Featured News Headlines

Crypto Market Eyes FOMC Decision — These 3 Altcoins Are Set to React

Top 3 Altcoins to Watch Before the FOMC Meeting – The crypto market is heating up as investors await the Federal Open Market Committee (FOMC) meeting on October 28–29, with traders eyeing potential interest rate cuts following a cooler-than-expected U.S. CPI report. With sentiment improving and liquidity hopes rising, several altcoins are showing technical setups worth watching—particularly Chainlink (LINK), Dogecoin (DOGE), and Zcash (ZEC).

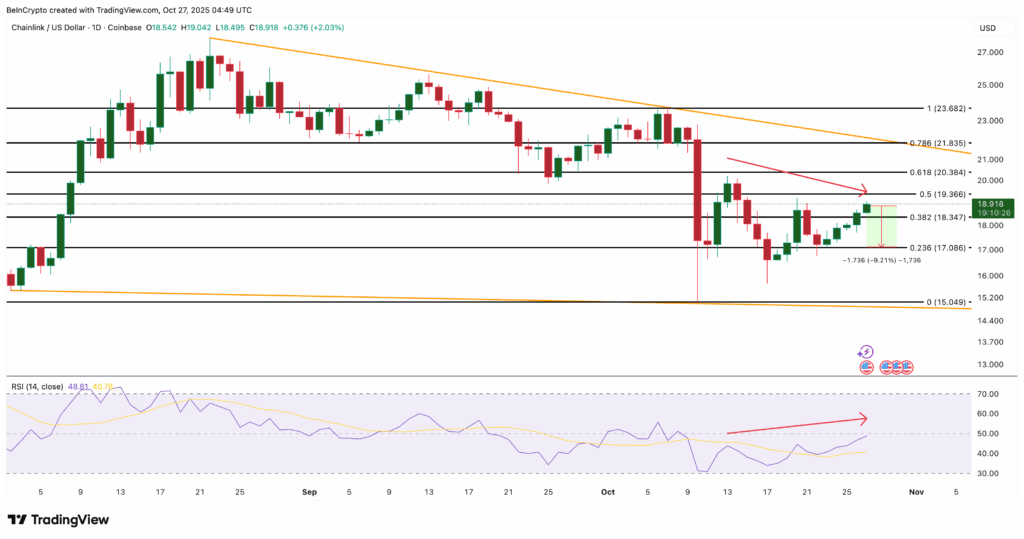

Chainlink (LINK): Whale Activity Returns Amid Mixed Signals

Chainlink (LINK) is trading within a falling wedge pattern, a setup that typically signals a bullish reversal. However, a hidden bearish divergence has emerged between October 13 and 27, with price making lower highs while the Relative Strength Index (RSI) forms higher highs—a sign that downward pressure could persist.

Currently, LINK is down 10.2% over the past month, but up 6.8% in the past week. The key support level sits at $17.08; a clean break below could trigger a drop toward $15.

Still, there are bullish undercurrents. The Money Flow Index (MFI) is forming higher highs, suggesting continued dip-buying, while the Chaikin Money Flow (CMF) has just moved above zero—an early sign of whale accumulation. The FOMC’s tone could determine whether LINK breaks higher or slips lower.

