Confidence in BTC Grows Amid Uncertainty

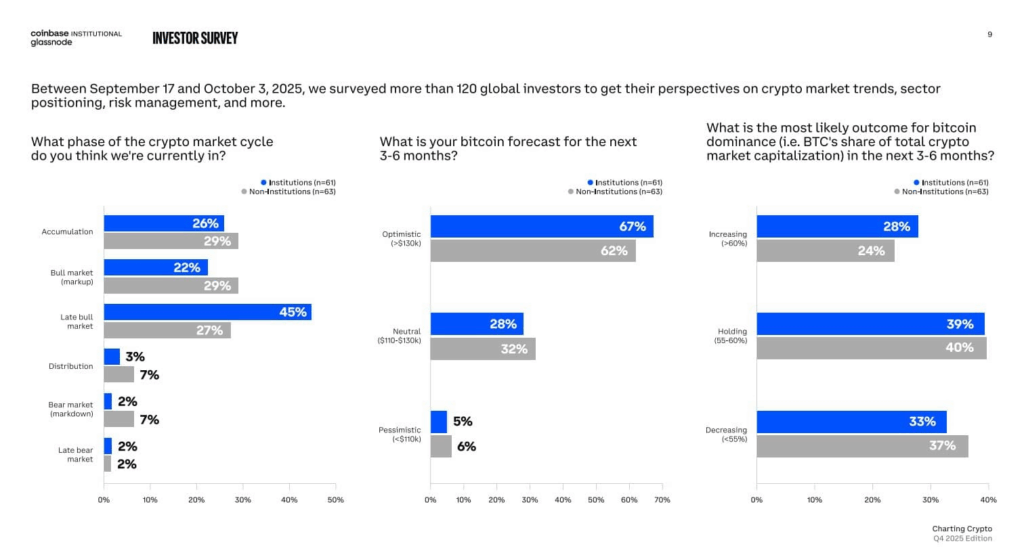

Institutional conviction in Bitcoin [BTC] is rising, but there’s growing debate over where we are in the market cycle. A recent Coinbase report, “Navigating Uncertainty,” highlights that 67% of institutional investors expect Bitcoin prices to rise through 2026. Yet, they remain divided: 45% believe the bull run is entering its late stage, while others see continued upside.

David Duong, Head of Institutional Research at Coinbase, noted that “liquidity remains strong,” but acknowledged that volatility has made investors more cautious in recent months.

