HYPE Price Analysis- Key Indicators Point to HYPE Accumulation by Big Players

HYPE Price Analysis– Despite weak price movements and growing retail short positions, subtle indicators suggest that informed investors are quietly turning bullish on HYPE.

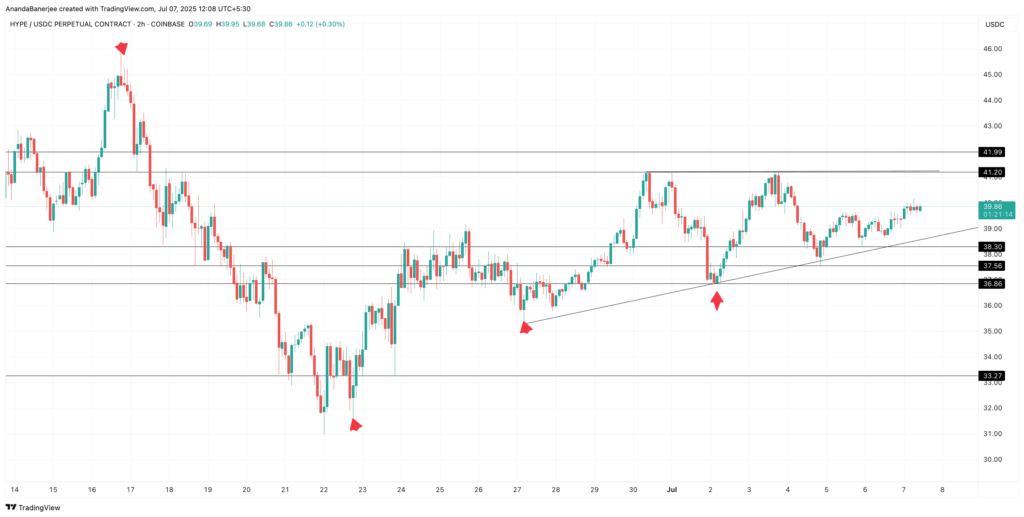

Since mid-June, prominent large wallets such as 0xDc50 and 0x89AB have been depositing significant amounts of USDC into Hyperliquid. These inflows coincide with price dips, after which HYPE tokens quickly bounced back. According to Lookonchain data, wallet 0xDc50 alone acquired over 500,000 HYPE tokens around $33–$34, spending more than $17 million within two days. These accumulation points often align with local lows on TradingView charts, revealing strategic buying by major players.

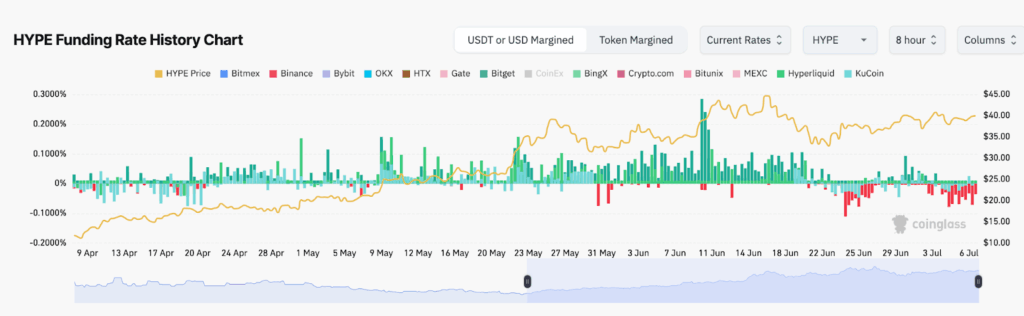

Negative Funding Rates Fail to Shift Sentiment

Since July 1, funding rates for HYPE perpetual contracts have turned negative, meaning short sellers are paying premiums to maintain their positions. For example, address 0x4F12 exited a large position at $42, realizing $2.8 million in profits. However, new wallets like 0xE2f8 and 0xCaC1 have been stepping in to replace these sellers. Although the long-to-short ratio on Hyperliquid has declined slightly from over 2.1 to below 2.0 in 48 hours, longs still outnumber shorts by 64% to 36%, signaling that the overall market bias remains bullish.

The Chaikin Money Flow (CMF) indicator, which measures volume-weighted capital inflows and outflows, continues to stay above zero. This suggests sustained buying pressure from institutional or “smart money” investors during periods of price consolidation. Unlike momentum indicators like RSI or MACD, CMF tracks the actual flow of funds, highlighting that capital continues to accumulate in HYPE tokens despite sideways price action.

HYPE remains within a rising wedge pattern on the hourly chart, characterized by steadily higher lows since June 27 and resistance near $41. A decisive breakout above $42 accompanied by strong volume could trigger a short squeeze, putting pressure on short sellers to cover their positions rapidly.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Cryptocurrencies and stocks, particularly in micro-cap companies, are subject to significant volatility and risk. Please conduct thorough research before making any investment decisions.

Comments are closed.