South Korean Bank Stocks Soar Amid Crypto Hype

South Korean Banks Stocks – South Korea’s major banks have seen their stock prices soar following recent trademark applications for Korean won-pegged stablecoins, signaling strong institutional interest in digital currencies.

According to Google Finance, banks like Kakao Bank, Kookmin Bank, and the Industrial Bank of Korea filed for stablecoin-related trademarks in late June. Following these filings, Kakao Bank’s shares jumped nearly 19.3%, Kookmin Bank’s rose over 13%, and Industrial Bank’s shares increased by more than 10% — all within days.

Political Support Fuels Crypto Optimism

These developments closely followed the inauguration of South Korea’s 21st president, Lee Jae-myung, on June 4. His administration’s promise to develop a Korean won-backed stablecoin has injected optimism into the market and encouraged banks to accelerate their crypto strategies.

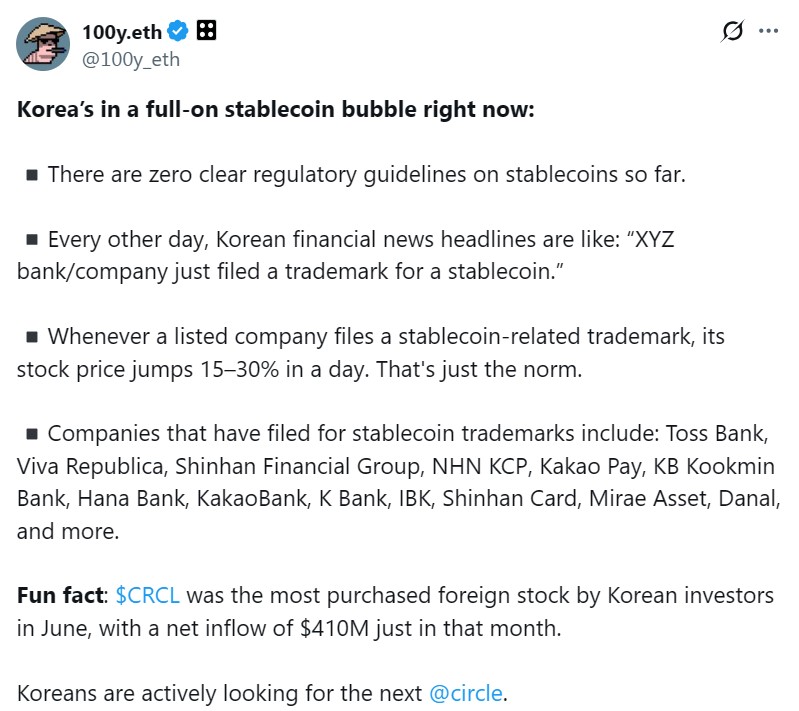

Despite excitement, experts like 100y, research lead at Four Pillars, caution that South Korea could be entering a “stablecoin bubble.” The lack of clear regulatory guidelines raises concerns about the sustainability of the current rush toward stablecoin projects.

What’s Next for South Korean Banks and Crypto?

While banks have yet to reveal detailed plans for their stablecoin projects, the surge in trademark filings and stock prices clearly reflects growing momentum in South Korea’s crypto sector. This trend may pave the way for wider adoption of digital assets within the country’s financial system.

As South Korea pushes forward with its crypto ambitions, regulatory clarity will be crucial. The ongoing uncertainty poses risks for banks and investors alike, making the coming months critical for the stablecoin landscape in the country.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Cryptocurrencies and stocks, particularly in micro-cap companies, are subject to significant volatility and risk. Please conduct thorough research before making any investment decisions.

Comments are closed.