Featured News Headlines

MON Price Breaks Out: Key Metrics and Market Insight

Monad (MON) returned to the spotlight after a strong post-launch rebound, recording gains of more than 19% in the past 24 hours at the time of writing. While buying interest pushed prices higher, gradual price rejections suggested that the rally was being closely tested.

The recent upside move appears to be driven by a combination of improving on-chain activity and ecosystem developments, raising questions about whether the momentum can be sustained in the near term.

Network Activity Shows Early Signs of Recovery

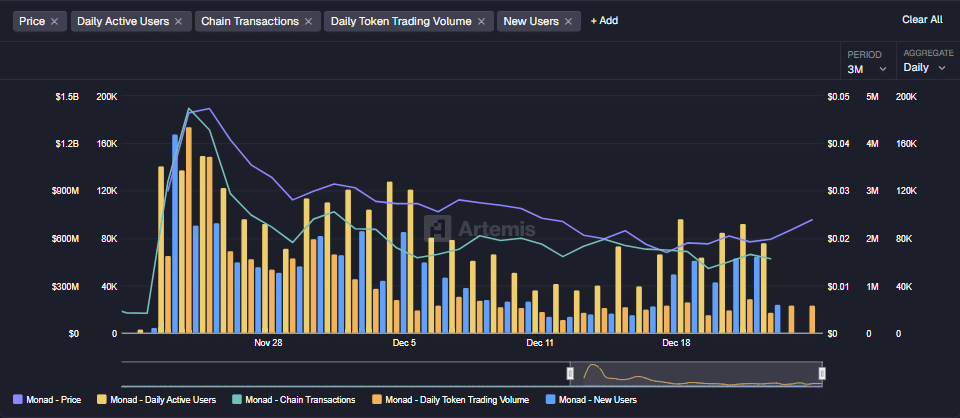

On-chain data from Artemis indicates that Monad’s network activity has been recovering from lows observed around December 11. Over the past week, both daily active users and new users trended higher, with activity levels pointing to cautiously positive sentiment.

Daily active users averaged roughly 76,000, while new users stood near 24,000. Meanwhile, daily transactions exceeded 1.6 million, a figure that, while relatively stable, remained above the previous week’s levels. This improvement in usage coincided with the recent price advance.

Another factor supporting liquidity was the integration of the USD1 stablecoin on the Monad chain, which contributed to increased trading activity. As a result, MON was among the cryptocurrencies that posted double-digit gains during the session.

Additionally, the introduction of exchange-based staking mechanisms brought attention to potential supply dynamics, as temporarily immobilized tokens may influence circulating supply conditions.

Technical Breakout Draws Attention

From a technical perspective, MON’s price moved out of a wedge consolidation that had been forming since December 18. Indicators such as bullish RSI divergence and expanding Bollinger Bands reflected rising volatility and short-term bullish control.

Market observers noted:

“The breakout was supported by volatility expansion, which explains the sharp price movement seen over the last session.”

Despite this, the possibility of short-term pullbacks remains part of the broader market structure.

Capital Inflows Highlight Market Interest

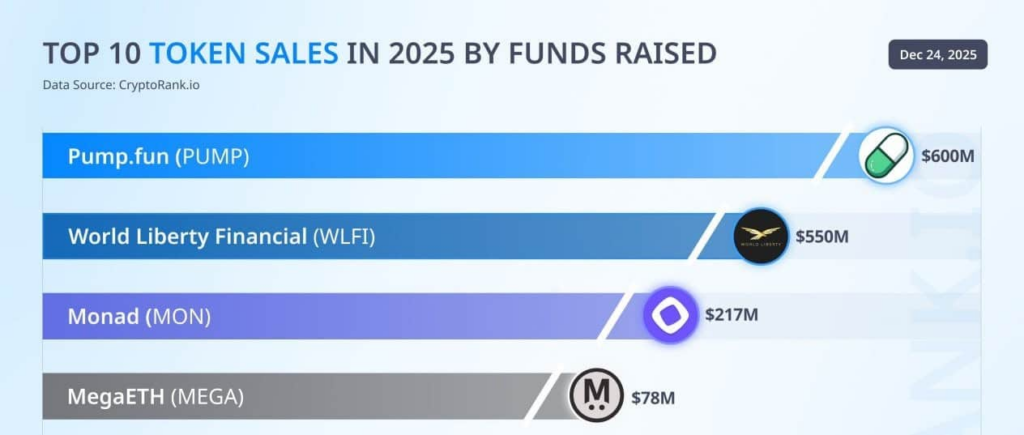

Beyond price action, Monad recorded notable capital inflows. In 2025, it ranked as the third-most sold token among new crypto market entrants, generating more than $217 million in sales. This figure underscores sustained interest in the project’s ecosystem as it continues to develop.

As market sentiment evolves, upcoming sessions are likely to play a key role in determining whether MON’s recent momentum can stabilize or consolidate further.

Comments are closed.