Ethereum Price Gains Momentum as Bitcoin Dominance Falls

Ethereum (ETH) may be significantly undervalued, according to several top analysts, as global liquidity (M2) reached a record $95.58 trillion. M2—broad money supply across major economies like the US, Eurozone, Japan, UK, and Canada—serves as a key indicator of how much capital is circulating. A rise in M2 typically leads to more funds entering riskier assets, including cryptocurrencies.

Crypto analyst TedPillows noted that if ETH were moving in line with M2 trends, it would be trading above $8,000 today. “This shows how undervalued ETH is right now,” he said on X. Eric Trump, co-founder of World Liberty Financial, backed the statement with a simple: “Agreed.”

Technical Breakouts Support Bullish Targets

Pseudonymous crypto analyst Wolf echoed the sentiment, suggesting a conservative ETH target of $8,000, with an optimistic forecast pushing above $13,000. Wolf expects a 20–25% correction after reaching new all-time highs (ATHs), calling it “the final shakeout before liftoff.”

Institutional demand for Ethereum via spot ETFs and growing interest from Ethereum treasury corporations continue to strengthen the bullish case, with many analysts projecting ETH will land in the $5,000–$10,000 range by end of 2025.

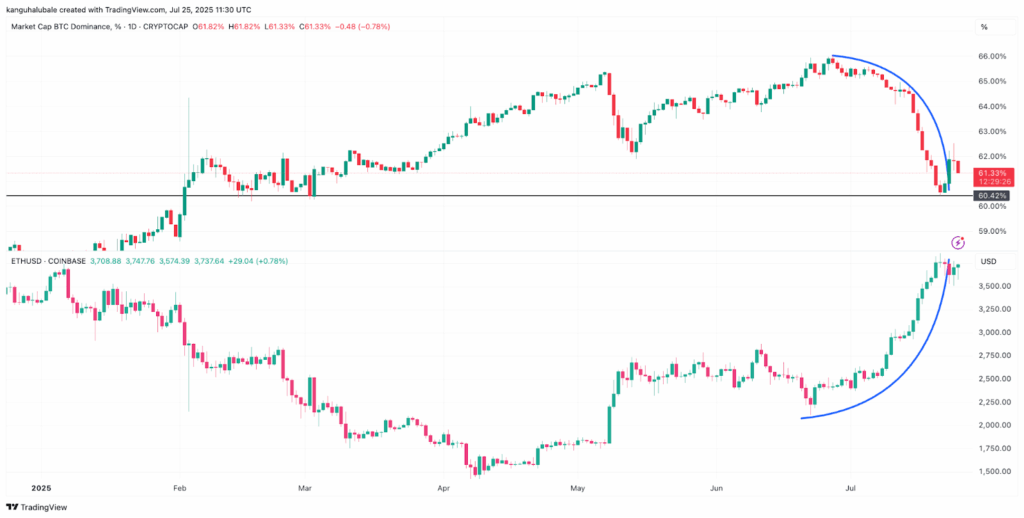

ETH Gains as Bitcoin Dominance Drops

The recent ETH price surge coincides with a fall in Bitcoin dominance (BTC.D), now down to 60%, its lowest since February. Since June 27, BTC.D has dropped 8.5%, while ETH has gained 77% in the same period. Historically, declining BTC dominance has led to massive ETH rallies—as seen in 2017 and 2021.

ETH/BTC is also up 40% this month, further fueled by stronger spot ETF inflows for Ethereum, which have outpaced Bitcoin’s for seven straight days.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Cryptocurrencies and stocks, particularly in micro-cap companies, are subject to significant volatility and risk. Please conduct thorough research before making any investment decisions.

Comments are closed.