Solana Price Stabilizes as Institutional Demand Offsets Selling Pressure

Despite heightened volatility across digital asset markets, established blockchain networks continued to attract capital, underscoring their longer-term relevance. Short-term fear weighed heavily on retail participation, pressuring on-chain activity and usage metrics across the sector. However, this slowdown appeared more closely tied to broader market sentiment than to structural weaknesses within individual ecosystems.

Solana stood out during this period as one of the more resilient Layer-1 blockchains. While activity declined alongside the wider market downturn, the network continued to draw interest from both large holders and institutional vehicles, even as risk appetite deteriorated.

Network Revenue and User Activity Decline Amid Market Fear

Solana’s on-chain revenue experienced a sharp peak in January before entering a steady decline that brought metrics down to their lowest levels of the year. The retracement erased gains made earlier in the cycle, largely reflecting reduced trading activity across decentralized applications.

This contraction coincided with extreme fear conditions across crypto markets rather than signaling a breakdown in the network’s fundamentals. As volatility rose and sentiment weakened, retail users scaled back engagement, a trend visible across most major blockchains.

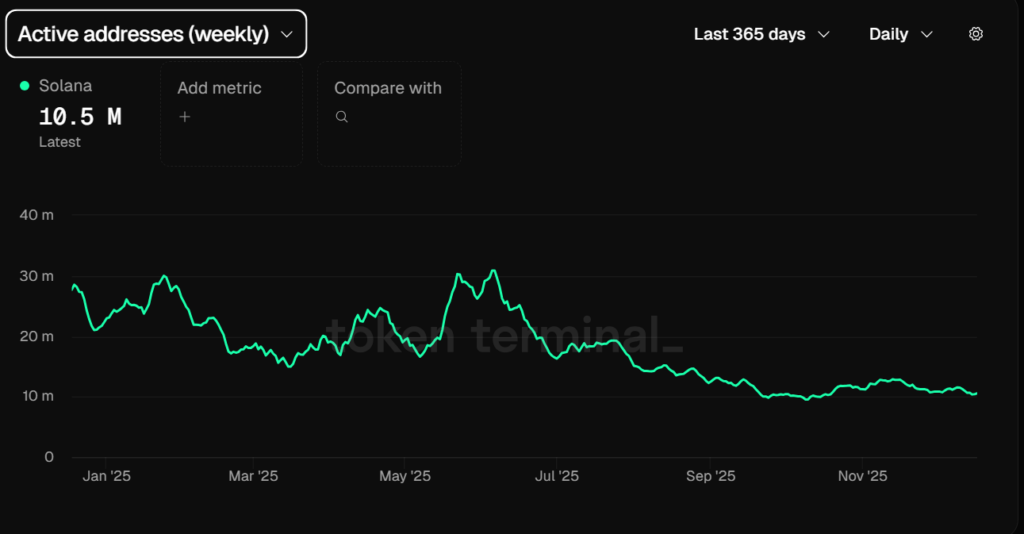

Weekly Active Addresses on Solana followed a similar trajectory, trending lower during the same period. The decline aligned with broader risk-off behavior as traders and smaller participants reduced exposure. Importantly, activity appeared to stabilize near recent lows as volatility compressed, suggesting a pause rather than an acceleration in the downturn.

Whale Accumulation Increases Below Key Price Levels

As Solana’s price dropped below the $120 level on December 18, on-chain data showed a notable increase in whale accumulation. Several large wallets added to their holdings during the pullback, indicating selective positioning during periods of weakness.

One wallet, identified as “G6gemN,” purchased approximately 41,000 SOL, valued near $5 million, during the dip. The transaction suggested deliberate accumulation rather than reactive trading behavior.

Historical activity provided additional context. Roughly eight months earlier, the same wallet accumulated 24,528 SOL near the $122 price area. Those holdings were later sold around $175, generating an estimated profit of $1.28 million. The return to accumulation at similar levels highlighted a recurring pattern of capital entering during fear-driven declines.

Rather than triggering widespread distribution, price weakness appeared to attract long-term capital. Whale behavior during this period reflected confidence in the network’s durability despite short-term uncertainty.

Comments are closed.