Featured News Headlines

Burry Closes Scion Amid AI Bubble Concerns

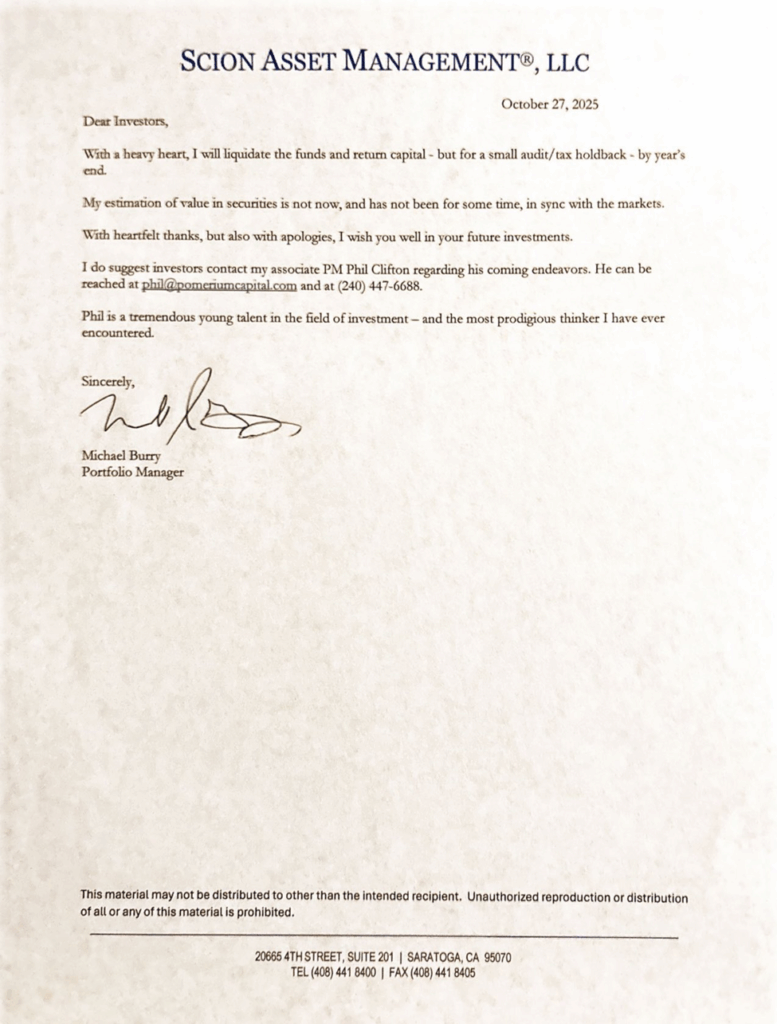

In a letter to investors dated October 27, 2025, Michael Burry announced that his “estimation of value in securities is not now, and has not been for some time, in sync with the markets.” This marks the second time the famed contrarian investor has voluntarily closed a fund, the first being after his profitable subprime mortgage bets. This time, Burry cites what he describes as an “AI-bubble dynamic” as a key factor in stepping back from traditional equities.

Critique of Corporate Accounting Practices

On X (formerly Twitter), Burry criticized major tech companies for “fudging depreciation schedules” to artificially boost AI-related earnings, drawing parallels to the late-1990s dot-com boom. His most recent 13F filing, unusually submitted early, shows tens of thousands of long-dated put options extending into 2026 and 2027, signaling aggressive bearish positioning against stocks like Palantir ($PLTR).

One user commented on Burry’s approach:

“Burry’s tweet is pure contempt. The system is rigged. He knows it. The man who shorted the world is staring at a market that refuses to bleed…That’s why he said it. Not to warn. He’s tired.”

From Fund Manager to Family Office

By deregistering Scion and shifting to a family office model, Burry removes himself from quarterly disclosures and investor pressures, gaining full control over his capital. This step highlights a growing trend among top investors prioritizing autonomy over public fund management.

Implications for the Crypto Space

Burry’s exit comes as Bitcoin consolidates near $103,000, amid rising institutional interest in crypto ETFs. Market observers note that a significant equity market correction could accelerate flows toward non-traditional assets seen as hedges against volatility. While Burry has not disclosed any personal crypto holdings, his shift away from traditional markets aligns with arguments often cited by Bitcoin advocates, including skepticism of inflated valuations and central bank liquidity.

Another user noted:

“Michael Burry throwing in the towel and shutting down Scion is the most compelling anecdotal signal I’ve seen yet of a potential top forming in the equity market.”

Burry hinted at a new focus scheduled for November 25, 2025. Whether this entails alternative assets, private ventures, or personal projects remains unclear. His retreat from public markets underscores a broader sentiment shift: even legendary investors are questioning traditional market valuations and signals.

“On to much better things, November 25,” Burry noted.

As traditional markets appear increasingly detached from fundamentals, some analysts argue that self-custody and hard-asset exposure may again appeal to contrarian strategies.

Comments are closed.