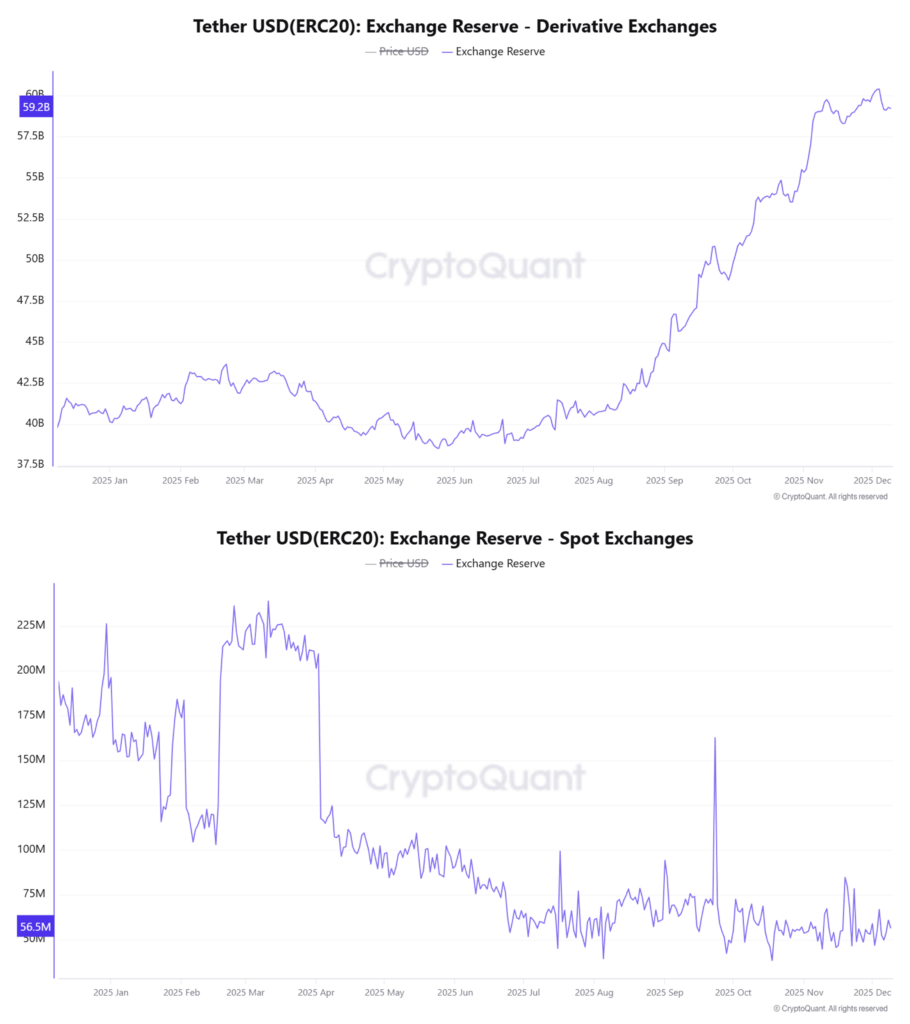

Blockchain analytics indicate that stablecoins are increasingly funneled into leveraged trading rather than spot buying. CryptoQuant data shows that USDT (ERC-20) balances on derivatives exchanges climbed from under $40 billion to nearly $60 billion since early 2025, while spot exchange balances have dropped to yearly lows. USDC on spot platforms has also fallen from $6 billion to $3 billion.

This trend reflects a market leaning toward short-term trades instead of long-term accumulation. Heavy use of leverage fuels rapid profit-taking but also drives frequent liquidations. Several multi-billion-dollar wipeouts in 2025 highlight this unstable environment.