Whales Drive Accumulation, Not Speculation

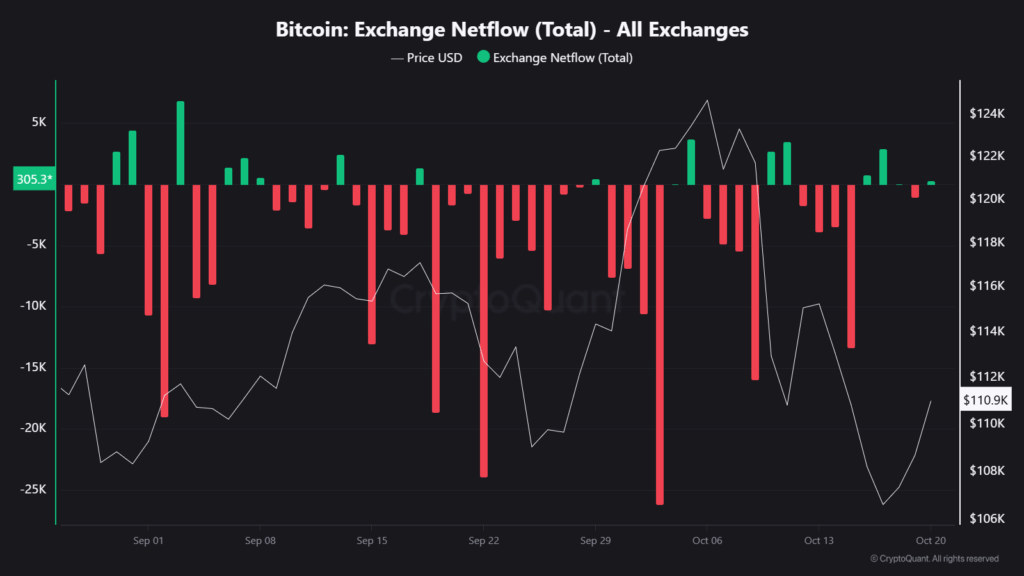

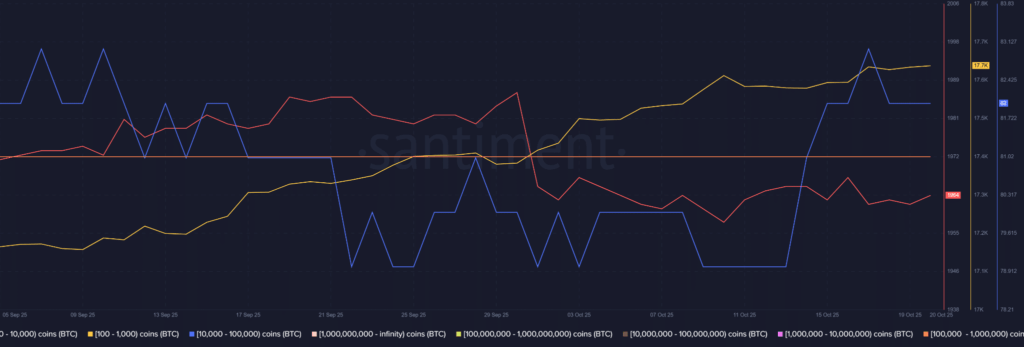

Despite mixed sentiment, on-chain metrics suggest growing confidence. Bitcoin exchange outflows remained consistent throughout October, signaling ongoing accumulation by large holders. According to Santiment, wallets holding 10,000 to 100,000 BTC expanded their balances during Q3.

This behavior aligns with Coinbase’s assessment that long-term conviction is overpowering short-term fear.

“Bitcoin’s illiquid supply declined just 2% in Q3, even as prices surged,” the report noted, underscoring that most long-term holders (LTHs) are not selling into strength.

Supporting data from Glassnode confirms this trend, with more BTC remaining untouched for over a year, reflecting strong hands across the market.

Steady Accumulation Into 2026

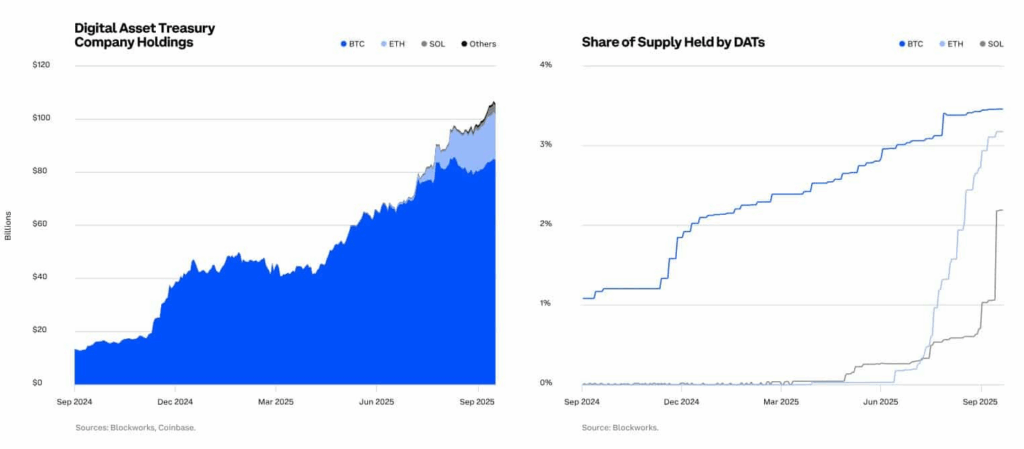

While some investors argue we may be nearing a peak, the data suggests otherwise. Institutional buying, stable liquidity, and limited sell pressure point to a market driven by strategic positioning—not hype.

As Coinbase concludes, Bitcoin remains in a solid accumulation phase, fueled by long-term conviction and growing institutional interest.

Comments are closed.