Will HBAR Sustain Its Uptrend or Face a Downturn?

HBAR’s recent recovery appears closely linked to Bitcoin’s trajectory, reflecting a strong market correlation. Currently, HBAR holds a correlation coefficient of 0.95 with Bitcoin, indicating that its price movements tend to follow the leading cryptocurrency. With Bitcoin trading above $117,000 and sustaining upward momentum, HBAR stands to benefit if this rally continues.

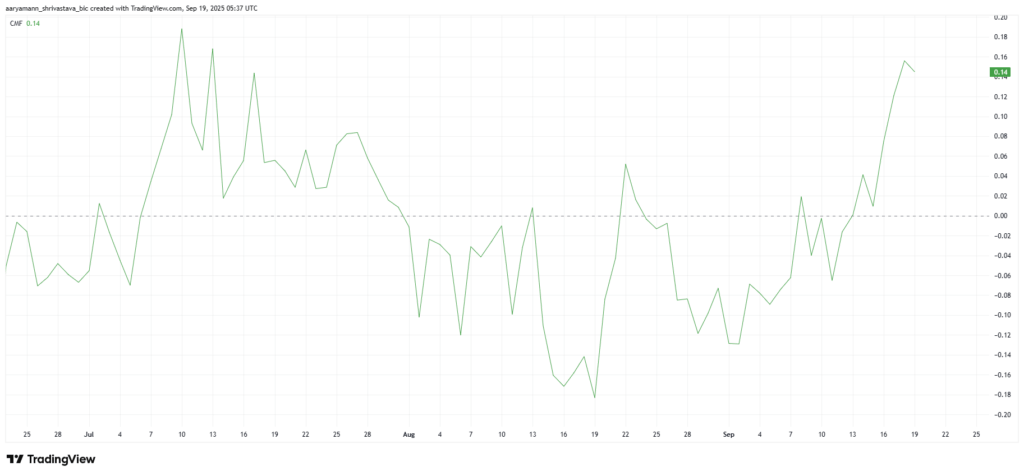

Investor Confidence Grows as Capital Flows Increase

Beyond correlation, technical indicators like the Chaikin Money Flow (CMF) show increased investor interest in HBAR. The CMF has sharply moved into positive territory, signaling rising capital inflows and growing confidence in the asset’s near-term prospects. This influx of funds suggests that despite overall market uncertainty, HBAR is attracting notable attention.

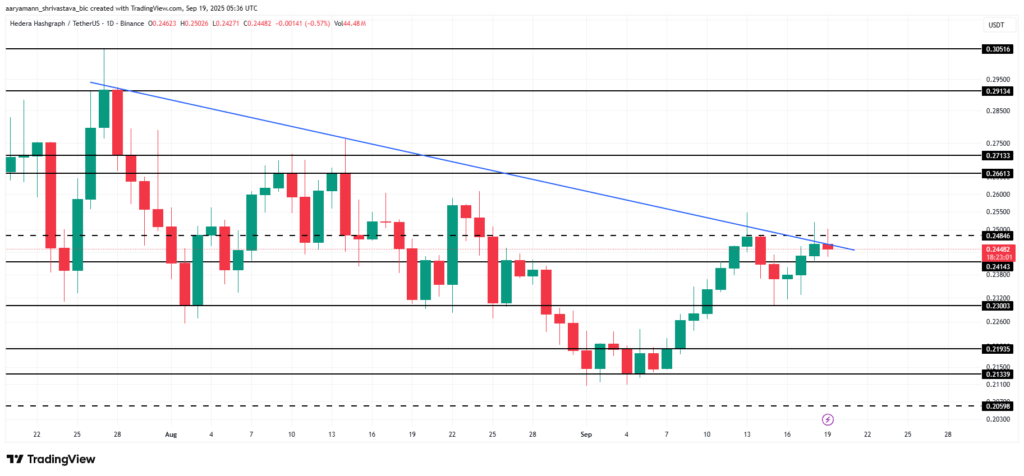

Key Resistance and Support Levels to Watch

At $0.244, HBAR trades just below a critical resistance point at $0.248. This level is crucial as it represents the potential end of a downtrend that started in late July. Should bullish momentum hold, breaking above $0.248 could pave the way for HBAR to reach $0.266. Successfully flipping these resistance points into support would signal a potential trend reversal and set the stage for further price gains.

Conversely, failure to maintain strength in line with Bitcoin or loss of investor backing could see HBAR fall below the $0.241 support level. A breakdown here might drive prices down to $0.230 or even $0.219, challenging the current optimistic outlook.

Comments are closed.