Stablecoins Now Serve Broader Real-World Functions

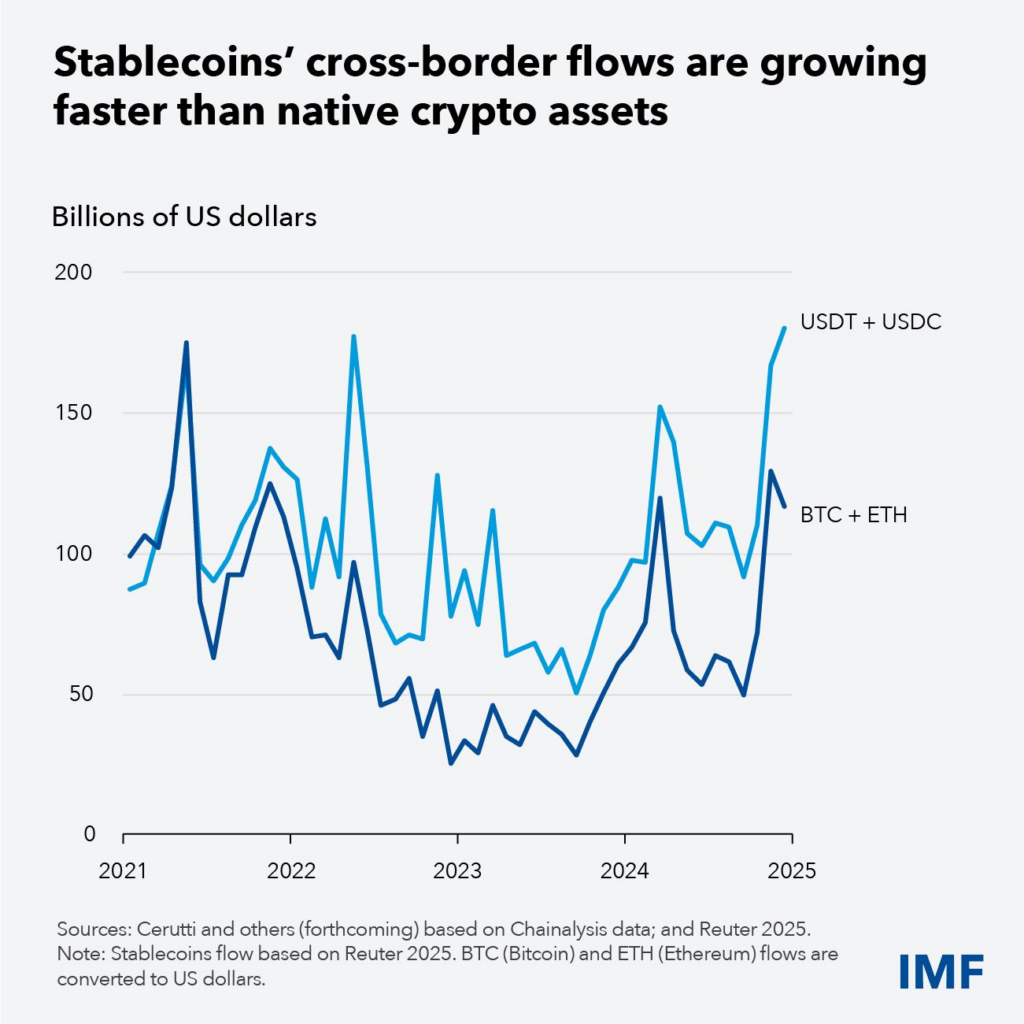

Stablecoin issuance is no longer tied solely to crypto-native activity. Demand increasingly comes from global financial use cases. An IMF report noted that cross-border flows using USDT and USDC reached roughly $170 billion in 2025, adding that “Stablecoins could enable faster and cheaper payments, particularly across borders and for remittances.”

As a result, much of the newly minted supply is absorbed by remittances, payments, and settlement networks—not by speculative crypto trading.

Investor Caution Is Slowing Capital Rotation

Market sentiment remains fragile. A Matrixport analysis described current conditions as dominated by low volume and weak retail engagement, stating: “Without volume, enthusiasm cannot compound, and without enthusiasm, volume will not return.” In this environment, investors tend to hold stablecoins rather than shift into Bitcoin or altcoins.

Historical patterns support this behavior. During 2022, stablecoin supply continued rising even as the market turned bearish, then contracted sharply as investor confidence collapsed later that year.

Comments are closed.