CryptoQuant Contributor: Short-Term BTC Holders Hold the Key to Next Surge

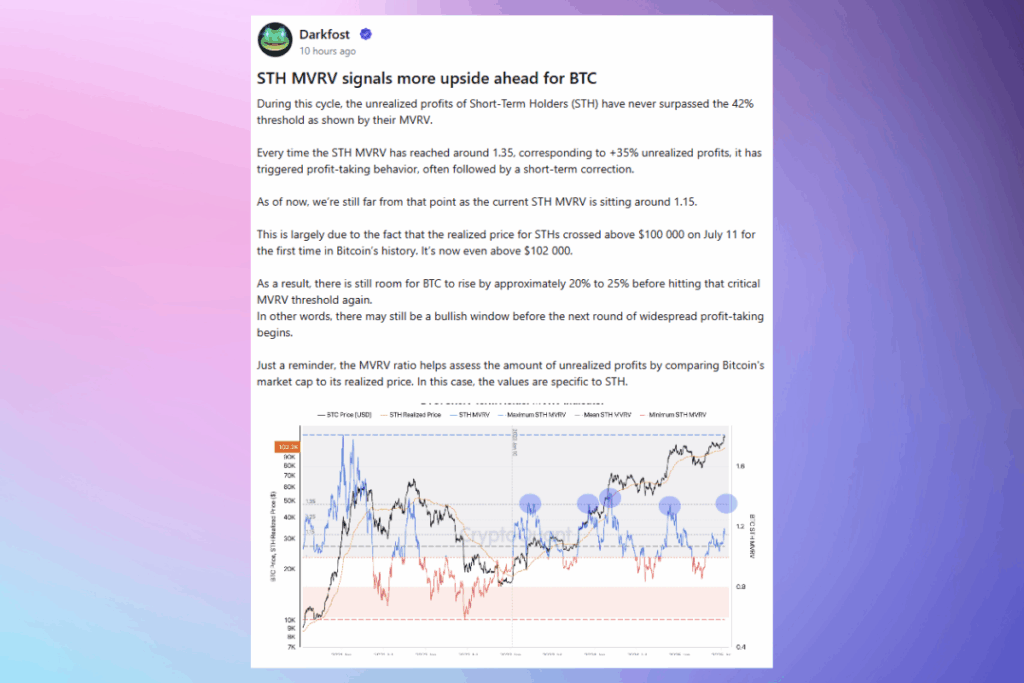

New on-chain data indicates that there might still be space for the surge to continue, as Bitcoin is still exhibiting resilience close to all-time highs. A July 17 research by Darkfost, a contributor to CryptoQuant, suggests that the price may still climb before encountering strong resistance. His research focuses on a subset of investors known as short-term holders who bought Bitcoin within the last several months.

The market value to realized value ratio, which contrasts the market price of Bitcoin with the average price paid by these holders, is a popular tool for monitoring their activity. The amount of profit that short-term holders are holding onto is measured by the MVRV ratio.

Bitcoin Could Climb Another 25% Before Major Sell-Off

In the past, selling usually occurred when these short-term holders‘ unrealized profit rose to about 35%. Usually, such results in a temporary reversal. This criterion corresponded to an MVRV reading of approximately 1.35 in previous cycles.

At present, that figure is around 1.15. To put it simply, short-term holders are not currently sitting on the kind of profits that have previously led to significant sell-offs. This allows Bitcoin to rise another 20% to 25% before reaching that well-known tipping point. The realized price, or the average price paid by short-term holders, just surpassed $100,000 for the first time, which is largely responsible for this change.

Bitcoin’s Bullish Bias Intact Amid Falling Trading Volume and Caution

The market has been less active in spite of the price recovery. There is cooling momentum as the daily trade volume has dropped by more than 22%. Data from Coinglass indicates that open interest has slightly decreased, and volume has decreased by 16.3% in the futures market. This implies that, for the time being, traders are being more cautious.

Technically, BTC is consolidating at a level slightly below the upper Bollinger Band, which is approximately $122,151. A relative strength index of 69 indicates strong but not overheated momentum, just below the overbought threshold. Momentum and MACD indicators, among other oscillators, continue to suggest a bullish bias. The idea that Bitcoin is still in a firmly bullish situation is supported by the upward-advancing moving averages from the 10-day to 200-day periods.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.