Mini Altcoin Season: Altcoins Surge Past Bitcoin as Market Shifts

As Bitcoin (BTC) approached a new all-time high, other cryptocurrencies tried to challenge its hegemony. Bitcoin thus fell to $110,000 despite its most recent price spike. When assets test new price chart levels, this is a typical occurrence. But then it increased to $118,856, which was a new high. However, altcoins appear to be challenging the top cryptocurrency and trying to start a new altcoin season based on their durability.

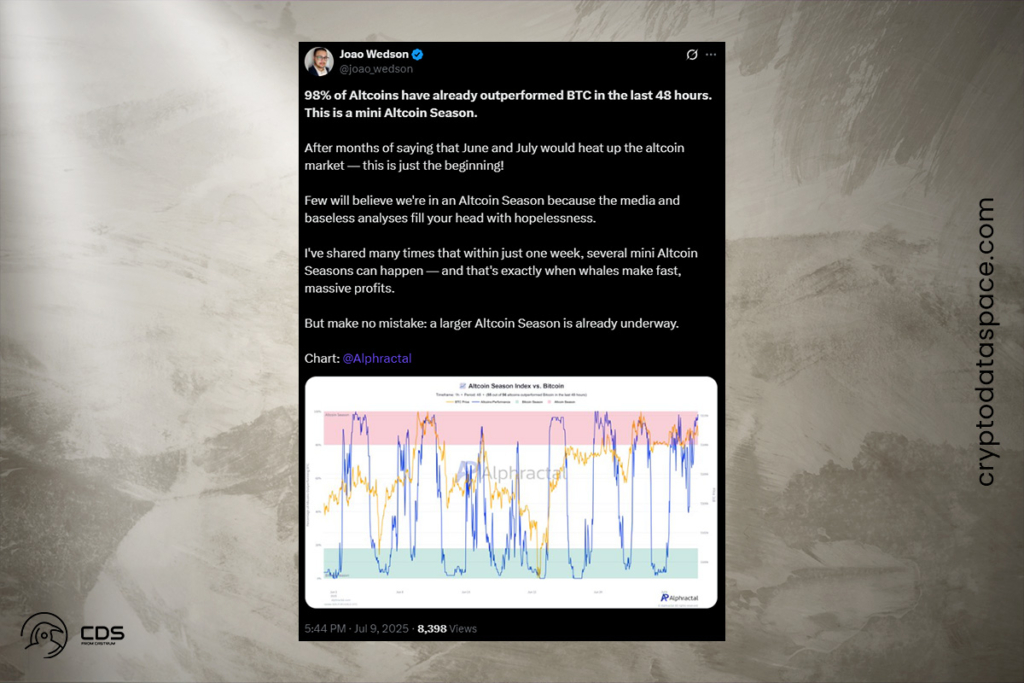

Joao Wedson’s most recent post suggests that a mini altcoin season may be underway. As of this writing, Bitcoin had underperformed 98 percent of the market’s altcoins in just the previous 48 hours. Altcoins’ performance entered the altseason zone as a result. Altcoins were at the top of the short-term rankings, as this congruency demonstrated.

Whale vs. Retail: Big Buyers Dominate as Altcoins Flash Bullish Signals

While the Altcoin Performance Index experienced wild volatility, the price of Bitcoin remained relatively constant between $110,000 and $120,000. Mini altcoin rallies frequently also have this feature. As anticipated, these figures suggested that a longer and more extensive cryptocurrency season might already be underway, despite all the buzz and skepticism.

