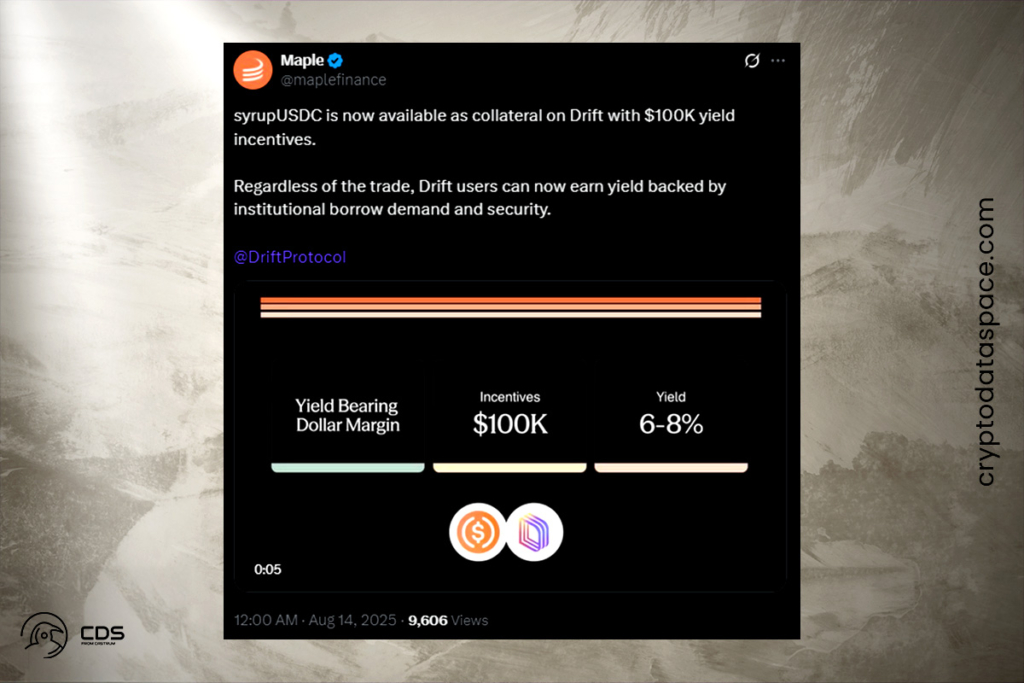

Maple Expands Solana Trading Collateral: New Yield Opportunities With syrupUSDC

In terms of assets managed, Maple Finance is the biggest on-chain asset manager. They have added syrupUSDC as collateral for trading perpetual futures on the Drift Protocol. By means of the integration, traders on the decentralized exchange situated in Solana can earn an annual percentage yield (APY) of 7% to 8% on leverage collateral while engaging in transactions.

The second-largest perpetuals DEX on Solana, Drift, which has $1.21 billion in total value locked, now accepts syrupUSDC in addition to its cross-collateral technology. By allowing traders to provide passive income or balance funding costs without relocating assets out of position, this closes the long-standing capital efficiency gap in DeFi margin trading.

Maple CEO: Traders Can Now Trade, Earn, and Compound Profits Simultaneously

Maple (SYRUP) has implemented $100,000 in bonuses and established a $50 million initial supply cap for syrupUSDC collateral on Drift in an effort to promote usage. This launch follows Maple’s June extension of syrupUSDC to Solana, which started with $30 million in liquidity on platforms like Kamino and Orca. In just two weeks, $60 million was made on Solana thanks to Chainlink’s Cross-Chain Interoperability Protocol. According to Maple CEO Sid Powell, the integration gives traders access to previously unattainable opportunities to accomplish more with their money, allowing them to trade, earn, and compound profits all at once.

Institutional Pools and Cross-Margin Trading Fuel syrupUSDC Growth

With $1.9 billion in AUM, SyrupUSDC has emerged as DeFi’s yield-bearing stablecoin with the quickest rate of growth. It produces yield from Maple’s institutional lending pools, which in Q2 2025 generated an average annual percentage yield of 9.2% on high-yield products and 5.2% on Bitcoin yield products. Additionally, syrupUSDC can be used with different collateral types thanks to Drift’s cross-margin architecture, which is uncommon on decentralized exchanges that normally restrict collateral to USD or USD Coin (USDC).

Maple has increased its year-end goal to $5 billion and now manages $3.24 billion in assets, surpassing BlackRock in on-chain AUM. With this introduction, Maple is anticipated to gain traction in Solana‘s expanding DeFi ecosystem and set a benchmark for integrating yield-bearing stablecoins into leveraged trading environments.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.