The Ether Machine Set to Debut: ETHM Aims to Dominate Institutional Ethereum Access

With over $1.5 billion raised and 400,000 ETH secured in its vault, The Ether Machine is set to launch on the Nasdaq. It is the outcome of a reverse merger between the blank-check business Dynamix Corp. and the cryptocurrency startup The Ether Reserve. Yahoo Finance data shows that after the deal was made public, Dynamix Corp.’s shares more than doubled in premarket trading.

It is anticipated that the new company will start trading before the end of 2025 and will use the ticker ETHM. Ether Machine will be the greatest public vehicle providing institutions with direct access to ETH, the second-largest cryptocurrency in the world, following the completion of this merger in the fourth quarter.

The Ether Machine Attracts Big Investors as ETH Hits 7-Month High

There is a lot of capital invested in this endeavor. Through an expanded common stock offering, investors such as Kraken, Pantera Capital, and Blockchain.com contributed more than $800 million, pushing the total amount raised above $1.6 billion. Andrew Keys, the new chairman, is in charge. With Andrew on board, the project has a face that is intimately familiar with the Ethereum environment.

Similar tactics have been tried by several cryptocurrency startups in recent months, including public listings that enable traditional finance to wager on tokens through stocks. Bitcoin has been the focus of the majority of those efforts, but ETH has been rapidly catching up. In this regard, Cryptopolitan said that it recently reached a seven-month high on Friday.

Ether Dominates Institutional Demand With Record-Breaking Momentum

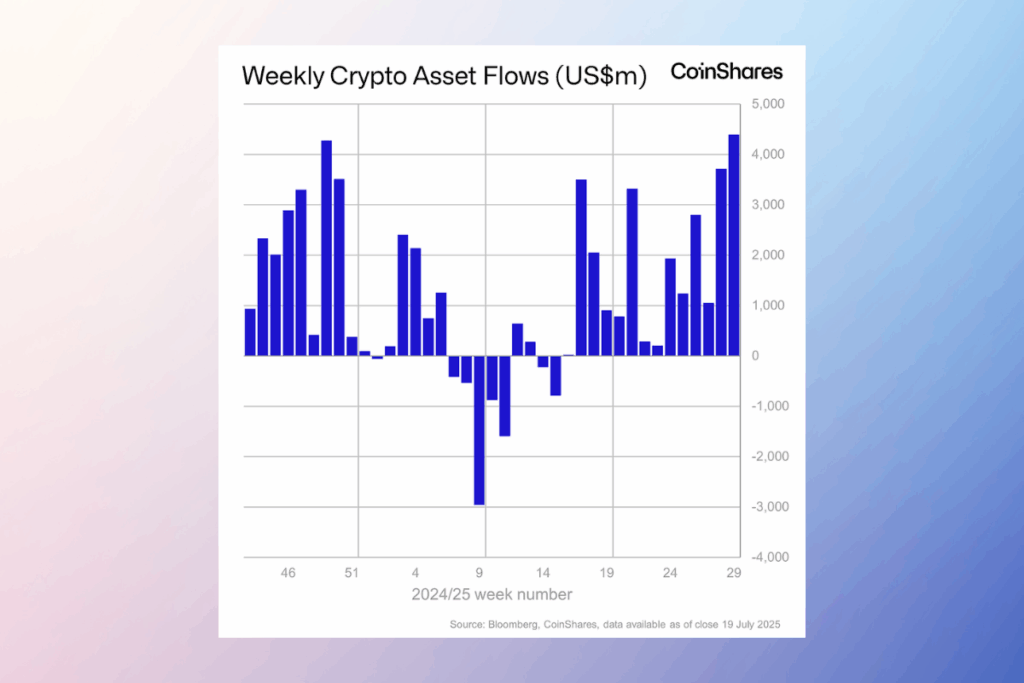

Ether is having its moment at the moment. Its associated investment products recently attracted a record $2.12 billion in inflows, almost doubling the previous peak of $1.2 billion. For the previous week, it has been the cryptocurrency with the best performance in terms of institutional interest. Furthermore, inflows have been recorded for 13 consecutive weeks, making up 23% of Ether’s total assets under management. projected 2025 revenue has already surpassed projected 2024 total by $6.2 billion.

All cryptocurrency investment products saw inflows of $4.39 billion last week, surpassing the previous high of $4.27 billion set shortly after the 2024 U.S. election. These figures boost this year’s total to $27 billion and represent the 14th consecutive week of growth. At $220 billion, the total assets under administration have reached yet another record high. The United States accounted for the majority of the capital, with inflows of $4.36 billion just this past week. Gains were also reported in other regions.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.