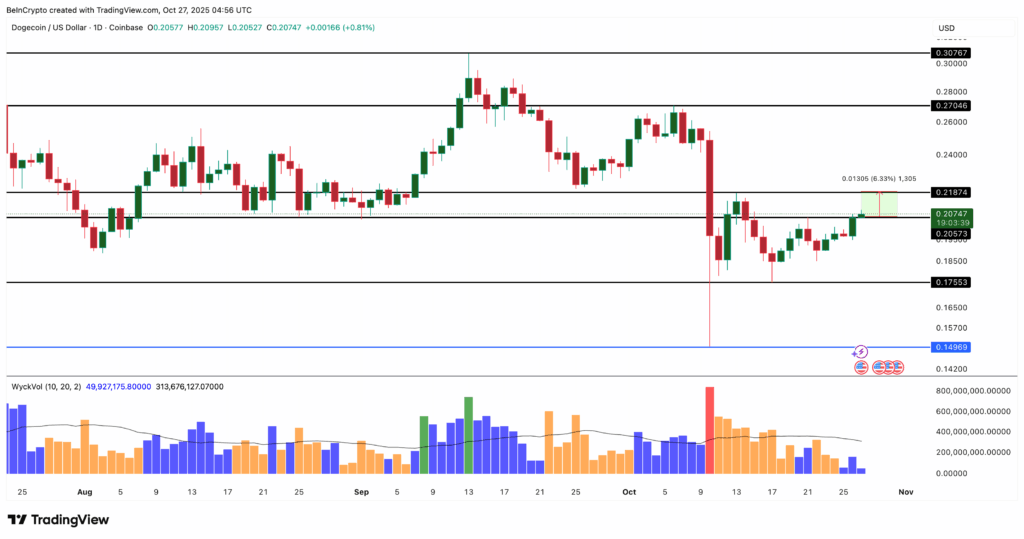

Dogecoin (DOGE): Whales Position for a Breakout

Dogecoin (DOGE) is consolidating in a tight range between $0.17 and $0.20, with traders watching $0.21 as the breakout level. A decisive move above it could drive a 6% rally toward $0.27, especially if the Fed hints at a dovish policy shift.

Recent Wyckoff volume profile data shows a short-term transition from seller control to buyer control, though momentum remains mixed. Notably, Dogecoin whales holding 100 million–1 billion DOGE have accumulated an additional 170 million DOGE (≈$34 million) in the last 48 hours, signaling early positioning before the meeting.

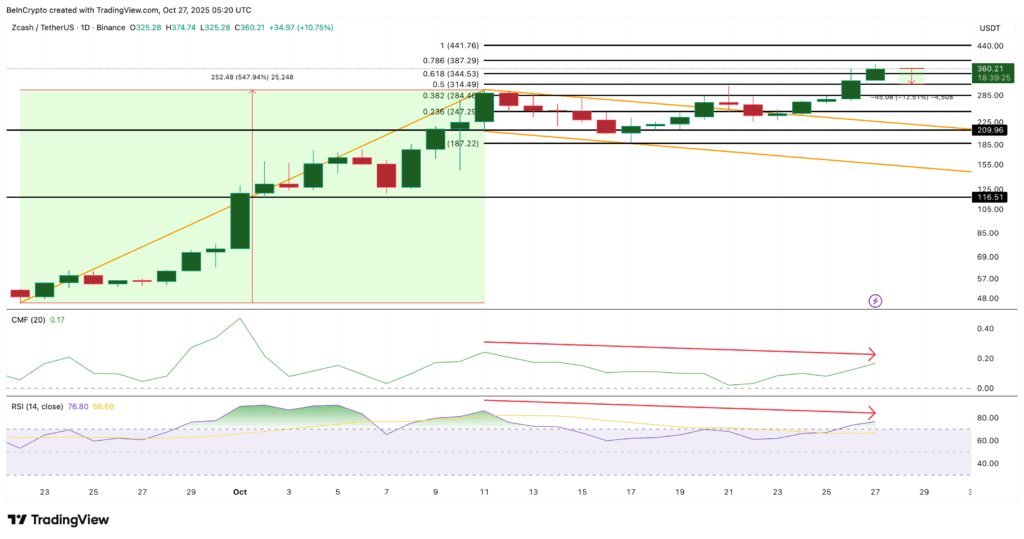

Zcash (ZEC): Momentum Cools After a 540% Rally

Zcash (ZEC) has been one of October’s standout performers, surging over 540% in the past month after breaking out of a bullish flag and pole pattern. The coin recently cleared key resistance at $314 and $344, but technical indicators are flashing caution.

Between October 11 and 27, both the RSI and CMF formed bearish divergences, suggesting buying momentum may be weakening. Analysts warn of a potential 10%–12% pullback, with price possibly retesting $314 or $284 before continuing upward.

Strong support sits near $247, while a break below $187 would invalidate the bullish setup.

Comments are closed.