Featured News Headlines

June 30, 2025 Crypto News: James Wynn’s 40x Bitcoin Bet: Risk or Reward?

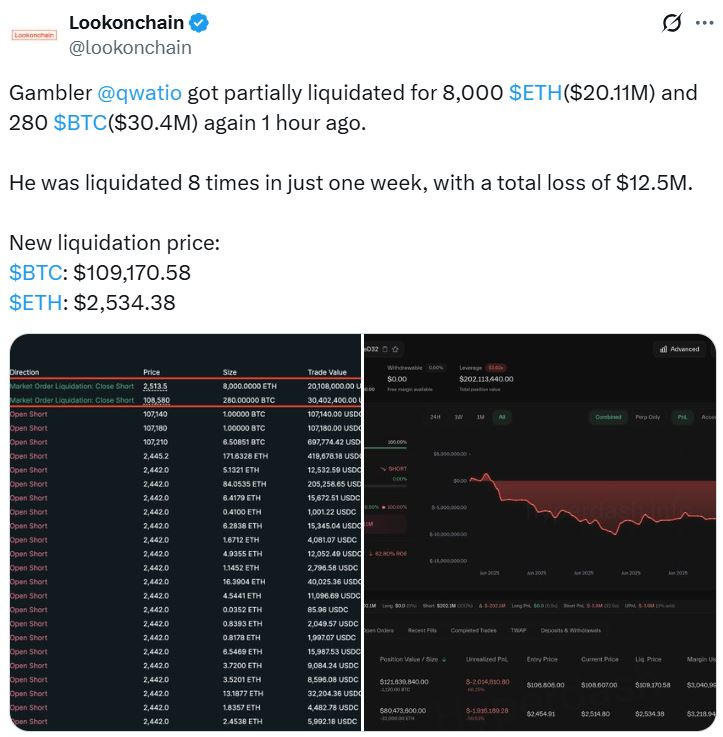

June 30, 2025 Crypto News – According to blockchain analytics platform Lookonchain, the trader known as qwatio was liquidated eight times in the past week, suffering a total loss of approximately $12.5 million. In the most recent liquidation on Monday, qwatio partially lost a 25x leveraged Ether (ETH) position.

Critical Liquidations on Ether and Bitcoin Positions

Lookonchain reported that the new liquidation price for Ether was set at $2,534 following the latest liquidation. Ether’s price fluctuated between $2,425 and $2,519 over the past 24 hours. Similarly, qwatio’s Bitcoin position was partially liquidated with a new liquidation price adjusted to $109,170.

$6.8 Million Profit Before Multiple Liquidations in March

Back in March, qwatio made headlines by netting a $6.8 million profit before multiple liquidations. This was achieved by opening long positions on Ether and Bitcoin with 50x leverage shortly before former U.S. President Donald Trump announced an executive order related to a crypto reserve. In the same month, qwatio also took a $3.46 million 50x leveraged position on Melania Trump’s memecoin MELANIA and successfully defended a 40x leveraged Bitcoin position by adding extra margin against “whale hunters” aiming to liquidate his holdings.

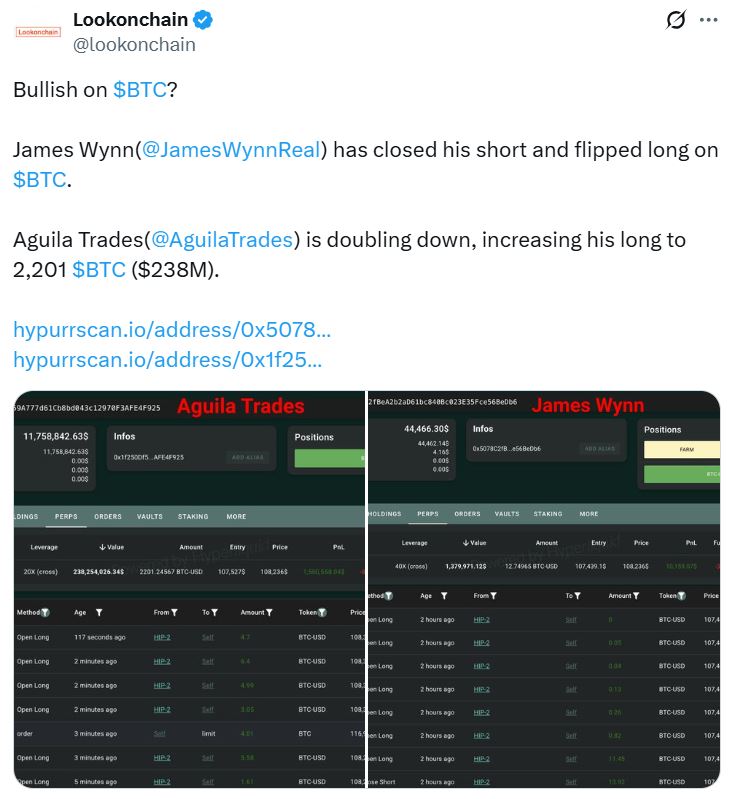

James Wynn Opens 40x Leveraged Bitcoin Short, Then Flips Position

Renowned for high-risk trades, millionaire trader James Wynn opened a 40x leveraged short Bitcoin position worth $37,000 on Sunday. With a liquidation price at $108,630, this trade had the potential to net $1.49 million if successful. However, when Bitcoin dropped to $107,250, Wynn closed his short and switched to a $44,466 long position. Wynn has a history of massive liquidations, losing nearly $100 million in May and another $25 million in early June.

Small Trader Turns $6,800 into $1.5 Million Profit

In a surprising twist, another lesser-known trader made waves by generating $1.5 million profit from an initial capital of only $6,800. Over two weeks, this trader executed trades totaling $1.4 billion and accounted for over 3% of the maker-side liquidity on a major crypto exchange, emerging as a significant market participant.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Cryptocurrencies and stocks, particularly in micro-cap companies, are subject to significant volatility and risk. Please conduct thorough research before making any investment decisions.

Comments are closed.