The Rise of Stock Tokenization in DeFi

The tokenization of stocks is gaining attention in the crypto industry, though its immediate impact on the broader cryptocurrency market is expected to be limited. According to NYDIG, the benefits of tokenized real-world assets (RWAs) could expand as they become more integrated, interoperable, and composable on blockchain networks.

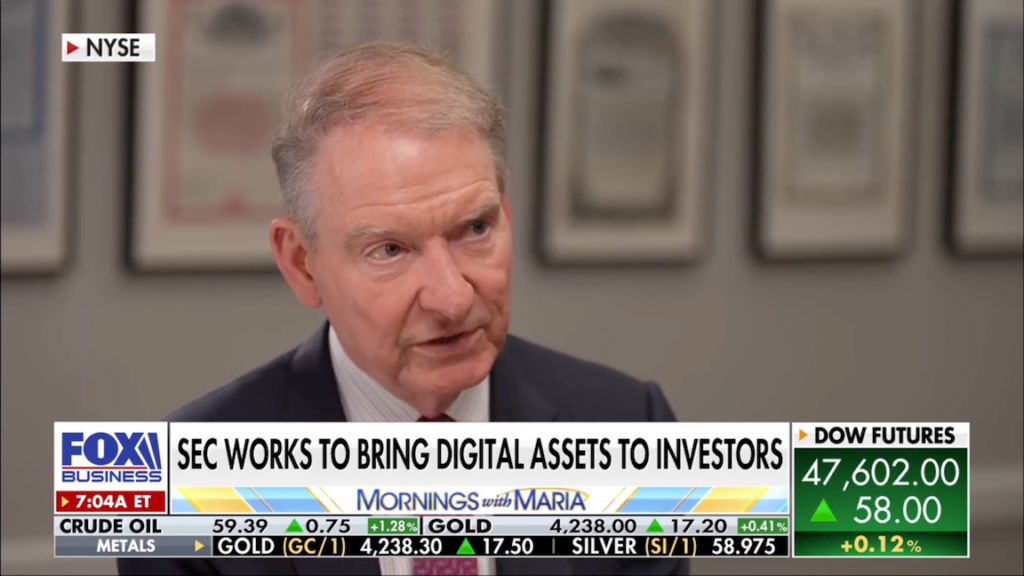

Greg Cipolaro, NYDIG’s global head of research, noted, “The benefits to networks these assets reside on, such as Ethereum, are light at first, but increase as their access and interoperability and composability increase.” Early advantages will include transaction fees and the growing network effects of blockchains hosting these assets.

RWAs and Blockchain Infrastructure

Tokenizing real-world assets like U.S. stocks has become a hot topic, with major exchanges such as Coinbase and Kraken exploring tokenized stock platforms in the U.S. following success overseas. Cipolaro highlighted that RWAs could eventually be incorporated into decentralized finance (DeFi) ecosystems, potentially serving as collateral for borrowing, assets to lend, or tradable instruments. However, he emphasized, “This will take time as technology develops, infrastructure is built out, and rules and regulations evolve.”

Creating composable and interoperable tokenized assets is complex due to differences in form, function, and network type. Cipolaro pointed out that the Canton Network, a non-public blockchain, currently hosts the majority of tokenized assets, while Ethereum leads among public blockchains with $12.1 billion in deployed RWAs. He explained, “Even on an open, permissionless network such as Ethereum, the design of the specific tokenized asset can vary greatly. These RWAs are often securities, broker-dealers, KYC/investor accreditation, whitelisted wallets, transfer agents, and other structures from traditional finance are required.”

Despite the reliance on traditional financial structures, blockchain technology offers benefits such as near-instant settlement, 24/7 operations, transparency, and programmatic ownership. Cipolaro concluded, “In the future, if things become more open and regulations become more favorable, access to these assets should become more democratized, and thus these RWAs would enjoy expanded reach.” He added, “Investors should pay attention, even if the economic impacts to traditional cryptocurrencies are minimal today.”,

Comments are closed.