Featured News Headlines

Whale Activity Signals Growing Confidence in Ethereum

As of this writing, Ethereum (ETH) was trading around $3,118, reflecting a marginal 0.03% daily increase and a 2.5% gain on the weekly chart. Despite the broader market pullback, investors appear to be using the correction as an opportunity to accumulate ETH at comparatively lower levels, signaling a subtle but notable shift in sentiment.

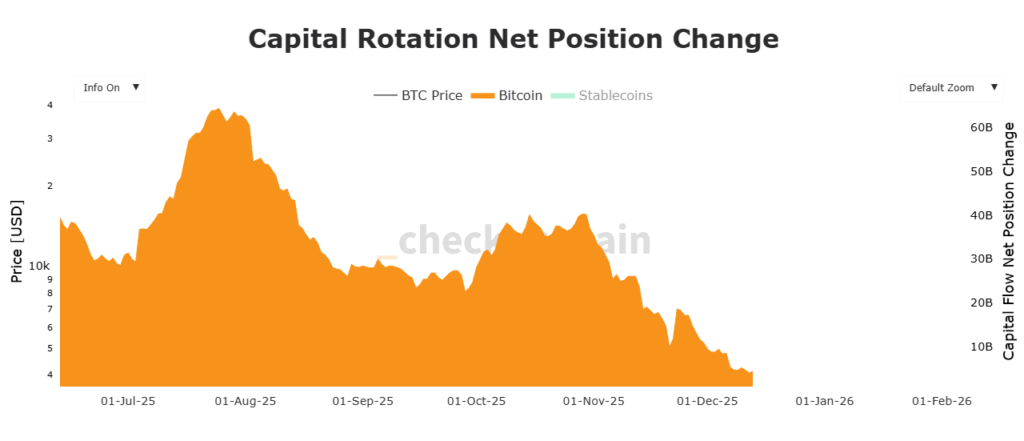

Whale Activity Highlights Capital Rotation

Recent on-chain data points to a significant rotation of capital away from Bitcoin (BTC) toward Ethereum. Market inflows into Bitcoin have reportedly declined sharply, falling from July highs of nearly $62 billion to roughly $4 billion. Ethereum has emerged as the primary beneficiary of this reallocation.

According to blockchain tracking platform Lookonchain, one whale executed a large swap, exchanging 502.8 BTC for approximately 14,500 ETH, valued at around $45.24 million. This transaction followed a series of similar moves. In total, the same entity has converted 1,969 BTC, worth about $177.9 million, into 58,149 ETH valued near $181.4 million. Such activity is often interpreted as a sign of elevated risk appetite and confidence in Ethereum’s longer-term narrative.

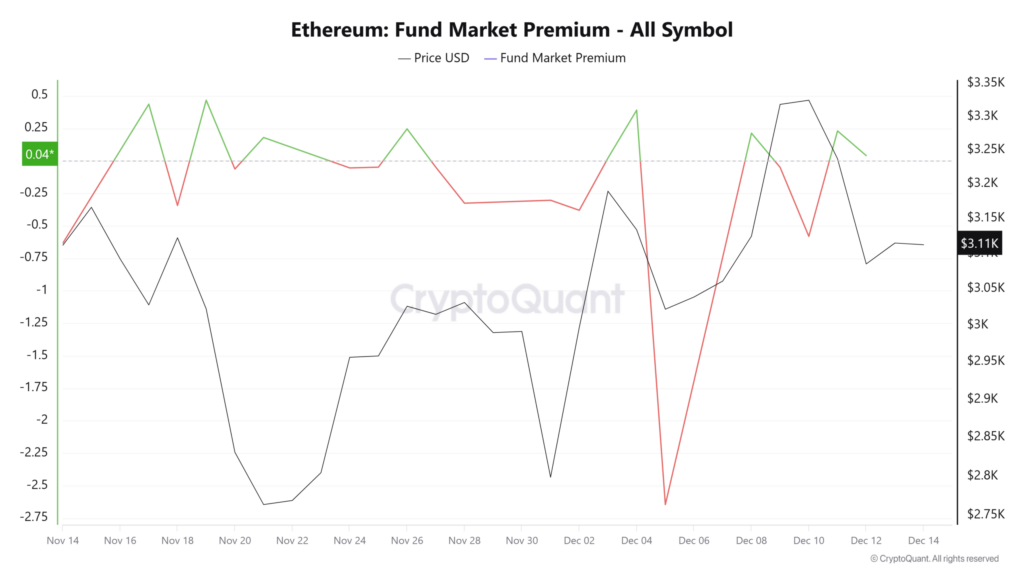

Improving Demand Signals

Alongside whale accumulation, Ethereum has shown signs of improving demand from institutional-style participants. The ETH Fund Market Premium has remained positive for two consecutive days, marking the first such occurrence in nearly two weeks. A positive premium typically indicates that investors are willing to pay above spot value to gain exposure through funds.

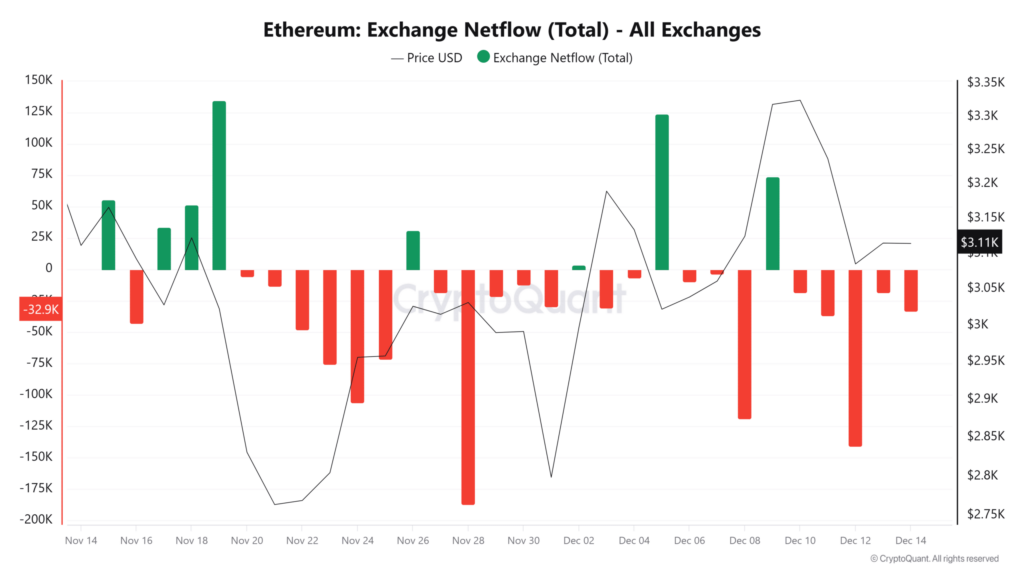

At the same time, Ethereum’s Exchange Netflow has stayed negative for five straight days. With net outflows around 32,000 ETH at the time of observation, this trend suggests continued withdrawals from exchanges, often associated with spot accumulation and reduced immediate selling pressure.

Market Structure Remains Cautious

Despite these demand-side improvements, Ethereum’s broader technical structure remains under pressure. Indicators such as the Directional Movement Index continue to reflect bearish dominance, highlighting the ongoing challenge for ETH to establish a sustained rebound. Market participants remain closely focused on whether current accumulation levels can meaningfully alter the prevailing trend.

Comments are closed.