Featured News Headlines

TRX/BTC Approaches Key Resistance as Network Usage Surges

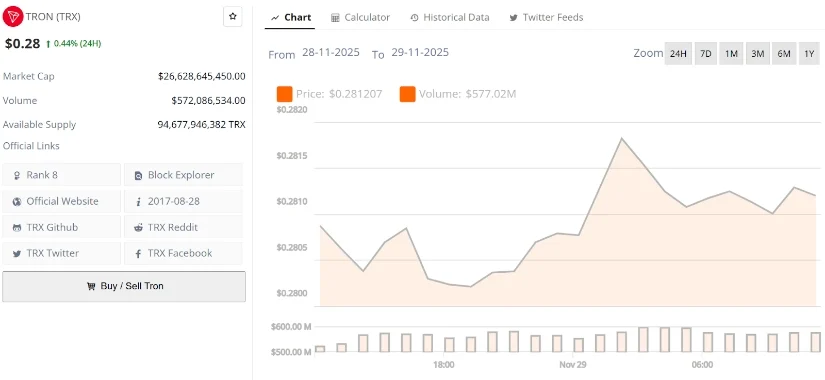

TRON (TRX) is trading near the $0.28 level after a turbulent November, with price action confined within a broader consolidation range. On-chain data shows that despite market fluctuations, the network continues to be among the most actively used in the cryptocurrency space.

While technical and on-chain signals are cautiously constructive, any discussion of TRX price movements into 2025 hinges on how the market reacts around the multi-month support zone.

TRX Remains Inside Symmetrical Structure

The daily chart indicates that TRX is moving within a large symmetrical structure, characterized by lower highs pressing against a rising support trendline. Recent activity in the demand zone between $0.26 and $0.27 suggests buyers remain active, though the mid-range has yet to be decisively reclaimed.

As noted by crypto analyst Blacksea, “TRX could first retest the lower boundary before rotating higher towards the $0.34 to $0.36 region.” This scenario maintains the broader consolidation pattern and aligns with TRON’s historical behavior, where periods of tightening volatility near trendline support are often followed by expansions.

Bullish Divergence Signals Potential End of Bear Cycle

Momentum indicators are revealing patterns that diverge from the current price trend. On the three-day chart, a strong bullish divergence is developing between TRX price and the RSI. While the price continues to grind lower, the oscillator’s lows are rising, a pattern commonly observed near the conclusion of extended corrective phases rather than at their onset.

Master Kenobi’s analysis of the 105-day cycle notes that “the current downswing mirrors the length and structure of the last major corrective leg,” suggesting that TRX may be approaching the latter stages of its bear cycle. Should this pattern persist, it could pave the way for a medium-term recovery toward the upper boundary of the channel once momentum confirms.

TRX Shows Potential Relative Strength vs BTC

On the TRX/BTC front, the pair is approaching a significant inflection point. Charts from Vuori Trading indicate that TRX is pressing against nearly six years of resistance, supported by a steady progression of higher lows forming a broad ascending base.

Vuori Trading highlights that “If TRX manages to break and hold above this resistance on the BTC pair, it would signal a move towards 0.00002035BTC and 0.00005210BTC.” For those analyzing TRX price dynamics in 2025, sustained outperformance against Bitcoin would represent a crucial confirmation layer, even as overall market trends remain unpredictable.

Network Activity Underlines Fundamental Strength

TRON’s fundamentals continue to capture attention. Daily active address metrics indicate that Tron consistently competes for top positions alongside BNB Chain, while networks such as Solana, Polygon, and Bitcoin trail behind.

According to Rand, “Tron leads in 24-hour active users,” reflecting the network’s ongoing relevance as a settlement and stablecoin hub. High user activity alone does not guarantee price movement, but it underscores that the ecosystem remains vibrant and heavily utilized.

This level of throughput could provide a solid foundation for TRX, particularly in supportive macroeconomic conditions. The consistent network engagement shows that Tron remains far from dormant, maintaining its position as a key infrastructure layer for cryptocurrency transactions.

TRX Outlook Amid Technical Patterns

Currently, TRX is navigating a critical support zone while early signs of momentum improvement emerge. The combination of a major support level, bullish divergence, and potential TRX/BTC breakout keeps the possibility of upward movement relevant, though confirmation is still pending.

Traders are closely monitoring whether TRX can maintain its base and approach the $0.40–$0.45 region. At the same time, a decisive break below support could extend the consolidation phase, emphasizing the importance of the current technical structure in shaping market behavior.

Comments are closed.