Billion-Dollar Valuations Shrink

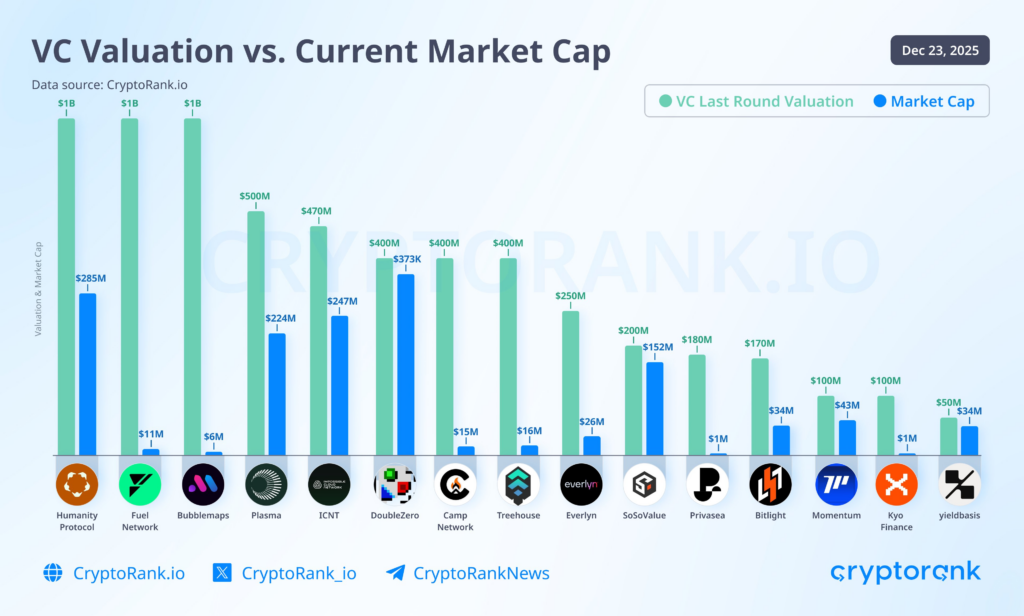

Several blockchain startups that once boasted venture valuations near $1 billion have seen their market capitalizations drop to a fraction of those figures, driven by tighter liquidity and changing market conditions. Data compiled by CryptoRank highlights the stark contrast between past expectations and current market realities.

Humanity Protocol, previously valued around $1 billion, now holds a market cap of roughly $285 million. Fuel Network, also once near $1 billion, trades closer to $11 million, while Bubblemaps has fallen to about $6 million from a similar venture capital (VC) valuation.

CryptoRank’s venture deals tracker, Fundraising Digest, notes, “During bull runs and narrative hype, VCs tend to overprice projects and assign aggressive valuations. However, once sentiment fades or the narrative loses traction, most projects get a reality check and the market resets those euphoric numbers.”

Ongoing Resets Across the Sector

The trend continues among projects with lower initial valuations. Plasma, valued around $500 million by VCs, now trades near $224 million. ICNT fell from $470 million to $247 million, and DoubleZero, once at $400 million, is now close to $373 million.

Even more dramatic disconnects exist. Camp Network and Treehouse, both previously at roughly $400 million, now sit at $15 million and $16 million, respectively. Everlyn, once near $250 million, trades around $26 million, while SoSoValue dropped from $200 million to about $152 million.

Crypto VC Funding Remains Weak

Venture capital funding in the crypto sector stayed subdued in November, extending a slowdown through late 2025. While some large rounds, such as Revolut’s $1 billion raise and Kraken’s $800 million pre-IPO round, bolstered total capital raised, early- and mid-stage funding remained limited. Only 57 disclosed rounds were recorded during the month, underscoring continued caution among investors.

The current environment illustrates the gap between past venture optimism and real market pricing, as liquidity constraints and narrative shifts force valuations into a more realistic range.

Comments are closed.