Featured News Headlines

Solana vs Ethereum: Revenue Gap Widens After 97% Activity Drop

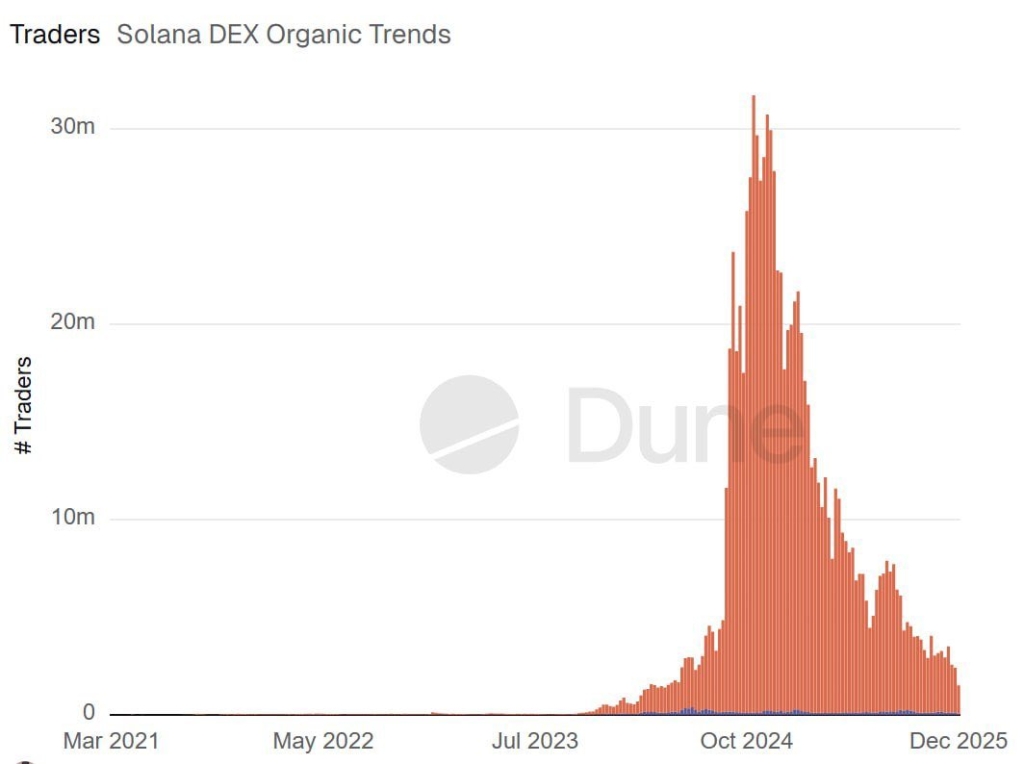

Solana (SOL) is facing mounting scrutiny after network activity plunged by 97% in Q4 2025, a collapse that coincided with a sharp downturn in the token’s price. Once home to more than 30 million active traders at its late-2024 peak, the network now reports fewer than 1 million monthly traders in 2025, raising concerns about Solana’s near-term trajectory.

Muted Activity Sparks Questions About Solana’s Future

The steep drop in activity prompted some analysts to question whether it may be “over for Solana.” While the late-2025 contraction in trading volumes affected the broader crypto market — with Bitcoin losing more than 30% — Solana’s situation appears more complex and deeply tied to its ecosystem dynamics.

Memecoins: Growth Engine or Structural Risk?

Throughout this market cycle, Solana and Hyperliquid emerged as standout performers. SOL surged from $8 to nearly $300, marking over 35x growth from the 2022 cycle lows. Despite improved network stability and fewer outages, memecoins remained a core driver of Solana’s traffic and revenue.

However, during the 2025 market rout, memecoins were among the first sectors to suffer. Supporters like Marty Party have argued that memecoins function as a stress test for future real-world applications, suggesting speculative users could eventually be replaced by equity traders and stablecoin users.

Still, the risks became evident as SOL fell from nearly $300 to the $120 yearly support, representing a 58% decline during the memecoin slowdown.

Institutional Interest and the Ethereum Comparison

Despite the downturn, Solana has attracted institutional interest, including Visa’s involvement in stablecoin settlements. Analysts suggest long-term resilience may depend on reducing reliance on speculative activity.

In comparison, Ethereum continues to dominate institutional adoption. In 2025, Ethereum generated over $1.4 billion in revenue, while Solana recorded $502 million, a threefold gap. Notably, Solana earned $2.5 billion in 2024, highlighting a fivefold revenue decline this year.

Diverging Price Outlooks for SOL

Anatoly Yakovenko, Solana’s co-founder, described 2025 as a “crazy year,” questioning whether permissionless protocols can sustain revenue growth. SOL has underperformed ETH by 56% in 2025, reversing its strong relative gains from last year.

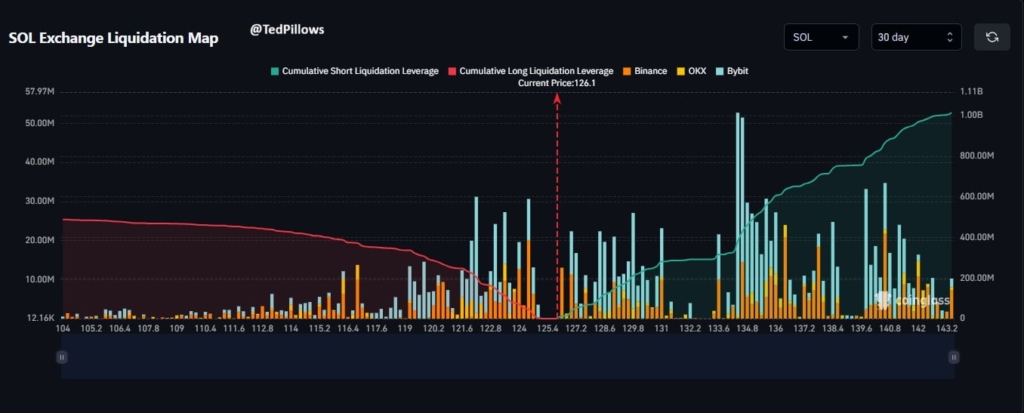

Looking ahead, Fundstrat projected a potential SOL decline to the $50–$75 range in H1 2026, while analyst Ted Pillows sees a possible 15% rebound to $134–$140, citing $1 billion in upside liquidity from leveraged short positions.

Comments are closed.