ETH Shows Social Media Strength Despite Bearish Market

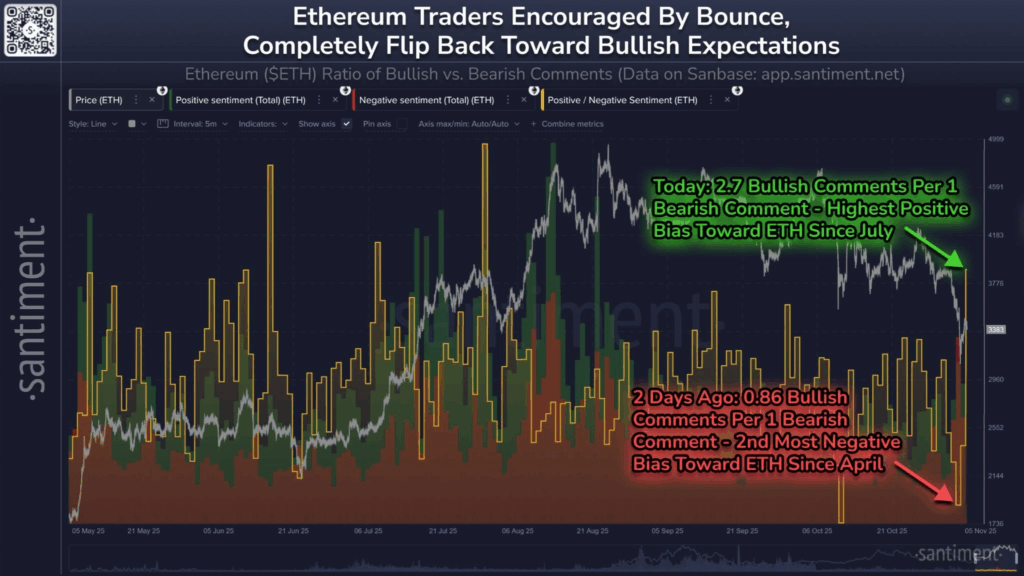

On Thursday, Ether nearly reached $3,500, prompting a surge in positive sentiment among traders. Market intelligence platform Santiment noted in an X post that the number of bullish comments has risen sharply. On average, there were 2.7 bullish comments for every bearish one, marking the highest positive bias for ETH since July.

“Ethereum traders have quickly pivoted from being extremely bearish to extreme bullish,” Santiment stated, adding that the near $3,500 rebound signaled to traders that the asset was “back in business.”

Over the past 24 hours, Ether has traded between $3,251 and $3,451, with an early Friday price of $3,323, according to CoinGecko.

FOMO Could Counteract the Rally

While positive sentiment may seem encouraging, Santiment warns that it can also signal caution. Historically, prices often move contrary to crowd expectations. On Tuesday, when ETH traded around $3,700, the platform recorded 0.86 bullish comments for every bearish comment, reflecting one of the strongest negative market biases since April.

“Historically, we want to see continued FUD like Ether had on Tuesday,” Santiment explained. “A sell-off fueled the rally the past few days, and now FOMO could halt it. True buy signals appear when bullish sentiment calms and traders adjust expectations.”

This analysis highlights the potential impact of crowd psychology on ETH price movements. Even strong social media optimism does not necessarily translate to sustained upward momentum.

Broader Crypto Market Remains Cautious

Outside of Ethereum, sentiment across the crypto market remains fearful. Trade tensions between the U.S. and China and macroeconomic concerns have contributed to continued declines. The Crypto Fear & Greed Index registered 24/100 on Friday, marking “Extreme Fear,” after averaging “Fear” over the previous week.

The index had dropped 50% on Tuesday to 21 points, its lowest in nearly seven months, after Bitcoin briefly fell below $106,000 for the first time in over three weeks.

Meanwhile, industry voices like Samson Mow, founder of Bitcoin infrastructure company Jan3, continue to highlight potential upside for Bitcoin. In a series of bullish X posts, Mow suggested that the Bitcoin bull run may still be ahead, signaling long-term optimism for the broader market.

Comments are closed.