Featured News Headlines

Dogecoin Price Analysis- Massive Sell-Off Hits DOGE — Should You Worry?

Dogecoin Price Analysis– Dogecoin [DOGE] is back in action, surging 7.5% in the last 24 hours and reclaiming the $0.254 level. But before bulls celebrate, warning signs suggest this rally might be short-lived.

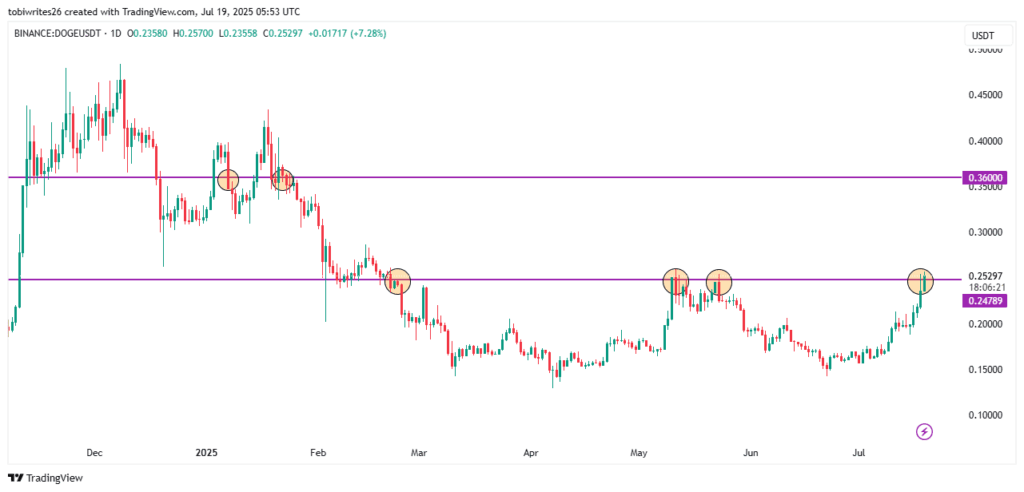

Strong Resistance Threatens DOGE Momentum

DOGE is once again testing the $0.2478 resistance — a level that’s triggered three previous price drops. If it fails to hold above this zone, we could see another sharp pullback. Historically, the $0.36 mark has acted as DOGE’s major ceiling. The last breakout attempt in January failed, sending the price spiraling to its 2024 low of $0.154.

This fourth test of resistance could go either way. A daily candle close above $0.2478 would tip the scales toward the bulls. Anything less may open the door to another correction.

$39M Sell-Off Raises Red Flags

According to CoinGlass data, spot traders dumped $39 million in DOGE over the past 24 hours — the largest since January 17. That level of selling pressure could signal an incoming shift toward bearish sentiment, especially if selling continues.

Liquidity Clusters Hint at Volatility and Opportunity

The liquidation heatmap shows two critical liquidity zones:

- Above: $0.259–$0.260 with $11.21M in sell orders

- Below: $0.249–$0.250 with $11.61M in buy orders

If DOGE climbs into the upper cluster first, a quick pullback to the lower buy zone is likely — a potential bounce point. But if it dips first, bulls might regain control as price gravitates upward again.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Cryptocurrencies and stocks, particularly in micro-cap companies, are subject to significant volatility and risk. Please conduct thorough research before making any investment decisions.

Comments are closed.