Featured News Headlines

US Bitcoin ETFs Record Sharp Outflows Amid Rising Market Fear

US Bitcoin ETFs – The US Bitcoin exchange-traded funds (ETFs) are witnessing steady outflows, signaling a notable shift in market sentiment. The Crypto Fear and Greed Index plunged to 11, reflecting extreme fear, as retail investors largely remain on the sidelines during the current downturn.

ETF Outflows Highlight Investor Caution

Data from Farside Investors shows that Bitcoin ETF holdings dropped from 441,000 BTC on October 10 to about 271,000 BTC by mid-November. Four consecutive days of outflows underscore a defensive mood that has dominated the market this month. Although daily redemptions have moderated—recently around $60 million—investors are still hesitant, with retail traders largely absent.

Average order size metrics from exchanges such as Binance, Coinbase, Kraken, and OKX indicate that whales are the primary buyers, rather than small-scale retail investors. Meanwhile, Bitcoin has declined nearly 27% from its October 6 all-time high of $126,272.76, trading between $91,000–$92,000, while Ethereum and Solana have also seen significant weekly losses.

Whales Accumulate Amid Market Weakness

Large investors continue to accumulate aggressively. OnchainLens reports a whale purchased 10,275 ETH at $3,032 for $31.16 million USDT within 24 hours, with total acquisitions from November 12–17 reaching 13,612 ETH at an average of $3,077.

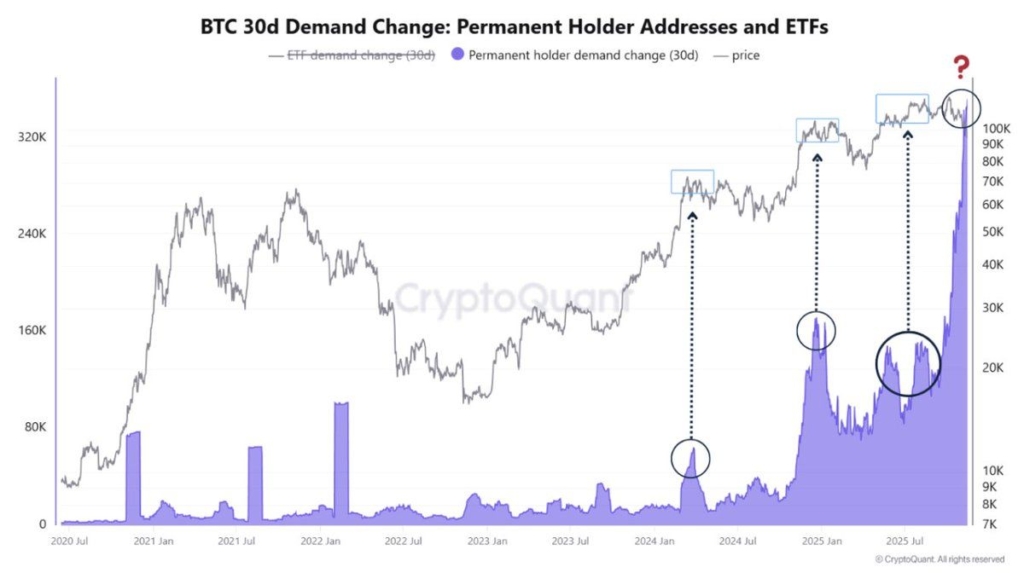

Additionally, permanent Bitcoin holders—wallets with no prior outflows—have boosted holdings from 159,000 BTC to 345,000 BTC, representing the largest accumulation in recent selloffs. This divergence between long-term holders and cautious retail investors highlights changing market dynamics, with CryptoQuant CEO Ki Young Ju noting that coins are mostly rotating among long-term holders rather than new capital entering.

Market Structure and Institutional Support

Despite technical signals remaining bearish—including Bitcoin’s death cross where the 50-day moving average fell below the 200-day—structural changes offer support. JPMorgan now accepts Bitcoin as loan collateral, providing deeper liquidity.

Mining firms like HIVE Digital Technologies plan to continue a mine-and-hold strategy, focusing on long-term accumulation despite volatility, contrasting with competitors pivoting to high-performance computing.

While macroeconomic pressures persist—delayed Federal Reserve rate cuts and global tightening—analysts point to long-term trends, including high sovereign debt and geopolitical tensions, as favorable for Bitcoin’s future.

Comments are closed.