DOGE Price Rally- Dogecoin Gains Momentum Despite Weak On-Chain Activity

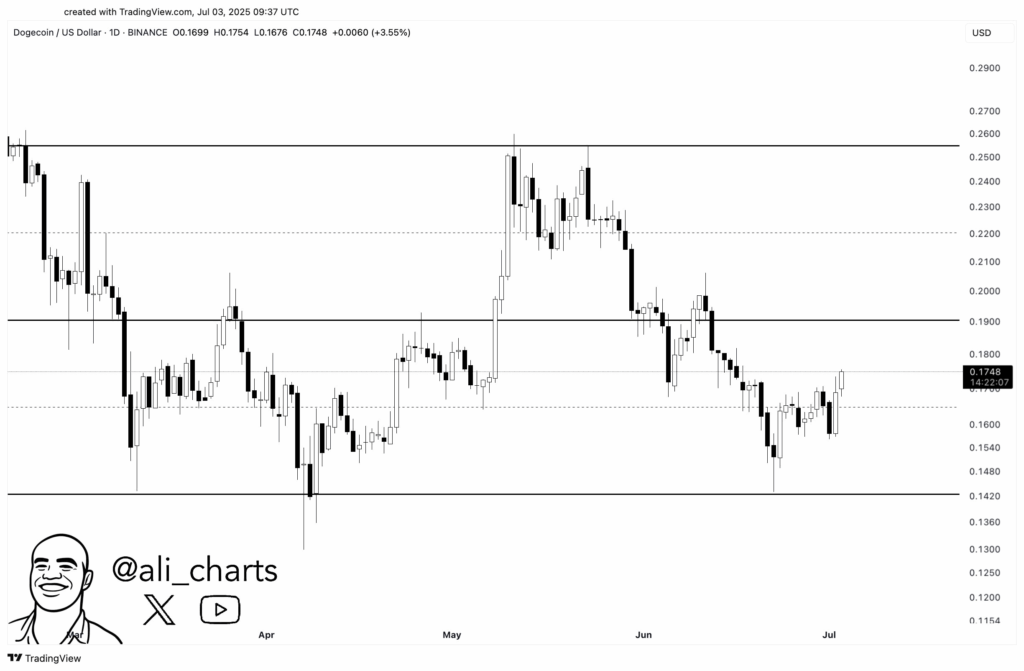

DOGE Price Rally– Dogecoin [DOGE] has sharply rebounded from the lower edge of its long-term trading channel, reviving bullish sentiment across the market. This bounce aligns with a notable 15.78% increase in Open Interest, now at $2.09 billion, alongside a staggering 402% spike in options volume. These signals suggest “traders are aggressively positioning for further upside.”

The price surge from the $0.13–$0.15 support zone has positioned DOGE near a key inflection point. However, a descending resistance near $0.19 continues to act as a technical ceiling. A daily candle close above this level could confirm a breakout and open the door toward the $0.26 target. As of now, Dogecoin [DOGE] remains “in a technical squeeze between historic support and dynamic resistance.”

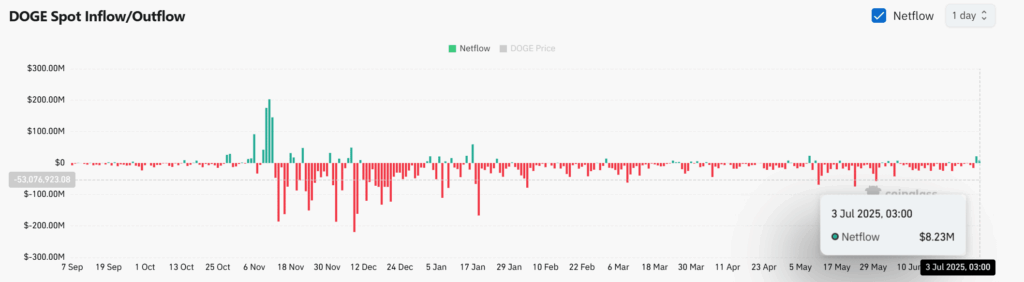

Whales Return as Spot Inflows Flip Positive

After sustained outflows, Dogecoin [DOGE] has recorded $8.23 million in net inflows, hinting at growing whale accumulation. Historically, “such inflows have aligned with bullish reversals or mid-term rallies,” supporting the case for sustained momentum if the inflow trend holds.

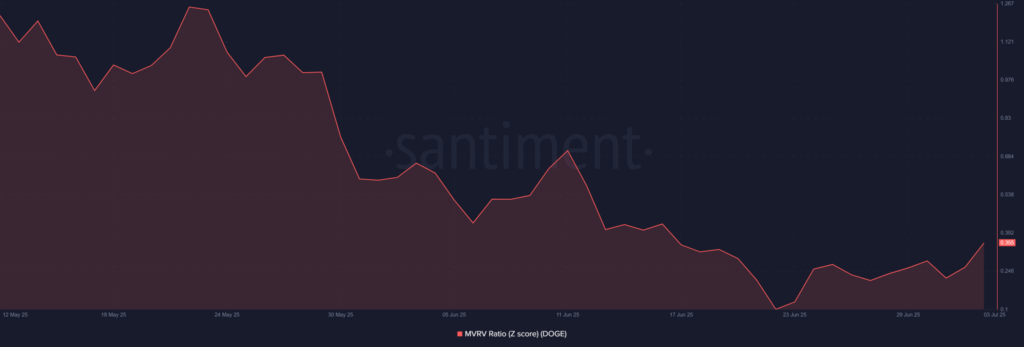

Dogecoin’s MVRV Z-score has rebounded to 0.355 from near-historic lows, reflecting recovering sentiment. While still below strong bullish thresholds, the uptick implies decreasing downside risk and the potential for sidelined investors to reenter.

Network Activity Lags Price Action

Despite improving price structure, on-chain usage has slowed. Daily active addresses and transaction counts have dropped significantly since late June. However, as noted in past cycles, “DOGE’s price has historically led activity, not followed it.”

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Cryptocurrencies and stocks, particularly in micro-cap companies, are subject to significant volatility and risk. Please conduct thorough research before making any investment decisions.

Comments are closed.