Tokenized Stocks Exploded as Capital Spreads Across Multiple Blockchains

One of the digital asset classes with the quickest rate of growth is tokenized stocks. This is changing the way blockchain infrastructure and traditional markets interact. They are gaining attention in 2025 due to their strong year-to-date performance, growing issuer engagement, and quickening multi-chain adoption. The competition between blockchains is getting more intense as capital flows expand beyond a single network. More and more people believe that tokenization is a crucial link between on-chain finance and trillion-dollar legacy markets.

Tokenized Equities Outperform as Multi-Chain Adoption Accelerates

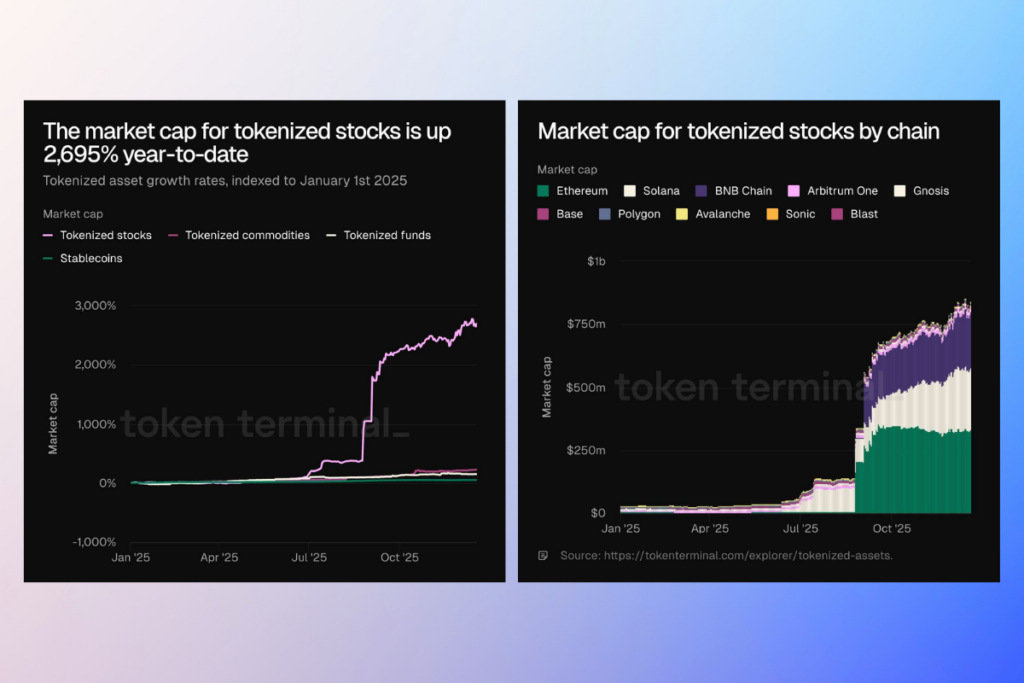

Tokenized stocks have obviously outperformed the rest of the tokenized asset market thus far in 2025. Compared to tokenized funds (148%) and tokenized commodities (225%), their market capitalization has increased 2,695% YTD. Even stablecoins have only increased 49% during the same time span, despite having a far larger base. Tokenized stocks improved in the middle of the year, according to data from Token Terminal. This upsurge is being led by issuers such as Backed, Ondo Finance, Dinari, and Robinhood.

On the other hand, Ethereum continues to dominate the tokenized stock market, but its dominance is not unquestionable. Although the network still accounts for the majority of issuance, newer chains are gradually catching up to it. Instead of going to Ethereum alone since the middle of 2025, the entire market capitalization has simultaneously increased across many chains. Solana, BNB Chain, Arbitrum, Base, and Polygon have taken significant portions of the market capitalization.

Infrastructure Wars Heat Up as Tokenized Assets Gain Momentum

At the infrastructure level, tokenized assets are significant due to the sizeable marketplaces that support them. Tokenized stocks, funds, and commodities exhibit significant unmet demand even in the absence of stablecoins. The combined market value of stocks and funds exceeds $100 trillion. Commodities present another possibility worth more than $30 trillion. Long-term relevance, utilization, and fees can all be improved by capturing even a little portion of this activity. Tokenized assets gain value if a network can reduce expenses, expedite settlement, and assist issuers in reaching new consumers. Even for the chains vying to host them, it makes them desirable.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.