Recent Ether Rally Draws Whale Attention as Large Transfers Hit Exchanges

Whales and institutional investors are taking notice of Ethereum’s recent comeback. After the rise, several big investors transferred their Ethereum to exchanges. Following the Bank of Japan’s 25 basis point rate hike, ETH saw a strong increase in value. It was unclear from that activity whether big players were merely revolving funds following gains or if they anticipated short-term declines.

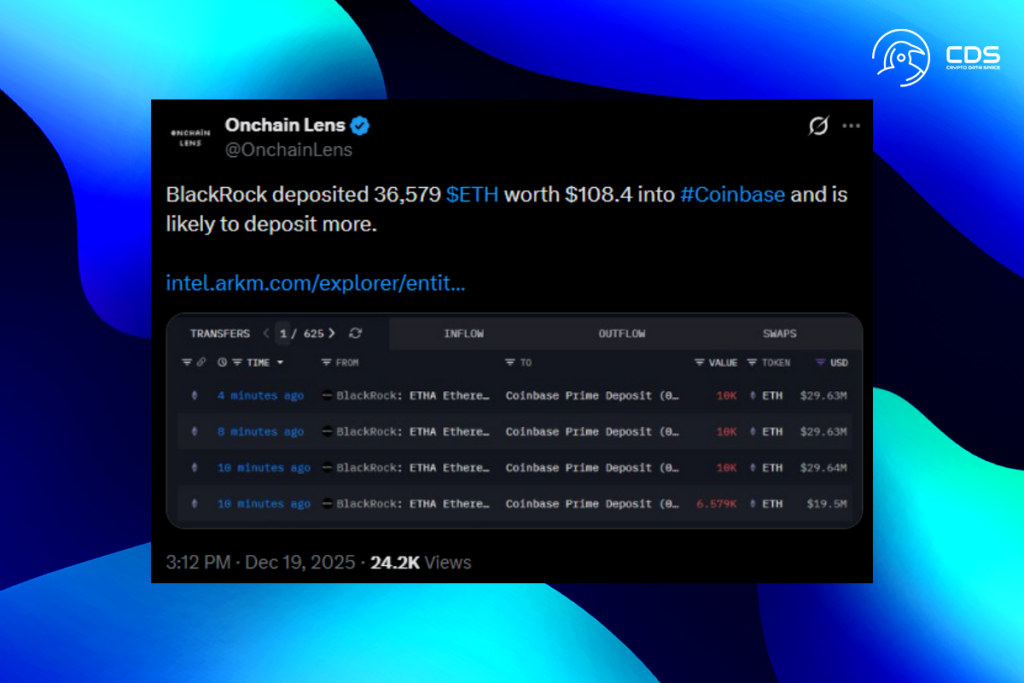

Large ETH Transfers Raise Questions Over Near-Term Price Direction

Onchain Lens, a crypto transaction tracker, revealed on X that BlackRock had made a 24-hour payment of 36,579 ETH into Coinbase. The estimated value of the transfer was $108.4 million. Arthur Hayes, a co-founder of BitMEX, sent 680 ETH to Binance, according to the post. The $2.03 million move is frequently seen as a possible indication of selling activity. Large transfers have the potential to affect short-term price direction, which is why whale activity frequently attracts attention. These wallets are regularly monitored by traders for indications of changes in sentiment or liquidity requirements.

Ethereum Trades Flat as Falling Volume Warns of Possible Downside

Ethereum traded near $2,993 at press time, up 0.59% in 24 hours. Spot market participation fell throughout the same period. Trading volume dropped 55.18% to $8.27 billion, indicating low conviction. Slowdown contrasted with derivatives positioning. Daily chart technical analysis by AMBCrypto showed ETH consolidating between $2,790 and $3,000. Meanwhile, the market structure continues to decline. ETH may only rally if it breaks out of this tight consolidation range, according to price activity. If the trend persists and the price breaks and closes a daily candle below $2,790, downward momentum may accelerate.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.