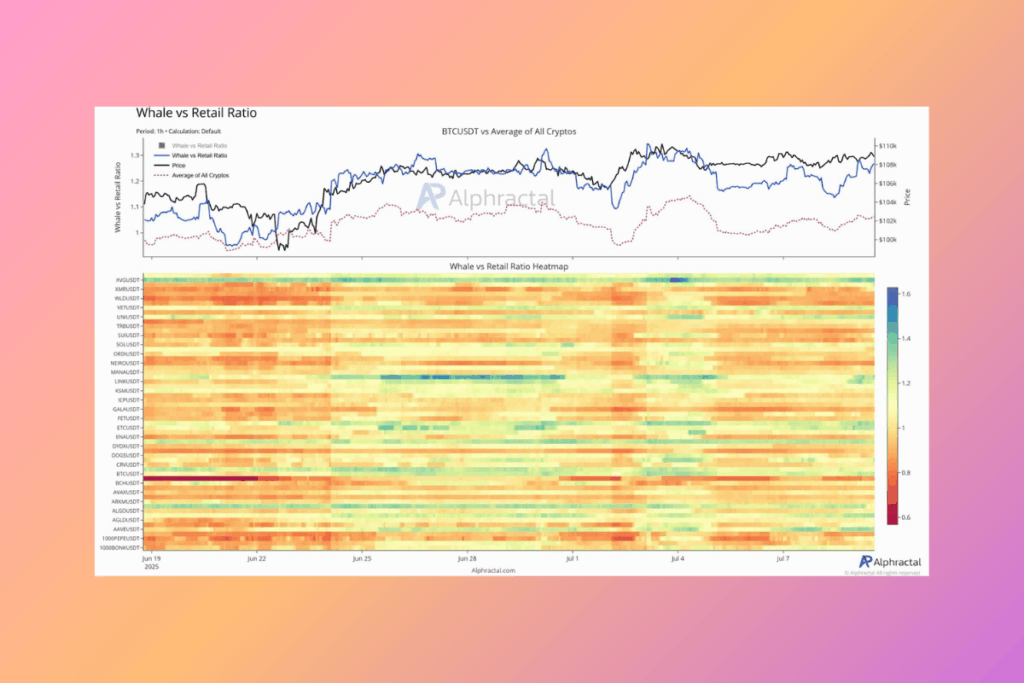

Another indication that the cryptocurrency season might be starting was the growing whale acquisition growth in comparison to retail. Since the end of June, the whale vs. retail ratio has been above 1.1, hinting at this.

Alphractal’s heatmap also revealed that whale activity has been very strong in a number of altcoins, such as Uniswap, Chainlink, and Algorand. Retail hands, on the other hand, have been inconsistent and feeble. There may be a reference to the movement of large whales in this imbalance.

Altcoin Bulls Emerge as Bitcoin’s Dominance Metric Breaks Down

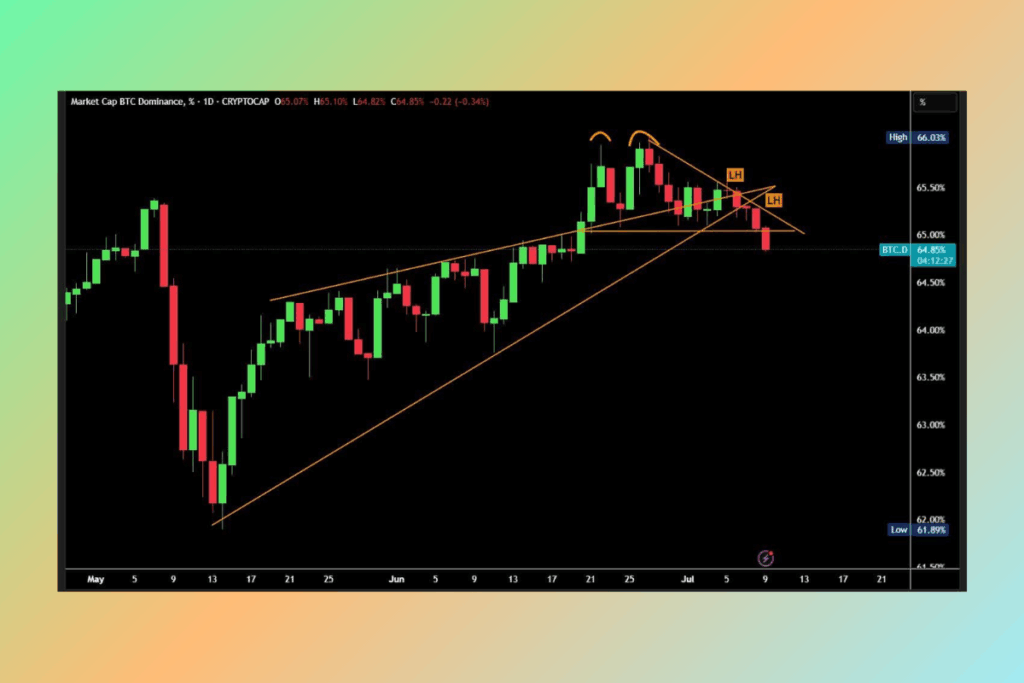

Last but not least, the prospective altseason was further influenced by Bitcoin’s dominance. An equal highs formation that indicated rejection and lower highs that broke the trendline broke the metric. This can be a warning sign that the market’s structure is changing. One can conclude that money has been moving into altcoins since the dominant coin has been losing support recently.

To sum up, as Bitcoin’s value declines relative to the overall market, altcoins have been gaining traction. Increased risk tolerance and speculation, particularly in high-beta investments, may be implied by such a drop.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.