Bitcoin and MSTR Rally Potential: Kynikos Covers Short Position

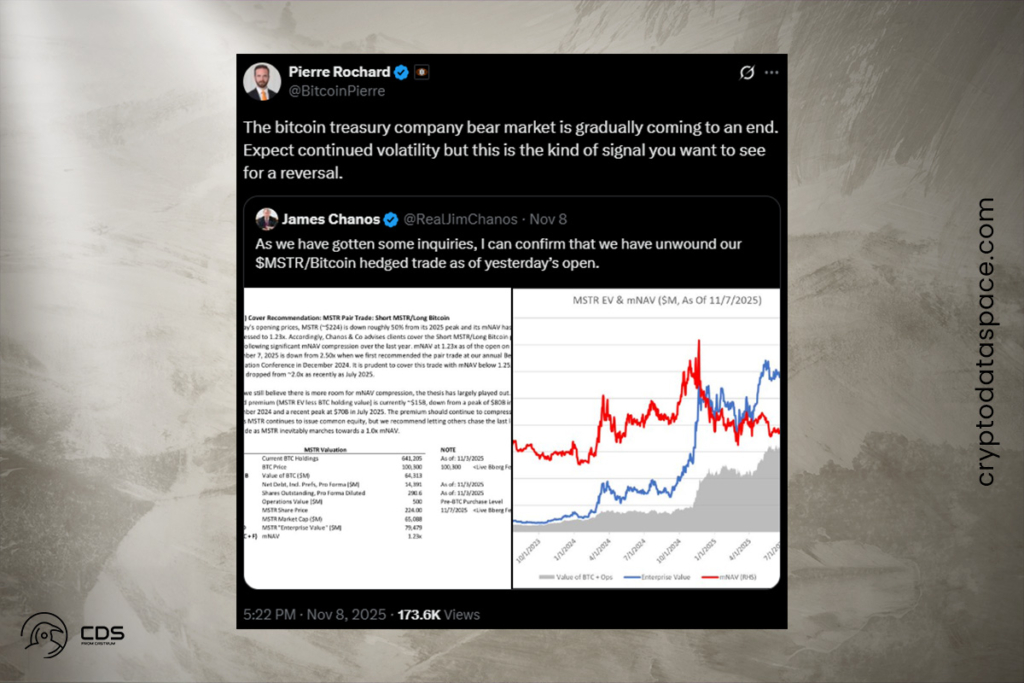

James Chanos, the founder of Kynikos Associates, announced on Sunday that his investment company has closed its short position on Michael Saylor’s Strategy (MSTR). At the beginning of Friday’s trading, the company also closed its long position in Bitcoin. In this sense, a period of static price movements for Bitcoin mining business equities may be coming to an end.

The Bitcoin treasury company bear market is gradually coming to an end,

The Bitcoin Bond Company CEO, Pierre Rochard

According to Chanos, shares of Strategy have dropped almost 50% from their peak in 2025. As a result, the market Net Asset Value (mNAV) of the company has decreased to 1.23x.

It is prudent to cover this trade with mNAV below 1.25x, having dropped from ~2.0x as recently as July 2025,

Chanos

Chanos Signals Possible Bottom for MSTR Valuation

According to Chanos, MSTR‘s implied premium, which is determined by deducting the value of its 641,205 Bitcoin holdings from its enterprise value, has decreased from almost $70 billion in July to $15 billion. This implies that the company’s value may now be more fair. The premise has mostly been realized, according to Chanos, even if MSTR might potentially encounter more mNAV compression, especially if it issues more common equity.

This is the kind of signal you want to see for a reversal,

Rochard

Bitcoin Holdings Trigger Massive Losses for Public Companies

In recent months, shares of many of the 200 publicly traded companies that have Bitcoin on their balance sheets have plummeted. This has made several analysts question whether Bitcoin treasury techniques are sustainable. In terms of overall value, Strategy was the most impacted company. Its market value dropped by more than 43%, from $122.1 billion in July to $69.5 billion as of Friday.

One of the top-performing equities on the Tokyo Stock Exchange at the beginning of 2025, Metaplanet has suffered large losses. Its market capitalization has decreased by 56% since June 21. In order to settle outstanding debt, other Bitcoin purchasing companies have even had to sell off a portion of their BTC holdings.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.