Featured News Headlines

AAVE Approves $50M Annual Buyback Program

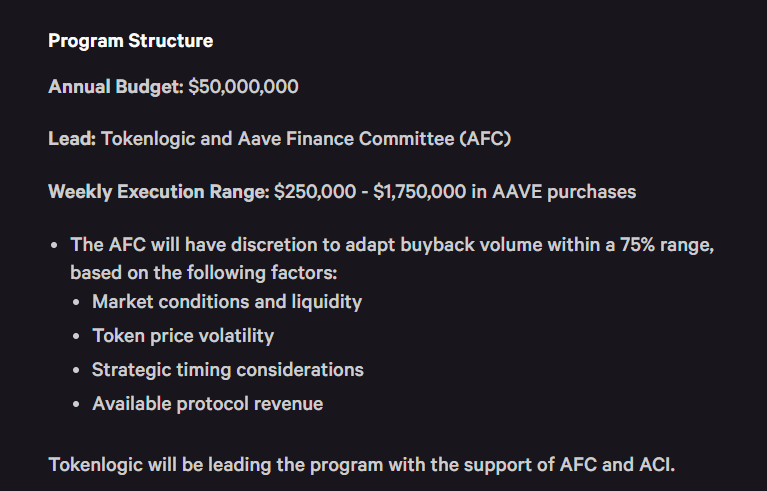

DeFi lending giant Aave (AAVE) has unanimously approved a $50 million per year buyback program, following a “strong success” from a pilot initiative launched in May. The program is designed to support the tokenomics of AAVE by reducing circulating supply.

Buyback Plan and Pilot Results

Under the new program, Aave plans to purchase $250,000 to $1.75 million worth of AAVE weekly, depending on protocol revenue and other factors. Before the proposal is fully implemented, two additional procedural steps remain.

The pilot program has already demonstrated notable activity. Since May, the initiative has acquired over 94,000 AAVE tokens, spending more than $22 million. May marked the largest monthly purchase, with 20,100 AAVE acquired. That same month, AAVE’s price surged over 50%, partly influenced by the broader DeFi market recovery in Q2. From July to October, monthly purchases averaged around 10,000 AAVE.

Despite these efforts, Q4 headwinds pushed AAVE below $200, showing that buybacks alone could not offset broader market challenges. The deflationary strategy, however, previously helped lift AAVE to $385 by August.

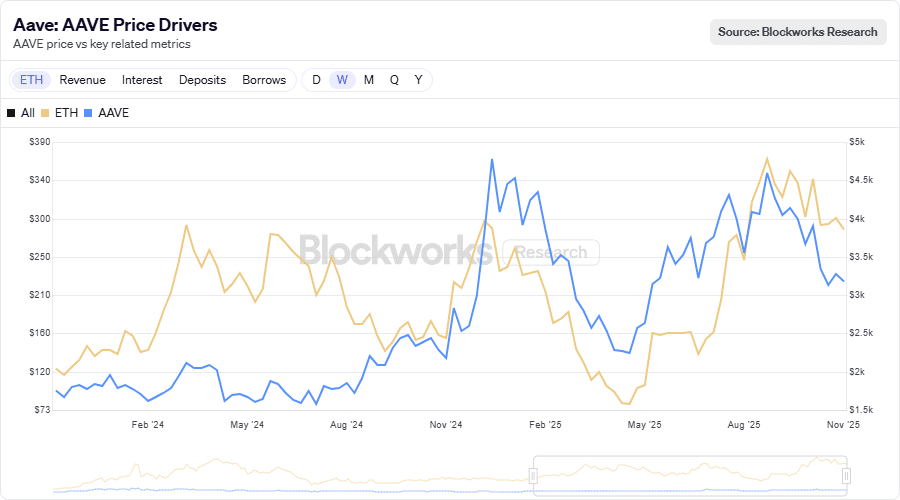

ETH Correlation Amplifies AAVE Swings

AAVE’s performance is closely tied to Ethereum (ETH), showing strong positive correlation. During ETH rallies, AAVE often experiences larger gains, while ETH pullbacks trigger sharper declines for the altcoin.

“As the barometer of the broader DeFi ecosystem, ETH’s momentum also trickles down to the sector’s outliers, including AAVE,” analysts noted.

This correlation suggests that a potential ETH rebound could positively influence AAVE, though ongoing selling pressure remains a factor.

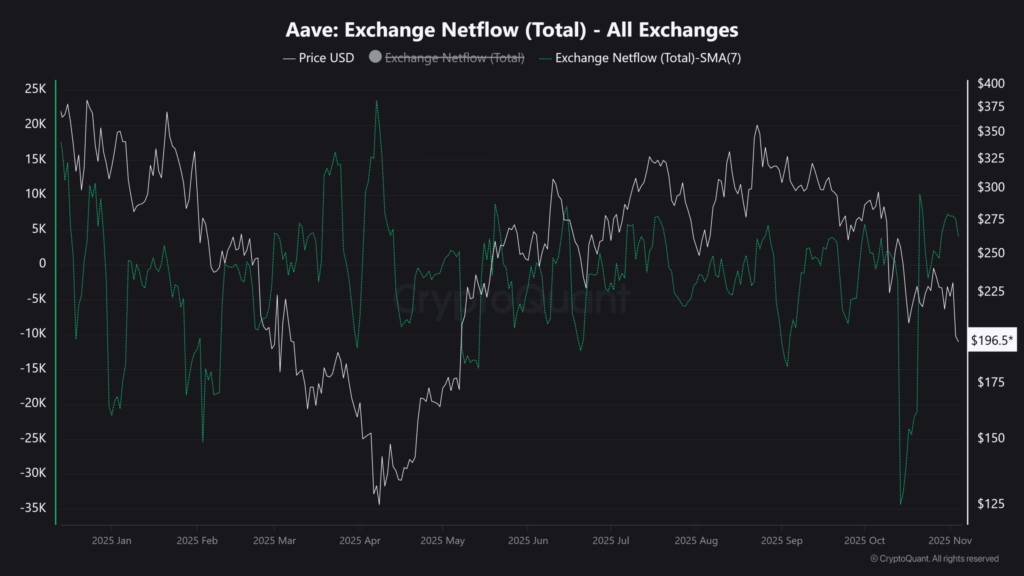

Exchange Inflows Add Pressure

According to CryptoQuant, exchange net inflows surged to a seven-month high last month, with roughly 10,000 AAVE sent to exchanges weekly for selling. These inflows have contributed to the recent downward pressure on AAVE’s price, adding to market volatility despite the buyback initiative.

The combination of deflationary mechanics, ETH correlation, and high exchange inflows underscores the complex dynamics affecting AAVE, reflecting broader trends in the DeFi lending sector.

[…] have spent any time navigating the world of cryptocurrency, and specifically Decentralised Finance (DeFi), you will undoubtedly have encountered the golden rule: “money must never sleep.” […]