Ethereum Gaining on Bitcoin as Big Investors Accumulate Billions in ETH

Ethereum – Institutional interest in Ethereum (ETH) is accelerating at a rapid pace, potentially setting the stage for a supply shock that could push the asset beyond key resistance levels. Galaxy Digital CEO Michael Novogratz believes this growing demand could allow Ether to outperform Bitcoin (BTC) in the next three to six months, as he told CNBC on Thursday.

“There’s not a lot of supply of ETH,” Novogratz stated, highlighting a tightening market dynamic. With ETH currently trading at $3,618, he believes it’s “destined to at least knock on the $4,000 ceiling a few times.” A break above that level would send ETH into price discovery, according to Novogratz.

Fueling this bullish momentum is a wave of institutional ETH accumulation. On Thursday, BitMine Immersion Technologies revealed it holds 566,776 ETH, worth approximately $2.03 billion. Similarly, Sharplink Gaming disclosed ETH holdings of 360,807 tokens (around $1.29 billion).

Adding to the institutional push, a new firm named Ether Machine is set to debut on the Nasdaq under the ticker “ETHM,” with over 400,000 ETH (valued at $1.5 billion) under management at launch.

“These companies are raising capital every day and buying Ether,” Novogratz emphasized, suggesting the buying spree is far from over.

ETH/BTC Ratio Surges as Bitcoin Also Eyes New Highs

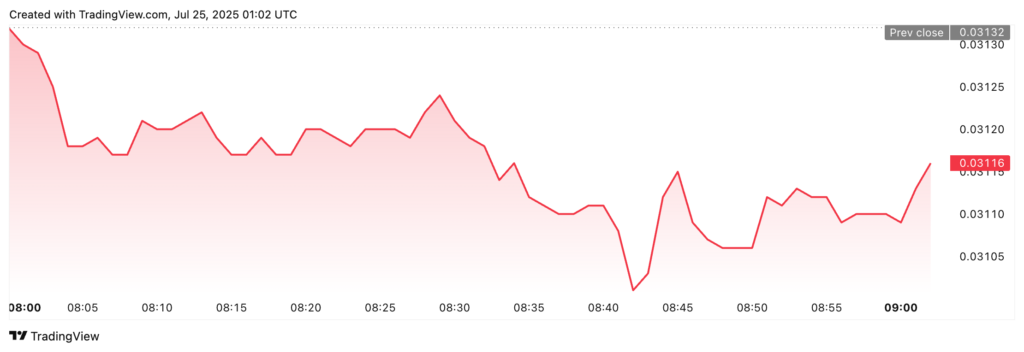

Ethereum’s performance relative to Bitcoin is already gaining attention. According to TradingView, the ETH/BTC ratio is up 36.53% in the past 30 days, signaling ETH’s growing strength.

Still, Novogratz remains bullish on Bitcoin too, predicting a potential surge to $150,000. “It feels like we’re destined to go higher,” he said, though he cautioned that U.S. interest rate policy could impact the broader market outlook.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Cryptocurrencies and stocks, particularly in micro-cap companies, are subject to significant volatility and risk. Please conduct thorough research before making any investment decisions.

Comments are closed.