Featured News Headlines

VIRTUAL Price Jumps as Futures Data Turns Positive

Virtuals Protocol’s native token VIRTUAL emerged as one of the day’s strongest performers after climbing roughly 11% within 24 hours, signaling a robust recovery from recent selling pressure. The move followed a decisive reaction at a key technical support level that has repeatedly defined the asset’s previous market cycles.

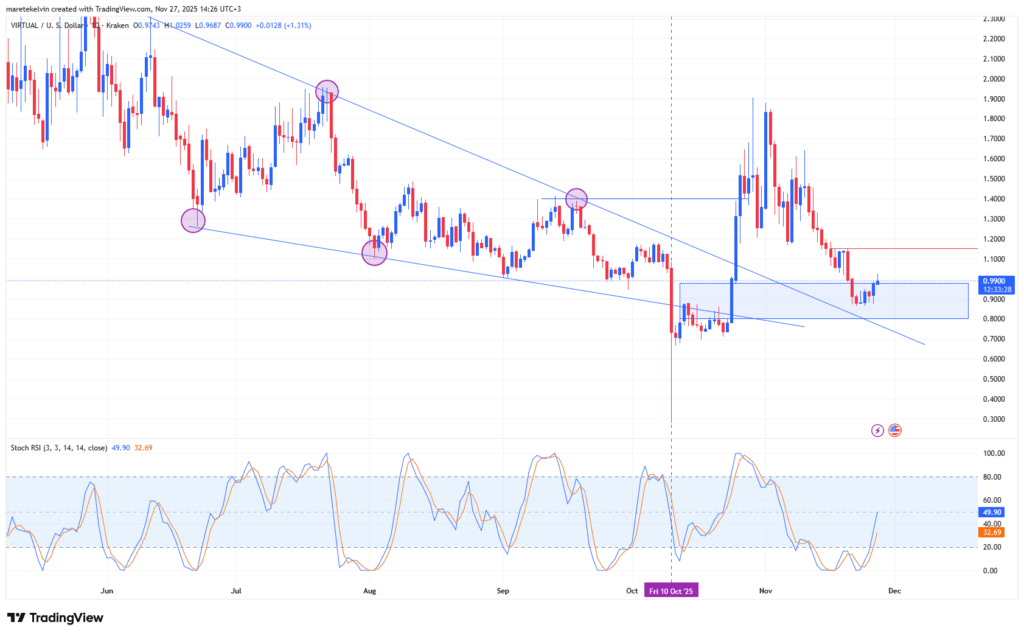

Price Rebounds From Key Pennant Support

The token’s latest bounce occurred precisely at the pennant trend-line support that previously guided earlier upswings. This level has acted as support multiple times, strengthening its relevance for traders monitoring market structure.

The successful retest boosted confidence across the board as the price worked through the imbalance near $0.90, a zone that has historically attracted significant demand. With this region now filled, short-term recovery momentum appears supported by renewed buy-side activity.

Indicators Signal Growing Positive Momentum

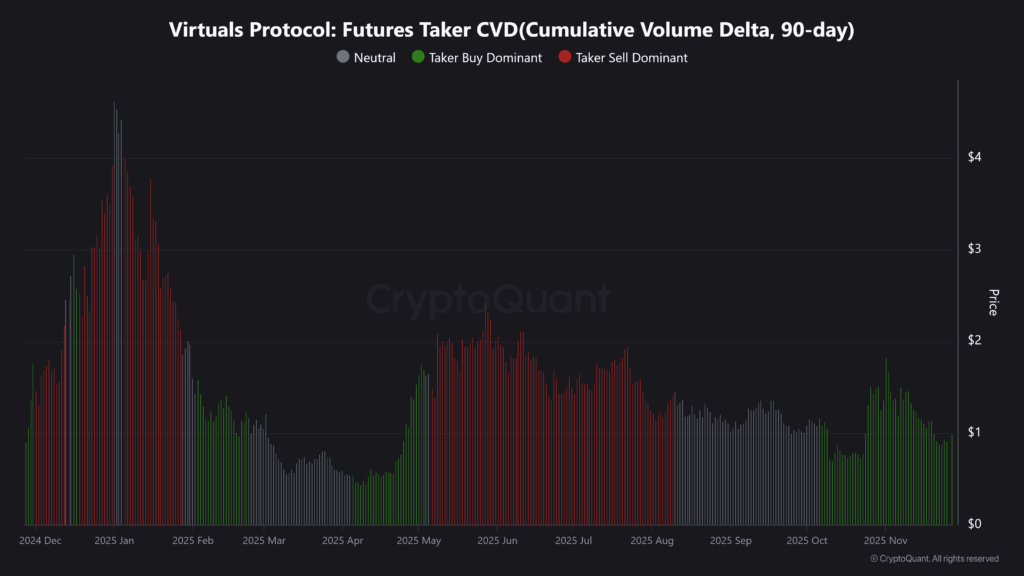

Technical signals reinforced the shift. The Stochastic RSI on the daily chart bounced from oversold territory, indicating improving bullish momentum. Complementing this move, Futures Taker CVD data from CryptoQuant showed buyers gradually regaining control in recent weeks.

That steady pressure from the buy side suggests the current rally may have structural support rather than representing a brief corrective move. Meanwhile, rising market dominance hinted that the push upward was driven mainly by aggressive long positioning, not slow spot accumulation.

Whales and Retail Traders Align on Bullish Activity

As derivatives metrics strengthened, larger holders—often described as whales—became more active. Futures Average Order Size charts highlighted a notable increase in large orders near the current price range, signaling renewed participation from major players.

Retail traders are also increasing activity, buying into dips and contributing to rising volume. The alignment between retail buyers and whales is typically seen as reinforcing short-term bullish setups, particularly when both are positioned in the same direction.

Derivatives Market Shows Expanding Long Positions

Across futures platforms, a rising share of long positions suggested that traders were preparing for continuation rather than reacting to a temporary bounce. With the pennant pattern still intact and price holding above the key reaction zone, expanding futures participation may help support further upside momentum.

For now, technical and behavioral data point toward an improving short-term structure, even as broader market conditions remain a key variable moving forward.

Comments are closed.