Russell 2000 Breakout Signals Potential Bull Run for Bitcoin and Altcoins

The Russell 2000 Index, comprising roughly 2,000 small-cap U.S. companies, is showing renewed momentum, raising hopes for Bitcoin (BTC) and altcoins. Known as a barometer for investor risk appetite, the index’s movements often align with trends in the crypto market, especially during risk-on periods.

Risk-On Sentiment and Crypto Correlation

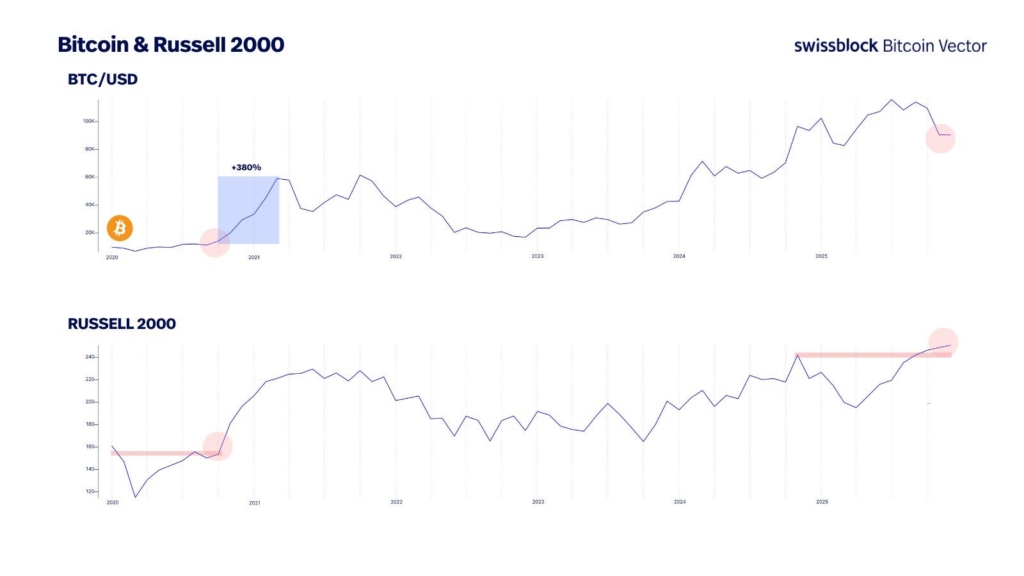

When investors flock to higher-risk assets, capital tends to flow into crypto, boosting both Bitcoin and the broader altcoin market. Analysts highlight that the Russell 2000’s December breakout above long-term resistance is a classic risk-on signal. Historically, such moves have preceded major upswings in crypto. For example, Bitcoin surged 380% following the Russell 2000’s late-2020 breakout, turning prior resistance into support, according to the Bitcoin Vector report by Swissblock.

Industry experts echo this sentiment. Negentropic, co-founder of Glassnode, noted that the index’s recent rally points to a broad return of investors to risk assets. Meanwhile, crypto analyst Ash Crypto suggests the Russell 2000 is a key indicator for Altseason, hinting at potential altcoin gains. Analyst Cryptocium also highlighted correlations between the altcoin market capitalization and the iShares Russell 2000 ETF, observing that altcoins often surge when the ETF surpasses previous highs—a pattern seen in 2017 and 2021.

A Closer Look Reveals Mixed Signals

Despite the bullish headlines, some caution is warranted. Duality Research noted that, while the Russell 2000 rose in 2025, small-cap ETFs within the index experienced net outflows of around $19.5 billion, a divergence from past rallies that were accompanied by strong inflows. This raises questions about the sustainability of the correlation between small-cap stocks and crypto. If the risk-on sentiment fades, the market could see a potential negative spillover into cryptocurrencies.

Comments are closed.