Featured News Headlines

White House Weighs Global Crypto Reporting Rules Amid Growing Tax Scrutiny

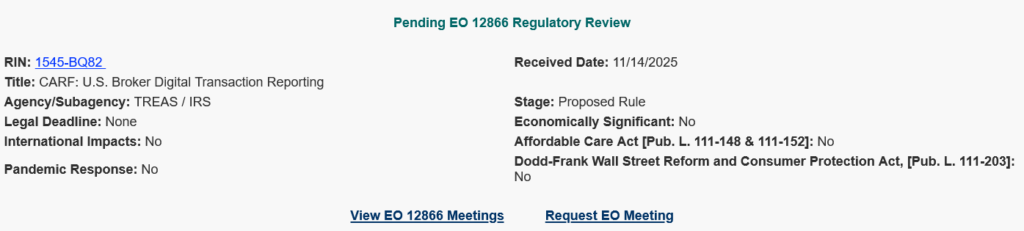

The White House is reviewing a new proposal from the Internal Revenue Service (IRS) that would bring the United States into the global Crypto-Asset Reporting Framework (CARF)—a move that would grant U.S. tax authorities access to Americans’ foreign crypto account data. The proposal, titled “Broker Digital Transaction Reporting,” was submitted to the White House last Friday.

U.S. Could Align With 72 Nations by 2028

If adopted, the rule would place the U.S. in line with 72 countries that have already committed to implementing CARF by 2028. Although the IRS did not classify the proposal as “economically significant,” it would require Americans to follow far stricter reporting guidelines for capital gains stemming from foreign crypto exchanges.

A White House report published in late July argued that adopting CARF could prevent U.S. taxpayers from moving digital assets offshore—keeping domestic crypto platforms competitive by reducing incentives to seek out jurisdictions with lighter reporting rules.

Global Adoption of CARF Accelerates

CARF, established by the Organization for Economic Cooperation and Development (OECD) in late 2022, aims to combat international tax evasion by enabling countries to exchange crypto-related data. The framework is scheduled to roll out in 2027 with 50 participating countries, including Brazil, Indonesia, Italy, Spain, Mexico, and the UK.

Another 23 nations, including the United States, appear committed to joining by 2028. The rapid expansion underscores governments’ growing concerns over how easily crypto users can transfer assets across borders, transact pseudonymously, and store wealth in self-custody wallets outside the traditional financial system.

Stricter U.S. Crypto Tax Rules Coming in 2026

The U.S. is also preparing to implement new domestic reporting standards. Beginning in January 2026, crypto exchanges will be required to issue 1099-DA forms, mandating detailed disclosure of both inbound and outbound transfers.

Crypto tax lawyer Clinton Donnelly described the upcoming rules as the beginning of the end of crypto anonymity, warning that the IRS will eventually gain “instant visibility” into blockchain activity. As tools improve, Donnelly says authorities will be able to analyze networks at scale to identify major non-reporters and target them for audits.

Comments are closed.