Crypto Rallies Losing Steam: No New Liquidity Flowing Into Crypto Markets

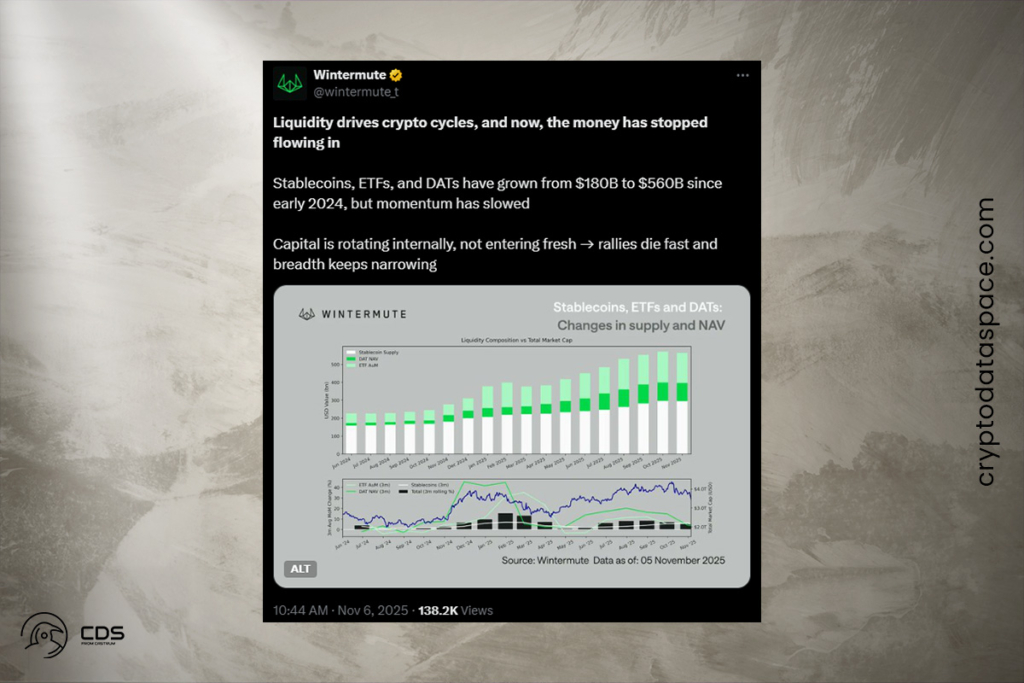

One of the most well-known cryptocurrency market makers, Wintermute, has cautioned that fresh liquidity is not entering the market. Instead of new inflows, the turnover of existing funds determines current price movements and trading. It noted that although cryptocurrency is now more funded, the liquidity flows from the previous year are slowing down. This implies that rallies might not last long and result in smaller surges. At this point, internal reallocation and changes between whale owners could occur in the cryptocurrency market. But only after fresh foreign inflows could there be a real bull market rebound.

Although an increase in the money supply is anticipated, inflows into cryptocurrency are not certain. A bear market may be imminent as a result of the recent market movements that have made investors more apprehensive.

Market Maker Wintermute at Center of Bitcoin Volatility Debate

Wintermute has frequently assisted in the internal restructuring of cryptocurrency funds. Additionally, the market maker was suspected of purposefully increasing Bitcoin sales during the most recent market drop. The market maker most frequently uses Binance, and some of the more significant price changes in recent weeks are a result of it. The market maker still has more than $549 million in cryptocurrency reserves, which it distributes to controlled markets, perpetual futures markets like Aerodrome, and DEXs like PancakeSwap.

Wintermute Says Bull Markets Depend on Fresh Capital Inflows

Long-term use of cryptocurrency has increased, even in times of market decline. The instruments used in the most recent bull market were developed at a time when price action and liquidity were comparatively slow. However, Wintermute pointed out that bull markets mostly rely on new capital inflows. In earlier cycles, the primary source of liquidity was closely linked to the new stablecoin minting. ETFs and treasury firms were also the primary sources of liquidity during the most recent market cycle; they both used money from the open market or tailored agreements with investors.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.