Featured News Headlines

Dogecoin Faces Technical Pressure as On-Chain Signals Hint at Possible Stabilization

Dogecoin (DOGE) continues to trade under visible technical pressure, with price action remaining confined within a declining structure. While chart patterns still suggest bearish risk in the near term, on-chain behavior is beginning to tell a more nuanced story. Recent data indicates that speculative selling pressure may be easing, even as longer-term holders quietly increase exposure.

Market participants are closely watching the next few trading sessions, which may determine whether Dogecoin extends its decline or begins to stabilize near current levels.

Price Structure Remains Weak

Dogecoin is currently trading near the lower boundary of a downward price channel, with technical indicators pointing to the formation of a bear flag pattern. This structure typically reflects continuation risk to the downside, especially if nearby support levels fail to hold.

Analysts monitoring short-term price behavior note that key support lies in the $0.124 to $0.120 range. A sustained break below this zone could expose Dogecoin to further losses. However, price action alone does not fully explain the current market setup, as on-chain data suggests notable changes in holder behavior beneath the surface.

One observation stands out: speculative supply has been exiting the market rapidly as price has drifted lower.

Speculative Holders Reduce Exposure

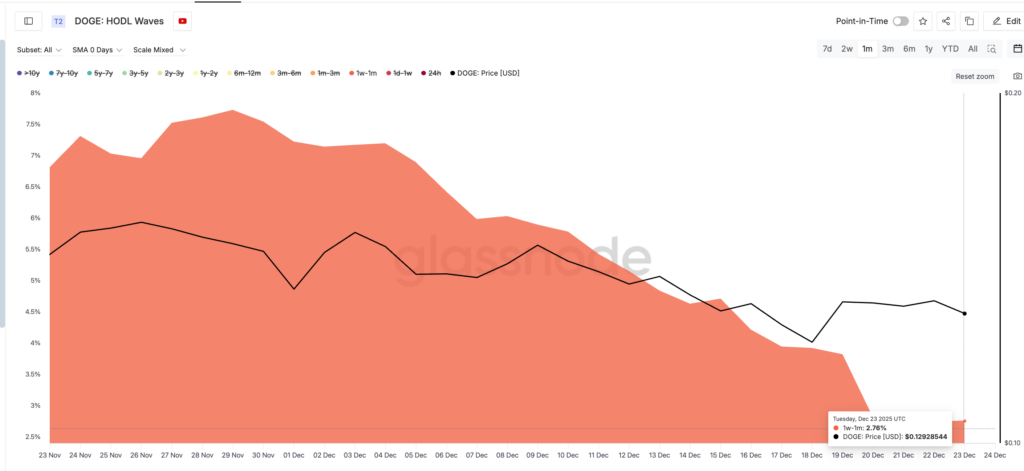

On-chain metrics show a sharp decline in Dogecoin supply held by short-term participants. According to the HODL Waves metric, which categorizes holders based on how long coins have remained unmoved, the 1-week to 1-month holder cohort has significantly reduced its share of total supply.

On November 29, this group controlled approximately 7.73% of Dogecoin’s circulating supply. By December 23, that figure had fallen to roughly 2.76%, marking a steep reduction in speculative positioning over less than a month.

This cohort is widely regarded as the most active swing-trading segment of the market. Their behavior often amplifies price volatility, particularly during sharp downturns. As noted by analysts, “these holders tend to intensify downside moves when panic selling begins.”

Their exit, however, can also have a stabilizing effect. When speculative traders leave the market, forced selling pressure near support zones often diminishes. This shift may reduce the likelihood of sudden breakdowns driven purely by short-term sentiment.

Long-Term Holders Begin to Accumulate

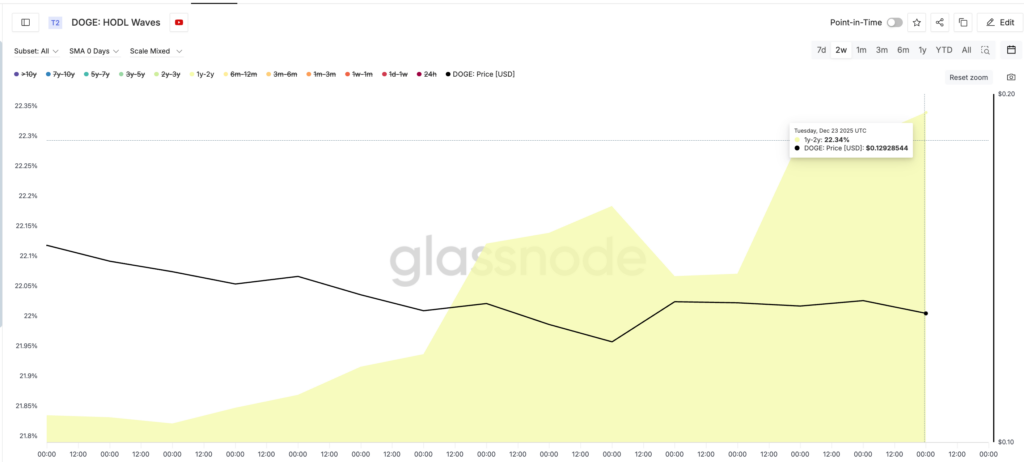

While speculative supply is shrinking, longer-term holders appear to be moving in the opposite direction. On-chain data shows a modest but notable increase in Dogecoin supply held by addresses with holding periods between one and two years.

This cohort’s share has risen from approximately 21.84% to 22.34%. Although the increase is relatively small, analysts consider it meaningful given the broader market context. Historically, these holders tend to add exposure selectively, often when perceived downside risk begins to ease.

As one market observer noted, “longer-term holders typically step in only when selling pressure shows signs of exhaustion.”

Network Activity Signals Cooling Selling Pressure

Additional support for this interpretation comes from Dogecoin’s network activity metrics. The spent coins age bandindicator, which tracks how many previously dormant coins are being moved, has declined sharply in recent weeks.

Data shows that spent coin activity dropped from roughly 251.97 million DOGE to about 94.34 million DOGE, representing a decline of more than 60%. This reduction suggests that fewer holders are actively moving or selling their tokens.

Lower coin movement often reflects a pause in aggressive selling behavior. Historically, similar declines in activity have coincided with short-term stabilization phases in Dogecoin’s price.

Earlier in December, a comparable slowdown in spent coin activity preceded a brief relief rally. At that time, Dogecoin rose from approximately $0.132 to $0.151, marking a gain of nearly 15% within three days. While past behavior does not guarantee future outcomes, the pattern remains relevant for market observers.

Comments are closed.