Ether Faces Supply Shock as Investors Shift to Long-Term Holding

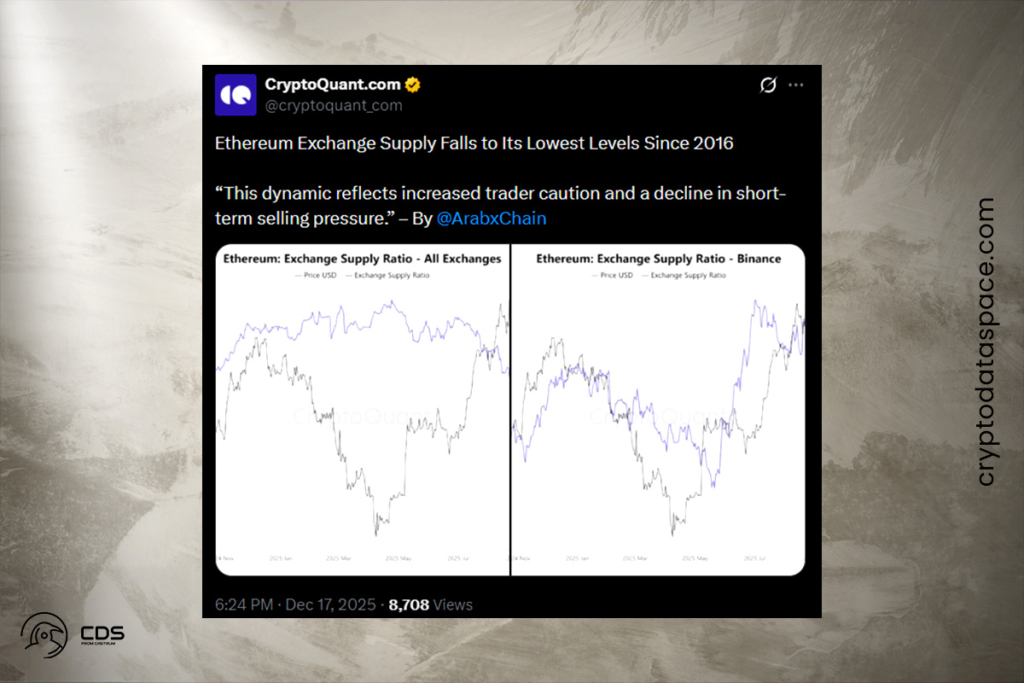

The amount of Ethereum that is available on centralized exchanges has dropped to its lowest point in almost ten years. Investor behavior is clearly shifting away from short-term trading and toward long-term holding and strategic accumulation, according to on-chain measurements. ETH is gradually being pulled off of liquid marketplaces by institutional demand, staking activity, and expanding Layer-2 usage. Ethereum’s supply dynamics are changing as a result of this structural shift, and overall market liquidity is becoming more constrained.

ETH Outflows Signal Accumulation Phase, Not Distribution

On all of the main trading platforms, the Exchange Supply Ratio is still trending downward. This drop is a result of consistent net ETH outflows from exchanges into long-term storage, custody services, and private wallets. These patterns have historically corresponded with phases of accumulation rather than cycles of distribution. There is less immediate sell-side pressure when there are fewer tokens accessible on exchanges. This change is largely due to Ethereum’s proof-of-stake architecture. In exchange for rewards, holders are incentivized to lock ETH off exchanges through staking incentives. The liquid supply continues to decrease as more money enters staking contracts. During times of consistent demand, this mechanism naturally promotes a tighter supply environment.

Long-Term Institutional Demand Strengthens Ethereum’s Supply Dynamics

Through reserve strategies, ETF products, and balance-sheet holdings, institutional exposure to Ethereum is still growing. These organizations typically have longer time horizons, which lowers turnover and increases supply rigidity. Because of this, when liquidity is limited, even small inflows may have a bigger effect on pricing. Ethereum’s Layer-2 ecosystems are taking in more capital concurrently. For less expensive transactions and DeFi activity, ETH is drawn to networks like Base, Arbitrum, and Optimism. As a result of this migration, assets are drawn into decentralized settings and away from controlled exchanges. These developments support a low-liquidity arrangement when coupled with growing self-custody acceptance.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.